Key Insights

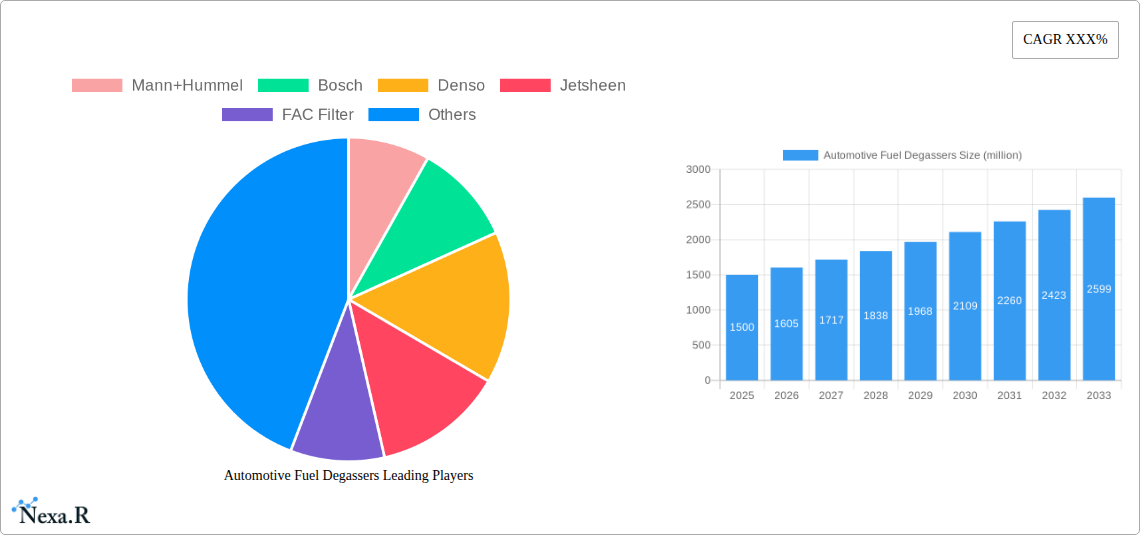

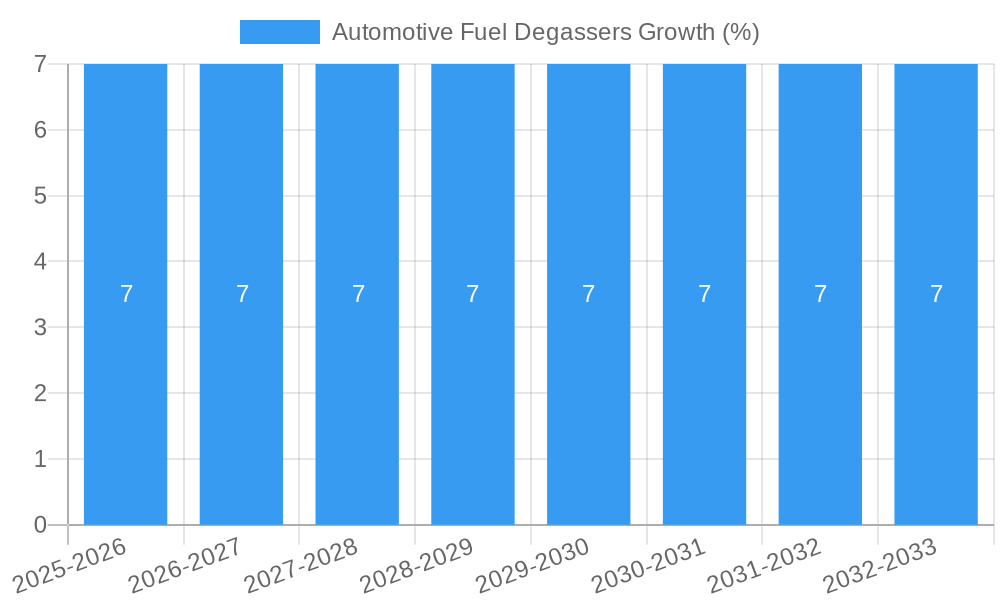

The Automotive Fuel Degasser market is poised for robust expansion, estimated to reach a significant market size of approximately $1,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This growth is propelled by several key drivers, including increasingly stringent emission regulations globally, which necessitate advanced fuel system components to minimize evaporative emissions. The rising adoption of sophisticated internal combustion engines, particularly in passenger cars and commercial vehicles, demanding more efficient fuel delivery and emission control systems, further fuels market demand. Technological advancements in fuel degasser systems, focusing on enhanced durability, lighter materials, and improved performance in diverse operating conditions, are also contributing to market traction. Furthermore, the growing global vehicle parc and the demand for cleaner transportation solutions, especially in emerging economies, are expected to underpin sustained market growth.

The market is segmented by application into Passenger Cars and Commercial Vehicles, with passenger cars likely dominating due to higher production volumes. By type, Gasoline and Diesel fuel degassers represent key segments, reflecting the prevailing engine technologies. Key players like Mann+Hummel, Bosch, Denso, and Mahle are at the forefront, driving innovation and capturing market share through their extensive product portfolios and strategic collaborations. However, the market faces certain restraints, such as the initial cost of advanced degasser systems and potential disruptions from the accelerating transition towards electric vehicles, which may gradually reduce the demand for internal combustion engine components. Despite these challenges, the immediate and medium-term outlook for automotive fuel degassers remains strong, driven by the continued dominance of internal combustion engines and the imperative for cleaner emissions across the automotive landscape.

Automotive Fuel Degassers Market Dynamics & Structure

The global automotive fuel degasser market is characterized by a moderate to highly concentrated structure, with key players like Mann+Hummel, Bosch, Denso, and Mahle commanding significant market shares. Technological innovation is a primary driver, focusing on enhanced fuel efficiency, reduced emissions, and improved engine performance. The development of lighter, more durable materials and advanced filtration technologies are central to this innovation. Regulatory frameworks, particularly stringent emission standards in North America, Europe, and Asia-Pacific, are compelling manufacturers to integrate sophisticated fuel degasser systems. Competitive product substitutes are limited, as fuel degassers are an integral component of modern fuel injection systems; however, advancements in alternative fuel technologies and electric vehicles pose a long-term disruptive threat. End-user demographics are evolving, with increasing demand for vehicles in emerging economies and a growing preference for SUVs and light trucks in developed markets, both requiring robust fuel degasser solutions. Mergers and acquisitions (M&A) activity remains a steady factor, with larger Tier-1 suppliers acquiring smaller, specialized component manufacturers to expand their product portfolios and market reach. For instance, recent years have seen an estimated 5-7 significant M&A deals annually, averaging a transaction value of approximately $50-100 million, reflecting consolidation and strategic portfolio enhancement. Barriers to innovation include the high cost of R&D, the need for extensive testing and validation to meet automotive safety standards, and the long product development cycles inherent in the automotive industry.

- Market Concentration: Moderate to High, with key players dominating.

- Technological Innovation Drivers: Fuel efficiency, emission reduction, engine performance optimization.

- Regulatory Frameworks: Stringent emission standards (Euro 7, EPA Tier 4).

- Competitive Product Substitutes: Limited direct substitutes, but evolving alternative fuel and EV technologies.

- End-User Demographics: Growth in emerging economies, preference for larger vehicles.

- M&A Trends: Consistent activity for portfolio expansion and market consolidation.

Automotive Fuel Degassers Growth Trends & Insights

The global automotive fuel degasser market is projected for robust growth, fueled by an increasing global vehicle parc and tightening environmental regulations. The market size is estimated to have been approximately $1,250 million in 2024 and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 4.8% from 2025 to 2033, reaching an estimated $1,800 million by 2033. This growth trajectory is underpinned by rising production volumes of both passenger cars and commercial vehicles globally. Adoption rates for advanced fuel degasser systems are accelerating as original equipment manufacturers (OEMs) strive to meet increasingly stringent emissions standards, such as Euro 7 in Europe and forthcoming EPA regulations in the United States. These regulations necessitate more efficient fuel delivery and emission control systems, directly boosting demand for sophisticated fuel degassers. Technological disruptions are primarily centered on material science and filtration efficiency. Innovations in nanocomposite materials are leading to lighter, more durable degassers that can withstand higher operating pressures and temperatures. Furthermore, advancements in multi-stage filtration technologies are enhancing the removal of particulate matter and vapor, contributing to cleaner exhaust emissions and improved fuel economy. Consumer behavior shifts are also playing a crucial role. There is a growing awareness among consumers regarding vehicle emissions and fuel efficiency, prompting a demand for vehicles equipped with advanced emission control technologies. This consumer preference indirectly drives OEMs to invest in and adopt more effective fuel degasser solutions. The demand for diesel fuel degassers remains significant, particularly in the commercial vehicle segment and in regions with established diesel infrastructure, while the gasoline segment sees continuous innovation driven by direct injection technologies. The increasing complexity of modern engines, with higher injection pressures and sophisticated fuel management systems, further necessitates the use of advanced fuel degassers to maintain optimal performance and longevity. The aftermarket segment is also a key contributor to market growth, as aging vehicle fleets require replacement parts, including fuel degassers, to maintain compliance with emission standards and ensure efficient operation. The penetration of advanced fuel degasser technologies is expected to deepen across all vehicle segments, driven by both regulatory mandates and the pursuit of greater fuel efficiency and reduced environmental impact.

Dominant Regions, Countries, or Segments in Automotive Fuel Degassers

The Application segment of Passenger Cars currently dominates the global automotive fuel degasser market and is poised to maintain this leadership position throughout the forecast period (2025-2033). This dominance is attributed to several key factors, including the sheer volume of passenger car production worldwide and the increasing integration of advanced fuel degasser technologies in this segment to meet evolving emission standards and fuel economy mandates.

- Market Share: Passenger Cars account for an estimated 65% of the total automotive fuel degasser market in 2025, with an anticipated steady growth rate of approximately 4.5% annually.

- Key Drivers for Passenger Cars:

- Global Production Volumes: Asia-Pacific, particularly China and India, continues to be the largest producer of passenger vehicles, driving substantial demand for fuel degassers. In 2025, an estimated 75 million passenger cars were produced globally, with over 30 million units in Asia-Pacific alone.

- Stringent Emission Regulations: Developed regions like Europe (Euro 7 standards) and North America (EPA regulations) are pushing for lower NOx and particulate matter emissions, making advanced fuel degasser systems a necessity.

- Technological Advancements: The widespread adoption of Gasoline Direct Injection (GDI) and advanced fuel injection systems in passenger cars necessitates more sophisticated fuel degassers to manage fuel pressure and purity.

- Consumer Demand for Efficiency: Growing consumer awareness and preference for fuel-efficient and environmentally friendly vehicles incentivize OEMs to equip their passenger car models with high-performance fuel degasser systems.

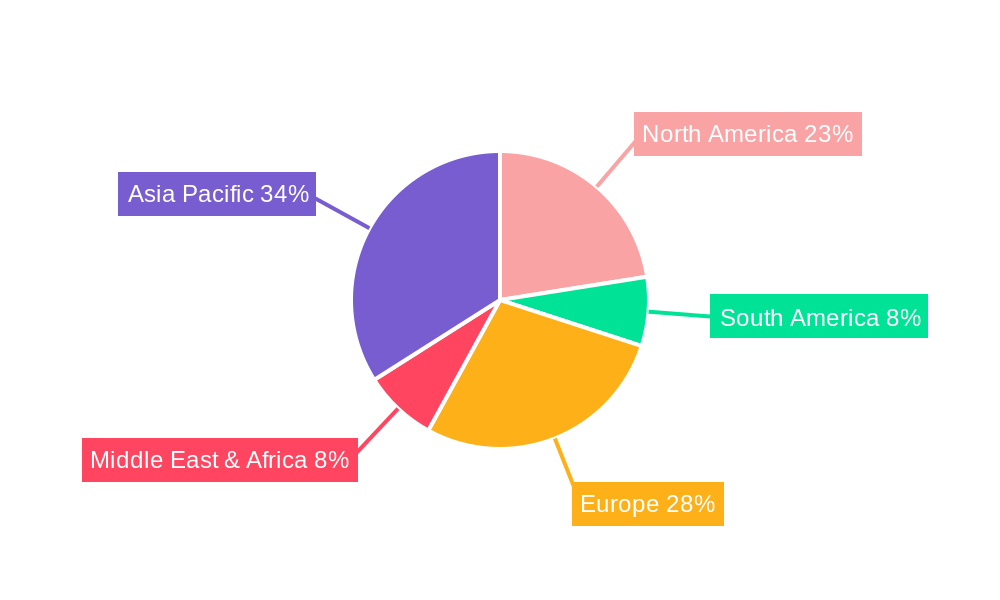

While Passenger Cars lead, the Commercial Vehicles segment is exhibiting strong growth, driven by increasing freight transportation demands and stricter emissions standards for heavy-duty vehicles. Countries with robust logistics industries, such as the United States and Germany, are significant contributors. The Type segment of Diesel fuel degassers remains critical, especially for the commercial vehicle sector, although the Gasoline segment is rapidly evolving with technological advancements in direct injection. The Asia-Pacific region is the largest geographic market, owing to its massive vehicle production capacity and growing automotive industry. China, in particular, is a dominant country, followed by the United States and Germany, which lead in adopting advanced technologies and meeting stringent regulations.

Automotive Fuel Degassers Product Landscape

The automotive fuel degasser product landscape is characterized by continuous innovation focused on enhancing filtration efficiency, durability, and compatibility with diverse fuel types and engine technologies. Manufacturers are developing compact, lightweight designs that integrate seamlessly into increasingly crowded engine bays. Advanced materials, such as reinforced polymers and corrosion-resistant alloys, are employed to extend product lifespan and withstand demanding operating conditions. Notable product innovations include multi-stage filtration systems capable of capturing finer particulate matter and water contaminants, thereby improving fuel quality and protecting sensitive engine components. Furthermore, the development of self-cleaning or extended-life degassers is gaining traction, offering reduced maintenance intervals for consumers and fleet operators. These advancements are crucial for meeting stringent emission regulations and optimizing fuel economy across a spectrum of vehicles.

Key Drivers, Barriers & Challenges in Automotive Fuel Degassers

Key Drivers:

- Stringent Emission Standards: Global regulations (e.g., Euro 7, EPA Tier 4) mandating reduced particulate matter and NOx emissions are the primary growth catalyst.

- Increasing Vehicle Production: Rising global vehicle production, particularly in emerging economies, directly translates to higher demand for fuel system components.

- Advancements in Fuel Injection Technology: Sophistication in GDI and common rail diesel systems necessitates advanced fuel degassers for optimal performance and longevity.

- Growing Demand for Fuel Efficiency: Consumer and regulatory pressure for improved fuel economy drives the adoption of components that ensure efficient fuel delivery.

Barriers & Challenges:

- Supply Chain Volatility: Geopolitical events and raw material price fluctuations can impact component availability and cost, affecting an estimated 5-10% increase in production costs during periods of instability.

- High R&D and Validation Costs: Developing and testing new fuel degasser technologies to meet stringent automotive standards requires significant investment.

- Electrification Trend: The long-term shift towards electric vehicles could eventually reduce the demand for internal combustion engine components, including fuel degassers, though this impact is projected to be gradual.

- Intense Competition: A fragmented supplier base can lead to price pressures and challenges in maintaining profit margins, especially in the aftermarket segment.

Emerging Opportunities in Automotive Fuel Degassers

Emerging opportunities in the automotive fuel degasser market lie in the development of smart, sensor-integrated degassers that can monitor fuel quality in real-time and provide diagnostic feedback to vehicle systems or the driver. There is also a significant opportunity in catering to the growing demand for robust fuel degasser solutions for alternative fuel vehicles, such as those running on biofuels or synthetic fuels, which may have unique purity requirements. Furthermore, the expansion of the global vehicle parc in emerging markets, coupled with the increasing adoption of stricter emission norms in these regions, presents a substantial untapped market for advanced fuel degasser technologies. The aftermarket segment, particularly for commercial vehicles, offers a consistent revenue stream as aging fleets require replacements to maintain operational efficiency and regulatory compliance.

Growth Accelerators in the Automotive Fuel Degassers Industry

Long-term growth in the automotive fuel degassers industry will be significantly accelerated by breakthroughs in material science enabling lighter, more resilient components and by the ongoing integration of advanced filtration technologies that offer superior contaminant removal. Strategic partnerships between component manufacturers and OEMs will be crucial for co-developing next-generation fuel degasser systems that align with evolving vehicle architectures and emission targets. Market expansion strategies, focusing on underserved regions with rapidly growing automotive sectors and tightening environmental regulations, will also act as key growth accelerators. The continuous drive towards higher fuel efficiency and lower emissions across all vehicle types will ensure a sustained demand for innovative fuel degasser solutions.

Key Players Shaping the Automotive Fuel Degassers Market

- Mann+Hummel

- Bosch

- Denso

- Jetsheen

- FAC Filter

- Pentius Automotive Parts

- Gud Holdings

- Mahle

- Sogefi

- Hengst

- K&N Engineering

- Cummins

- Illinois Tool Works

- Clarcor

- Donaldson

- Nevsky Filter Plant

- Yonghua Group

Notable Milestones in Automotive Fuel Degassers Sector

- 2019: Increased adoption of Gasoline Direct Injection (GDI) technology in passenger cars, driving demand for advanced fuel degassers.

- 2020: Introduction of new emission standards in key regions, such as stricter NOx limits in Europe, pushing for enhanced fuel system components.

- 2021: Significant investment in R&D for lighter and more durable materials for fuel degassers by major Tier-1 suppliers.

- 2022: Several M&A activities among smaller filter manufacturers to consolidate market presence and expand product portfolios.

- 2023: Enhanced focus on developing fuel degassers compatible with higher bio-content fuels and synthetic fuels.

- 2024 (Estimated): Further tightening of emission regulations globally, leading to increased demand for high-performance fuel degasser solutions.

- 2025 (Projected): Rollout of next-generation fuel degasser designs incorporating advanced filtration media and potential for integrated sensor technology.

In-Depth Automotive Fuel Degassers Market Outlook

- 2019: Increased adoption of Gasoline Direct Injection (GDI) technology in passenger cars, driving demand for advanced fuel degassers.

- 2020: Introduction of new emission standards in key regions, such as stricter NOx limits in Europe, pushing for enhanced fuel system components.

- 2021: Significant investment in R&D for lighter and more durable materials for fuel degassers by major Tier-1 suppliers.

- 2022: Several M&A activities among smaller filter manufacturers to consolidate market presence and expand product portfolios.

- 2023: Enhanced focus on developing fuel degassers compatible with higher bio-content fuels and synthetic fuels.

- 2024 (Estimated): Further tightening of emission regulations globally, leading to increased demand for high-performance fuel degasser solutions.

- 2025 (Projected): Rollout of next-generation fuel degasser designs incorporating advanced filtration media and potential for integrated sensor technology.

In-Depth Automotive Fuel Degassers Market Outlook

The automotive fuel degasser market outlook remains positive, driven by persistent demand from internal combustion engine vehicles and the ongoing transition to cleaner technologies. Growth accelerators like technological innovation in filtration and material science, coupled with strategic collaborations, will ensure sustained market expansion. The market will likely see an increased focus on optimizing fuel degasser performance for a wider range of fuel types, including biofuels and synthetic fuels, while simultaneously addressing the challenges posed by the long-term electrification trend. Strategic opportunities lie in expanding into emerging markets with developing automotive industries and increasing regulatory stringency, as well as in innovating for the aftermarket segment to support the existing global vehicle parc.

Automotive Fuel Degassers Segmentation

-

1. Application

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Type

- 2.1. Gasoline

- 2.2. Diesel

Automotive Fuel Degassers Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive Fuel Degassers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Fuel Degassers Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Gasoline

- 5.2.2. Diesel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Fuel Degassers Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Gasoline

- 6.2.2. Diesel

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive Fuel Degassers Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Gasoline

- 7.2.2. Diesel

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive Fuel Degassers Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Gasoline

- 8.2.2. Diesel

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive Fuel Degassers Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Gasoline

- 9.2.2. Diesel

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive Fuel Degassers Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Cars

- 10.1.2. Commercial Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Gasoline

- 10.2.2. Diesel

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mann+Hummel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bosch

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Denso

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jetsheen

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FAC Filter

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pentius Automotive Parts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gud Holdings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mahle

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sogefi

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hengst

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 K&N Engineering

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cummins

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Illinois Tool Works

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Clarcor

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Donaldson

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Nevsky Filter Plant

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Yonghua Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Mann+Hummel

List of Figures

- Figure 1: Global Automotive Fuel Degassers Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Fuel Degassers Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automotive Fuel Degassers Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automotive Fuel Degassers Revenue (million), by Type 2024 & 2032

- Figure 5: North America Automotive Fuel Degassers Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Automotive Fuel Degassers Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automotive Fuel Degassers Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automotive Fuel Degassers Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automotive Fuel Degassers Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automotive Fuel Degassers Revenue (million), by Type 2024 & 2032

- Figure 11: South America Automotive Fuel Degassers Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Automotive Fuel Degassers Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automotive Fuel Degassers Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Fuel Degassers Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automotive Fuel Degassers Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automotive Fuel Degassers Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Automotive Fuel Degassers Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Automotive Fuel Degassers Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automotive Fuel Degassers Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automotive Fuel Degassers Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automotive Fuel Degassers Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automotive Fuel Degassers Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Automotive Fuel Degassers Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Automotive Fuel Degassers Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automotive Fuel Degassers Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Fuel Degassers Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automotive Fuel Degassers Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automotive Fuel Degassers Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Fuel Degassers Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Fuel Degassers Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automotive Fuel Degassers Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Fuel Degassers Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Fuel Degassers Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automotive Fuel Degassers Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Automotive Fuel Degassers Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive Fuel Degassers Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automotive Fuel Degassers Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Automotive Fuel Degassers Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Fuel Degassers Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automotive Fuel Degassers Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Automotive Fuel Degassers Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Fuel Degassers Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automotive Fuel Degassers Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Automotive Fuel Degassers Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automotive Fuel Degassers Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automotive Fuel Degassers Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Automotive Fuel Degassers Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automotive Fuel Degassers Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automotive Fuel Degassers Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Automotive Fuel Degassers Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive Fuel Degassers Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Fuel Degassers?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Automotive Fuel Degassers?

Key companies in the market include Mann+Hummel, Bosch, Denso, Jetsheen, FAC Filter, Pentius Automotive Parts, Gud Holdings, Mahle, Sogefi, Hengst, K&N Engineering, Cummins, Illinois Tool Works, Clarcor, Donaldson, Nevsky Filter Plant, Yonghua Group.

3. What are the main segments of the Automotive Fuel Degassers?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Fuel Degassers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Fuel Degassers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Fuel Degassers?

To stay informed about further developments, trends, and reports in the Automotive Fuel Degassers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence