Key Insights

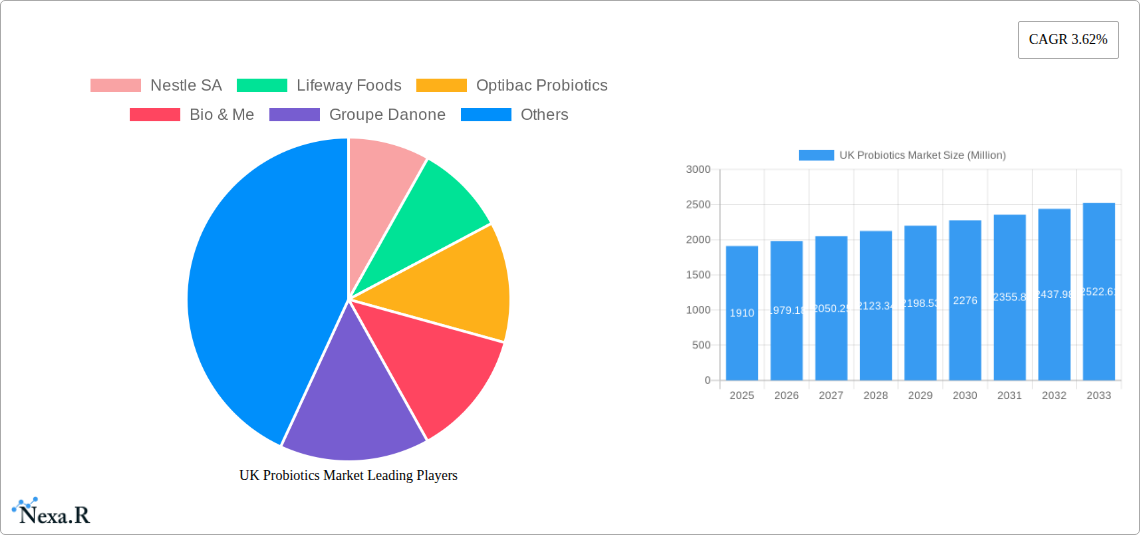

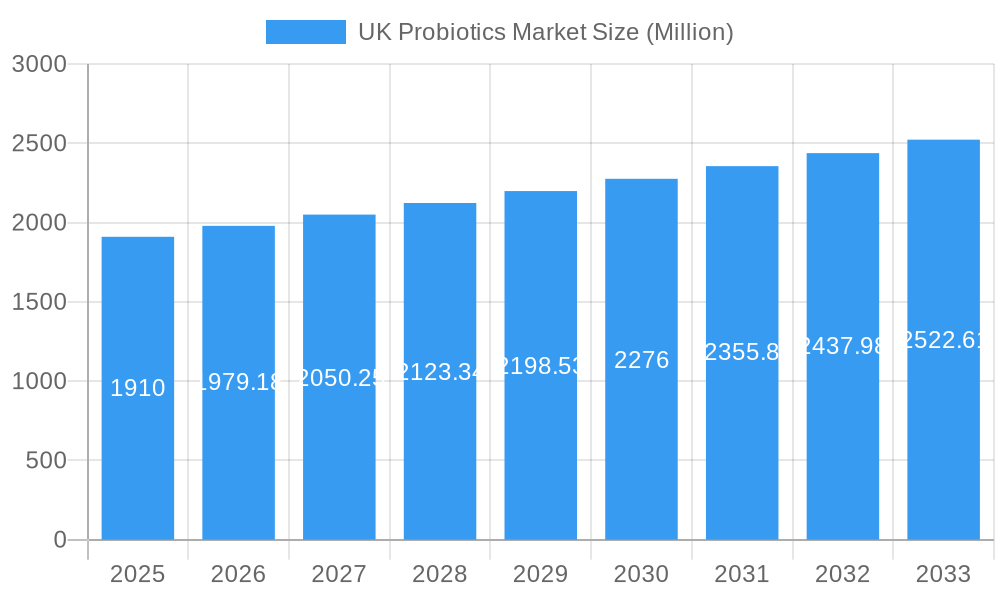

The UK probiotics market, valued at £1.91 billion in 2025, is projected to experience steady growth, driven by increasing consumer awareness of gut health and its connection to overall well-being. The market's Compound Annual Growth Rate (CAGR) of 3.62% from 2025 to 2033 indicates a consistent expansion, fueled by several key factors. Rising prevalence of digestive disorders, coupled with a growing preference for natural and functional foods and beverages, is significantly boosting demand for probiotic products. The functional food and beverage segment currently dominates the market, followed by dietary supplements and animal feed. Sales channels are diverse, with supermarkets/hypermarkets holding a major share, but online retail is exhibiting strong growth, reflecting the convenience and accessibility it offers consumers. Key players like Nestle SA, Danone, and Yakult Honsha are leveraging their established brands and distribution networks to maintain market leadership, while smaller companies are focusing on innovation and niche product offerings. The increasing focus on personalized nutrition and the emergence of advanced probiotic strains with targeted health benefits are expected to further fuel market expansion in the coming years. However, challenges remain, including concerns about regulatory frameworks and the need for more robust clinical evidence supporting specific health claims.

UK Probiotics Market Market Size (In Billion)

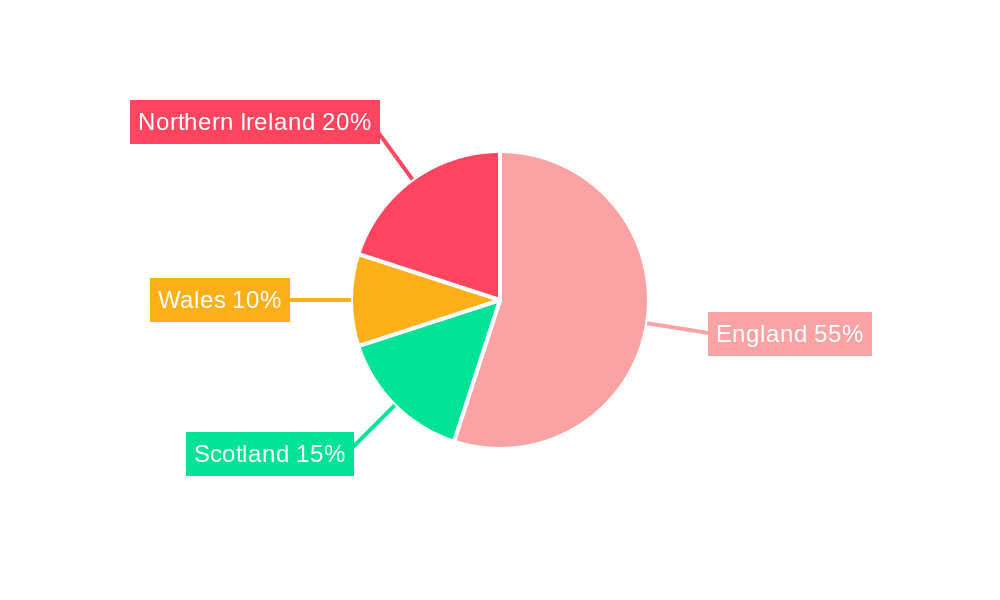

The competitive landscape is characterized by a mix of large multinational corporations and smaller, specialized companies. Larger players possess strong brand recognition and established distribution channels, allowing for broad market penetration. Smaller companies, in contrast, are leveraging innovation, offering niche probiotic products targeting specific health needs (e.g., immunity, weight management) and often focusing on direct-to-consumer marketing strategies. The regional distribution within the UK is relatively consistent across England, Wales, Scotland, and Northern Ireland, with variations primarily attributable to population density and consumer preferences. The sustained growth trajectory of the market is anticipated to continue, influenced by positive consumer perception, evolving product development, and rising health consciousness within the UK population. Future growth will depend on ongoing research into the efficacy of probiotics for various health conditions and continued efforts to communicate the benefits clearly and effectively to consumers.

UK Probiotics Market Company Market Share

UK Probiotics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK probiotics market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the parent market of functional foods and beverages and the child markets of dietary supplements and animal feed, offering a granular understanding of the UK's vibrant probiotics landscape. Projected market values are presented in million units.

Study Period: 2019-2033; Base Year: 2025; Estimated Year: 2025; Forecast Period: 2025-2033; Historical Period: 2019-2024

UK Probiotics Market Market Dynamics & Structure

This section analyzes the UK probiotics market's structure, identifying key trends shaping its growth trajectory. The analysis delves into market concentration, highlighting the leading players and their market shares. Technological innovation drivers, including advancements in probiotic strains and delivery systems, are meticulously examined. Further, the report assesses the regulatory landscape, competitive substitutes, end-user demographics, and the impact of M&A activities on market consolidation. Quantitative data on market share percentages and M&A deal volumes are provided, accompanied by qualitative insights into innovation barriers and market entry strategies. The market is estimated at xx Million units in 2025.

- Market Concentration: The UK probiotics market exhibits a moderately concentrated structure, with xx% market share held by the top 5 players in 2025.

- Technological Innovation: Ongoing R&D efforts focus on developing novel probiotic strains with enhanced efficacy and stability. The emergence of personalized probiotics and targeted delivery systems further fuels innovation.

- Regulatory Framework: Compliance with EU regulations and UK-specific food safety standards heavily influences market dynamics.

- Competitive Substitutes: The market faces competition from other functional foods and dietary supplements targeting gut health.

- End-User Demographics: Growing health consciousness and increased awareness of gut health benefits drive market growth amongst health-conscious consumers.

- M&A Trends: Consolidation through mergers and acquisitions is expected to continue, driving market concentration and innovation. xx M&A deals were recorded between 2019 and 2024.

UK Probiotics Market Growth Trends & Insights

This section leverages extensive market data to provide a detailed analysis of market size evolution, adoption rates, technological disruptions, and shifts in consumer behaviour within the UK probiotics market. The analysis encompasses a comprehensive review of historical trends (2019-2024), and the report projects market growth through 2033. Key metrics, such as Compound Annual Growth Rate (CAGR) and market penetration, are presented to provide in-depth insights. The detailed analysis sheds light on the factors driving the market expansion, including the increasing prevalence of digestive disorders and the rising consumer preference for natural and functional foods.

- Market Size: The UK probiotics market was valued at xx Million units in 2024 and is projected to reach xx Million units by 2033, exhibiting a CAGR of xx%.

- Adoption Rates: The adoption rate of probiotics is significantly influenced by rising health awareness and increasing disposable incomes among the UK population.

- Technological Disruptions: Advancements in microencapsulation and targeted delivery systems are enhancing the efficacy and stability of probiotics, driving market growth.

- Consumer Behaviour: The increasing demand for convenient, natural, and health-beneficial products has triggered the expansion of the UK probiotic market.

Dominant Regions, Countries, or Segments in UK Probiotics Market

This section pinpoints the leading regions, countries, and segments within the UK probiotics market. It analyses the factors driving growth in the key segments: Functional Food and Beverages, Dietary Supplements, and Animal Feed, and distribution channels including Supermarkets/Hypermarkets, Health Stores/Pharmacies, Online Retail Stores, and Other Distribution Channels. Key drivers, such as economic policies and infrastructure, are highlighted using bullet points, while paragraphs delve into the dominance factors, encompassing market share and growth potential. The dominant segment is analysed in detail, explaining its superior performance.

- Dietary Supplements: This segment dominates the UK probiotics market, with a projected market share of xx% in 2025 due to high consumer demand for targeted gut health solutions.

- Supermarkets/Hypermarkets: This distribution channel holds the largest market share owing to its wide reach and accessibility to a diverse consumer base.

- Growth Drivers: The increasing awareness of the gut-brain axis, growing popularity of functional foods, and strong support from the government promoting health and wellness programs are key growth drivers.

UK Probiotics Market Product Landscape

This section provides a concise overview of the innovative products, applications, and performance metrics within the UK probiotics market. The paragraph highlights the unique selling propositions (USPs) of leading products and the latest technological advancements. It underscores the key attributes driving market competition, such as product efficacy and consumer preferences.

Key Drivers, Barriers & Challenges in UK Probiotics Market

This section outlines the key drivers propelling the UK probiotics market's growth. These include factors such as technological advancements, economic growth, and supportive government policies. Examples of these drivers are provided to showcase their impact.

- Drivers: Growing health consciousness, increasing disposable incomes, and technological advancements in probiotic strain development are key drivers.

- Challenges and Restraints: Stringent regulatory requirements, intense competition, and potential supply chain disruptions pose significant challenges.

Emerging Opportunities in UK Probiotics Market

This section highlights emerging trends and lucrative opportunities in the UK probiotics market. It focuses on untapped segments, innovative applications, and evolving consumer preferences. This analysis provides valuable insights for businesses seeking expansion opportunities within this dynamic market.

Growth Accelerators in the UK Probiotics Market Industry

This section discusses the key growth catalysts in the UK probiotics market, emphasizing technological advancements, strategic partnerships, and market expansion strategies. These growth accelerators present lucrative opportunities for companies to expand their market share and profitability within this thriving industry.

Key Players Shaping the UK Probiotics Market Market

- Nestle SA

- Lifeway Foods

- Optibac Probiotics

- Bio & Me

- Groupe Danone

- Pepsico Inc

- BioGaia

- Now Foods

- Yakult Honsha

- Protexin Probiotics

- List Not Exhaustive

Notable Milestones in UK Probiotics Market Sector

- February 2022: Optibac Probiotics launched vegan gummies for adults' gut and immune health.

- August 2021: Muller launched its gut health yogurt, "Gut Glory," in various flavors.

- June 2021: HempFusion launched a probiotic line with Probulin, focusing on gut health and immune support.

In-Depth UK Probiotics Market Market Outlook

This section summarizes the growth accelerators identified throughout the report and provides a forward-looking perspective on the future potential of the UK probiotics market. It highlights the strategic opportunities for businesses looking to capitalize on the growth trajectory of this dynamic sector. The long-term outlook remains positive due to increasing health awareness and ongoing technological advancements in probiotic development.

UK Probiotics Market Segmentation

-

1. Type

- 1.1. Functional Food and Beverages

- 1.2. Dietary Supplements

- 1.3. Animal Feed

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Health Stores/Pharmacies

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

UK Probiotics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Probiotics Market Regional Market Share

Geographic Coverage of UK Probiotics Market

UK Probiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water

- 3.4. Market Trends

- 3.4.1. Demand for Probiotic Infused Functional Food & Beverages Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Functional Food and Beverages

- 5.1.2. Dietary Supplements

- 5.1.3. Animal Feed

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Health Stores/Pharmacies

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Functional Food and Beverages

- 6.1.2. Dietary Supplements

- 6.1.3. Animal Feed

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Health Stores/Pharmacies

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Functional Food and Beverages

- 7.1.2. Dietary Supplements

- 7.1.3. Animal Feed

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Health Stores/Pharmacies

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Functional Food and Beverages

- 8.1.2. Dietary Supplements

- 8.1.3. Animal Feed

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Health Stores/Pharmacies

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Functional Food and Beverages

- 9.1.2. Dietary Supplements

- 9.1.3. Animal Feed

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Health Stores/Pharmacies

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Functional Food and Beverages

- 10.1.2. Dietary Supplements

- 10.1.3. Animal Feed

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Health Stores/Pharmacies

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lifeway Foods

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Optibac Probiotics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bio & Me

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Groupe Danone

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pepsico Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BioGaia

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Now Foods

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yakult Honsha

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Protexin Probiotics *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global UK Probiotics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Probiotics Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America UK Probiotics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UK Probiotics Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America UK Probiotics Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America UK Probiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UK Probiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Probiotics Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America UK Probiotics Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America UK Probiotics Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America UK Probiotics Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America UK Probiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America UK Probiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Probiotics Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe UK Probiotics Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe UK Probiotics Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe UK Probiotics Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe UK Probiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe UK Probiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Probiotics Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa UK Probiotics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa UK Probiotics Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa UK Probiotics Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa UK Probiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Probiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Probiotics Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific UK Probiotics Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific UK Probiotics Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific UK Probiotics Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific UK Probiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Probiotics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global UK Probiotics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global UK Probiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global UK Probiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global UK Probiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global UK Probiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global UK Probiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Probiotics Market?

The projected CAGR is approximately 3.62%.

2. Which companies are prominent players in the UK Probiotics Market?

Key companies in the market include Nestle SA, Lifeway Foods, Optibac Probiotics, Bio & Me, Groupe Danone, Pepsico Inc, BioGaia, Now Foods, Yakult Honsha, Protexin Probiotics *List Not Exhaustive.

3. What are the main segments of the UK Probiotics Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water.

6. What are the notable trends driving market growth?

Demand for Probiotic Infused Functional Food & Beverages Products.

7. Are there any restraints impacting market growth?

Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water.

8. Can you provide examples of recent developments in the market?

In February 2022, Optibac Probiotics company launched its new vegan gummies for adults across the United Kingdom. The company claims that these products are designed to support adults' gut and immune health. These products are available in strawberry flavors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Probiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Probiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Probiotics Market?

To stay informed about further developments, trends, and reports in the UK Probiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence