Key Insights

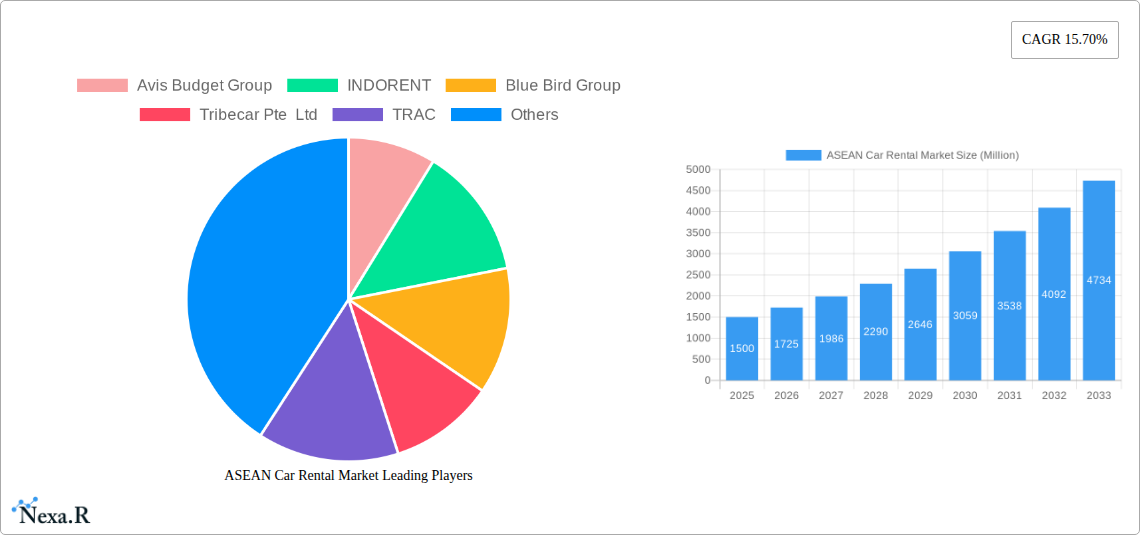

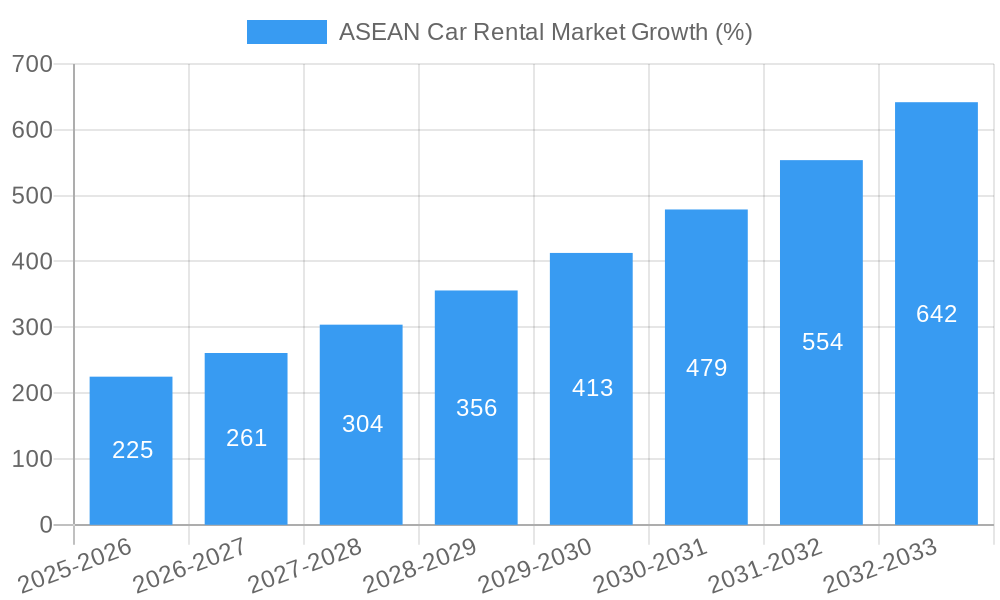

The ASEAN car rental market is experiencing robust growth, driven by a surge in tourism, increasing urbanization leading to higher commuting needs, and the rising popularity of online booking platforms. The market's Compound Annual Growth Rate (CAGR) of 15.70% from 2019 to 2024 suggests a significant expansion, which is expected to continue into the forecast period (2025-2033). This growth is fueled by the increasing affordability of cars, improved infrastructure in major ASEAN cities, and a growing middle class with disposable income for leisure travel and convenient transportation solutions. The segment breakdown reveals a strong preference for online bookings, reflecting the increasing digitalization of the region. While short-term rentals dominate the market due to tourist activity, the long-term rental segment is also showing promising growth, driven by business travelers and expatriates. Tourism-related rentals are the largest application type, though commuting rentals are a growing segment, especially in rapidly expanding urban centers. Key players like Avis Budget Group, INDORENT, and Blue Bird Group are strategically expanding their services and fleet sizes to capitalize on this growth opportunity, resulting in increased competition and innovation within the sector.

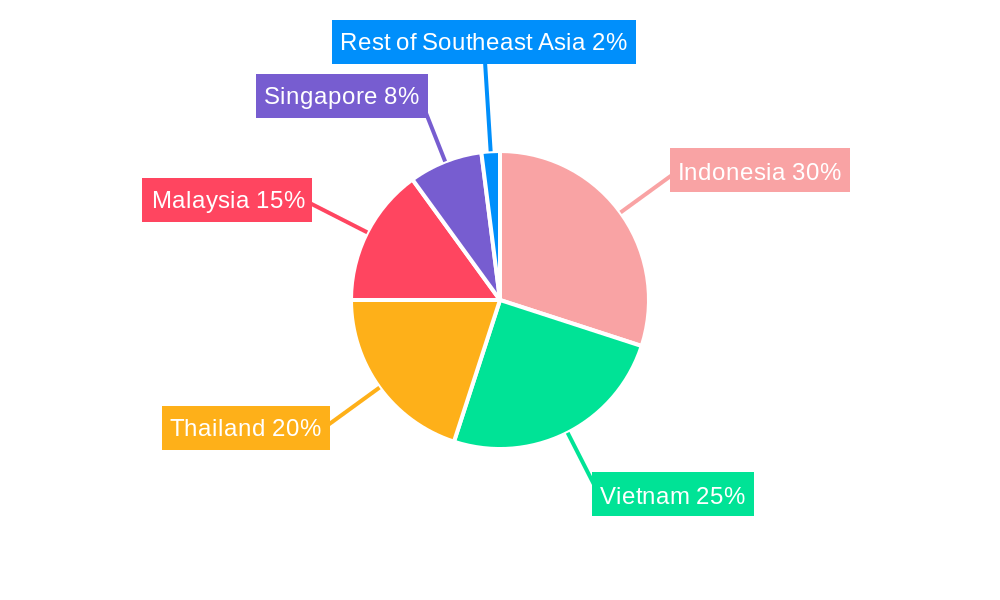

The competitive landscape is dynamic, with both international and local players vying for market share. The dominance of specific players varies across countries within the ASEAN region, with local companies often holding significant regional market share. Future growth will be significantly influenced by government regulations, infrastructure development, and the continued adoption of technology within the industry, including the rise of ride-sharing services and car-sharing platforms which could present both opportunities and challenges to traditional car rental businesses. Further growth is anticipated in the online booking segment as digital literacy and smartphone penetration continue to rise across the region. Indonesia, Vietnam, and Thailand are expected to be key growth markets within ASEAN due to their large populations and burgeoning tourism sectors. Strategic partnerships with hotels and travel agencies are also expected to contribute to market expansion.

ASEAN Car Rental Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the ASEAN car rental market, offering invaluable insights for industry professionals, investors, and strategic planners. With a focus on market dynamics, growth trends, and future opportunities, this report covers the period from 2019 to 2033, including a detailed analysis of the base year 2025. The report delves into key segments, including booking type (offline and online), rental duration (short-term and long-term), and application type (tourism and commuting), offering a granular understanding of the market's structure and evolution. The report also profiles key players such as Avis Budget Group, INDORENT, Blue Bird Group, Tribecar Pte Ltd, TRAC, Sixt SE, and Master Car Rental, alongside an analysis of significant market events and emerging trends. The ASEAN car rental market is projected to reach xx million units by 2033, presenting significant growth opportunities.

ASEAN Car Rental Market Dynamics & Structure

The ASEAN car rental market is characterized by a dynamic interplay of factors, including market concentration, technological innovation, regulatory frameworks, competitive forces, and evolving consumer demographics. The market exhibits a blend of established players and emerging disruptors, leading to varying levels of market concentration across different countries within the region.

Market Concentration & Competition: The market exhibits a moderately concentrated structure, with a few large players holding significant market share, but also a sizeable number of smaller, regional operators. The competitive landscape is further shaped by the emergence of peer-to-peer carsharing services and subscription models.

Technological Innovation: Technological advancements, including mobile applications, online booking platforms, and the integration of advanced telematics, are significantly impacting market dynamics. However, barriers to adoption, such as digital literacy levels and infrastructure limitations in certain regions, remain.

Regulatory Frameworks: Government regulations concerning licensing, insurance, and vehicle standards vary across the ASEAN region, creating complexities for operators. These regulations, while intended to ensure safety and consumer protection, also influence operational costs and market entry barriers.

Competitive Substitutes: The car rental market faces competition from alternative transportation modes, including ride-hailing services, public transportation, and private car ownership. The increasing affordability and convenience of these alternatives pose a challenge to the market's growth.

End-User Demographics & M&A Activity: The growing middle class, increasing tourism, and the rising popularity of business travel are key drivers of demand. The M&A landscape showcases consolidation trends, with larger players acquiring smaller companies to expand their market reach and service offerings. For instance, the number of M&A deals in the ASEAN car rental market from 2019-2024 totaled xx, with an average deal value of xx million USD.

ASEAN Car Rental Market Growth Trends & Insights

The ASEAN car rental market has witnessed significant growth over the historical period (2019-2024), driven by factors such as rising disposable incomes, increased tourism, and the expansion of business travel. The market size in 2024 reached xx million units, representing a CAGR of xx% during this period. This growth is anticipated to continue during the forecast period (2025-2033), though the rate may moderate slightly due to various factors discussed later. The increasing adoption of online booking platforms has transformed consumer behavior, favoring convenience and ease of access. Technological disruptions, particularly the emergence of electric vehicles and car-sharing services, are reshaping the market landscape. Consumer preferences are evolving, with a rising demand for flexible rental options and value-added services. The market penetration rate for car rentals in the ASEAN region is estimated to be xx% in 2025, projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in ASEAN Car Rental Market

The ASEAN car rental market is not uniformly distributed across the region. Significant variations exist in market size, growth rates, and dominant segments across different countries.

Leading Regions/Countries: Indonesia, Thailand, and Singapore typically represent the largest markets within ASEAN, driven by factors such as robust tourism sectors, developed infrastructure, and higher levels of disposable income.

Dominant Segments:

- Booking Type: Online bookings are experiencing a rapid growth trajectory, surpassing offline bookings in several markets due to greater convenience and competitive pricing.

- Rental Duration: Short-term rentals constitute the larger segment, owing to tourism and occasional travel needs. However, long-term rentals are gaining traction with the rise of business travel and relocation.

- Application Type: Tourism remains a primary driver of the car rental market, but commuting is gaining traction, particularly in urban areas with inadequate public transport systems.

Key Drivers:

- Economic Growth: Strong economic growth in several ASEAN countries has fueled increased disposable incomes and spending on travel and leisure activities.

- Tourism: The booming tourism sector is a crucial driver, particularly in countries like Thailand and Singapore.

- Infrastructure Development: Improvements in road infrastructure have facilitated greater accessibility and ease of travel.

- Government Policies: Supportive government policies promoting tourism and transportation are playing a positive role.

ASEAN Car Rental Market Product Landscape

The ASEAN car rental market offers a range of vehicle types, from economy cars to luxury SUVs, catering to diverse customer needs and budgets. Technological advancements are continuously shaping the product landscape, with features like GPS navigation, in-car entertainment systems, and advanced safety features becoming increasingly prevalent. The emergence of electric vehicles (EVs) in the rental fleet represents a significant trend, driven by sustainability concerns and government incentives. The integration of mobile apps for seamless booking, management, and customer service is becoming a standard feature. Many rental companies also offer value-added services such as insurance packages, roadside assistance, and airport transfers, enhancing customer experience and fostering loyalty.

Key Drivers, Barriers & Challenges in ASEAN Car Rental Market

Key Drivers:

- Rising Disposable Incomes: Increased purchasing power allows more individuals to access car rental services.

- Growing Tourism Sector: The flourishing tourism industry fuels demand for rental vehicles.

- Technological Advancements: Online booking platforms and mobile apps enhance convenience.

Key Challenges and Restraints:

- Competition from Ride-Hailing Services: Ride-hailing apps pose significant competition, particularly for short-distance travel.

- Infrastructure Limitations: Poor road conditions or limited parking availability in some areas can hinder operations.

- Regulatory Hurdles: Complex regulations and licensing requirements vary across countries, increasing operational costs.

- Supply Chain Disruptions: Global supply chain issues can affect vehicle availability and pricing.

Emerging Opportunities in ASEAN Car Rental Market

- Expansion into Untapped Markets: Several less-developed areas within ASEAN still present significant untapped potential.

- Subscription Models: Car subscription services are gaining traction, offering flexible alternatives to traditional rentals.

- Electric Vehicle Rentals: The increasing adoption of EVs presents growth opportunities for companies offering sustainable transportation solutions.

- Focus on Niche Markets: Catering to specific travel segments (e.g., adventure tourism, corporate travel) can yield higher margins.

Growth Accelerators in the ASEAN Car Rental Market Industry

The long-term growth of the ASEAN car rental market will be significantly influenced by technological advancements, strategic partnerships, and expansion into new markets. Investment in digital technologies, such as AI-powered booking platforms and predictive analytics for fleet management, will enhance operational efficiency and improve the customer experience. Strategic alliances with hotels, airlines, and tourism agencies can create cross-selling opportunities and increase market reach. Furthermore, expansion into previously underserved areas, coupled with the introduction of innovative service offerings, will drive growth.

Key Players Shaping the ASEAN Car Rental Market Market

- Avis Budget Group

- INDORENT

- Blue Bird Group

- Tribecar Pte Ltd

- TRAC

- Sixt SE

- Master Car Rental

- List Not Exhaustive

Notable Milestones in ASEAN Car Rental Market Sector

- January 2022: ekar launched car subscription and peer-to-peer carsharing services in Thailand.

- July 2022: InterContinental Phuket Resort and SIXT Thailand partnered to introduce electric vehicle rentals.

- June 2022: Carro acquired a 50% stake in MPMRent, Indonesia's largest car rental company.

In-Depth ASEAN Car Rental Market Market Outlook

The ASEAN car rental market is poised for continued growth, driven by several factors, including rising disposable incomes, robust tourism growth, and the increasing adoption of innovative technologies. The market's future potential is substantial, particularly in countries experiencing rapid economic development and improvements in infrastructure. Strategic partnerships, investments in technology, and expansion into new markets will be crucial for companies to capitalize on the opportunities presented by this dynamic market. The focus on sustainable and technologically advanced solutions will differentiate successful players in the coming years.

ASEAN Car Rental Market Segmentation

-

1. Booking Type

- 1.1. Offline

- 1.2. Online

-

2. Rental Duration

- 2.1. Short-term

- 2.2. Long-term

-

3. Application Type

- 3.1. Tourism

- 3.2. Commuting

ASEAN Car Rental Market Segmentation By Geography

- 1. Vietnam

- 2. Indonesia

- 3. Malaysia

- 4. Thailand

- 5. Singapore

- 6. Rest of Southeast Asia

ASEAN Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand for Clean Energy Driving the Market

- 3.3. Market Restrains

- 3.3.1. Rising Safety Concerns is Antcipated to Restrain the Market

- 3.4. Market Trends

- 3.4.1. Rising Tourism Industry in the Region Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Offline

- 5.1.2. Online

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration

- 5.2.1. Short-term

- 5.2.2. Long-term

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Tourism

- 5.3.2. Commuting

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.4.2. Indonesia

- 5.4.3. Malaysia

- 5.4.4. Thailand

- 5.4.5. Singapore

- 5.4.6. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Vietnam ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Booking Type

- 6.1.1. Offline

- 6.1.2. Online

- 6.2. Market Analysis, Insights and Forecast - by Rental Duration

- 6.2.1. Short-term

- 6.2.2. Long-term

- 6.3. Market Analysis, Insights and Forecast - by Application Type

- 6.3.1. Tourism

- 6.3.2. Commuting

- 6.1. Market Analysis, Insights and Forecast - by Booking Type

- 7. Indonesia ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Booking Type

- 7.1.1. Offline

- 7.1.2. Online

- 7.2. Market Analysis, Insights and Forecast - by Rental Duration

- 7.2.1. Short-term

- 7.2.2. Long-term

- 7.3. Market Analysis, Insights and Forecast - by Application Type

- 7.3.1. Tourism

- 7.3.2. Commuting

- 7.1. Market Analysis, Insights and Forecast - by Booking Type

- 8. Malaysia ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Booking Type

- 8.1.1. Offline

- 8.1.2. Online

- 8.2. Market Analysis, Insights and Forecast - by Rental Duration

- 8.2.1. Short-term

- 8.2.2. Long-term

- 8.3. Market Analysis, Insights and Forecast - by Application Type

- 8.3.1. Tourism

- 8.3.2. Commuting

- 8.1. Market Analysis, Insights and Forecast - by Booking Type

- 9. Thailand ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Booking Type

- 9.1.1. Offline

- 9.1.2. Online

- 9.2. Market Analysis, Insights and Forecast - by Rental Duration

- 9.2.1. Short-term

- 9.2.2. Long-term

- 9.3. Market Analysis, Insights and Forecast - by Application Type

- 9.3.1. Tourism

- 9.3.2. Commuting

- 9.1. Market Analysis, Insights and Forecast - by Booking Type

- 10. Singapore ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Booking Type

- 10.1.1. Offline

- 10.1.2. Online

- 10.2. Market Analysis, Insights and Forecast - by Rental Duration

- 10.2.1. Short-term

- 10.2.2. Long-term

- 10.3. Market Analysis, Insights and Forecast - by Application Type

- 10.3.1. Tourism

- 10.3.2. Commuting

- 10.1. Market Analysis, Insights and Forecast - by Booking Type

- 11. Rest of Southeast Asia ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Booking Type

- 11.1.1. Offline

- 11.1.2. Online

- 11.2. Market Analysis, Insights and Forecast - by Rental Duration

- 11.2.1. Short-term

- 11.2.2. Long-term

- 11.3. Market Analysis, Insights and Forecast - by Application Type

- 11.3.1. Tourism

- 11.3.2. Commuting

- 11.1. Market Analysis, Insights and Forecast - by Booking Type

- 12. Vietnam ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Indonesia ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Malaysia ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Thailand ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Singapore ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Rest of South East Asia ASEAN Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Avis Budget Group

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 INDORENT

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Blue Bird Group

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Tribecar Pte Ltd

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 TRAC

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Sixt SE

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Master Car Rental*List Not Exhaustive

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.1 Avis Budget Group

List of Figures

- Figure 1: ASEAN Car Rental Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: ASEAN Car Rental Market Share (%) by Company 2024

List of Tables

- Table 1: ASEAN Car Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: ASEAN Car Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 3: ASEAN Car Rental Market Revenue Million Forecast, by Rental Duration 2019 & 2032

- Table 4: ASEAN Car Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 5: ASEAN Car Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: ASEAN Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: ASEAN Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: ASEAN Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: ASEAN Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: ASEAN Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: ASEAN Car Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: ASEAN Car Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 19: ASEAN Car Rental Market Revenue Million Forecast, by Rental Duration 2019 & 2032

- Table 20: ASEAN Car Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 21: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: ASEAN Car Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 23: ASEAN Car Rental Market Revenue Million Forecast, by Rental Duration 2019 & 2032

- Table 24: ASEAN Car Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 25: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: ASEAN Car Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 27: ASEAN Car Rental Market Revenue Million Forecast, by Rental Duration 2019 & 2032

- Table 28: ASEAN Car Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 29: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: ASEAN Car Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 31: ASEAN Car Rental Market Revenue Million Forecast, by Rental Duration 2019 & 2032

- Table 32: ASEAN Car Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 33: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: ASEAN Car Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 35: ASEAN Car Rental Market Revenue Million Forecast, by Rental Duration 2019 & 2032

- Table 36: ASEAN Car Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 37: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: ASEAN Car Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 39: ASEAN Car Rental Market Revenue Million Forecast, by Rental Duration 2019 & 2032

- Table 40: ASEAN Car Rental Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 41: ASEAN Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Car Rental Market?

The projected CAGR is approximately 15.70%.

2. Which companies are prominent players in the ASEAN Car Rental Market?

Key companies in the market include Avis Budget Group, INDORENT, Blue Bird Group, Tribecar Pte Ltd, TRAC, Sixt SE, Master Car Rental*List Not Exhaustive.

3. What are the main segments of the ASEAN Car Rental Market?

The market segments include Booking Type, Rental Duration, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand for Clean Energy Driving the Market.

6. What are the notable trends driving market growth?

Rising Tourism Industry in the Region Drives the Market.

7. Are there any restraints impacting market growth?

Rising Safety Concerns is Antcipated to Restrain the Market.

8. Can you provide examples of recent developments in the market?

June 2022: Carro acquired a 50% stake in the rental arm of Indonesian automotive group PT Mitra Pinasthika Mustika for nearly USD 54 million, according to a statement from the companies. PT Mitra Pinasthika Mustika Rent (MPMRent) is Indonesia's largest car rental company, with a fleet of over 13,000 vehicles and financing services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Car Rental Market?

To stay informed about further developments, trends, and reports in the ASEAN Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence