Key Insights

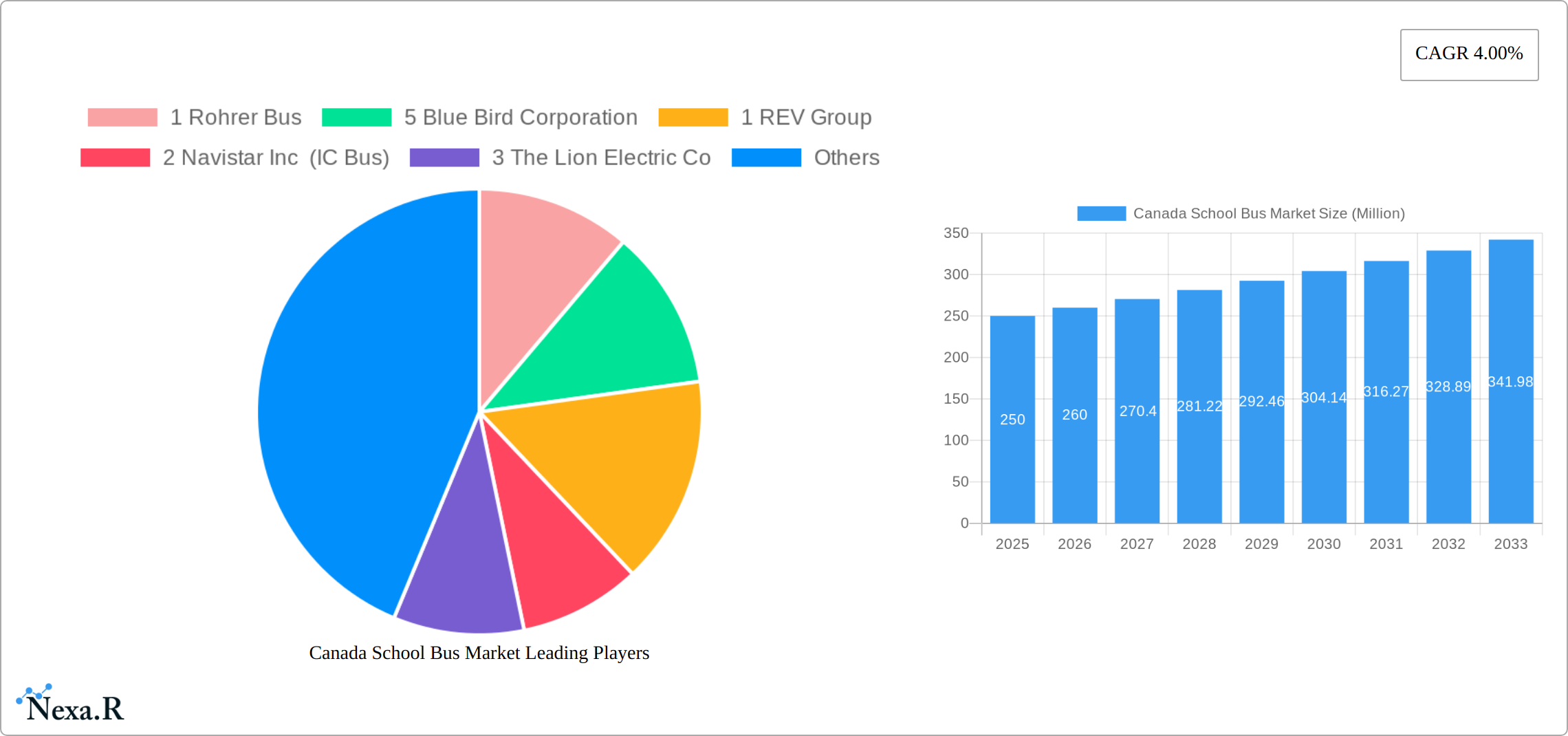

The Canadian school bus market, valued at approximately $X million in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 4.00% from 2025 to 2033. This growth is fueled by several key factors. Increasing school enrollment, particularly in expanding urban centers within Canada's provinces, consistently drives demand for new school buses. Furthermore, the ongoing shift towards more fuel-efficient and environmentally friendly vehicles, such as hybrid and electric buses, presents significant opportunities for market expansion. Government regulations promoting cleaner transportation and initiatives supporting sustainable infrastructure are also acting as catalysts for this transition. While rising raw material costs and supply chain disruptions pose some challenges, the long-term outlook remains positive, particularly for manufacturers and operators who can effectively adapt to the evolving technological landscape. The market segmentation, encompassing internal combustion engine (ICE), hybrid, and electric propulsion systems, as well as diverse bus design types (A, B, C, and D), reflects the varied needs of different school districts across Canada's diverse geography.

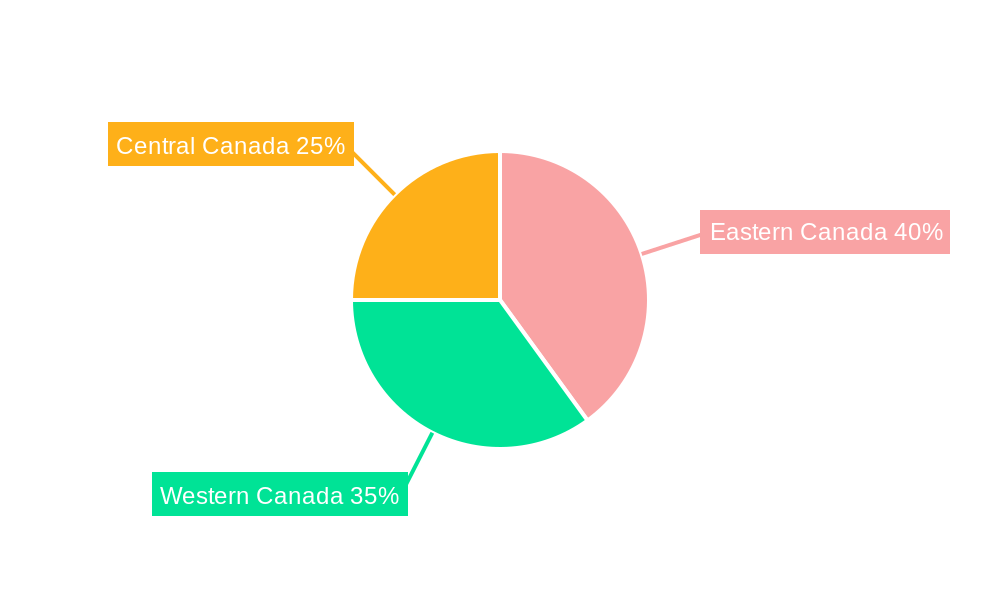

The competitive landscape is characterized by a mix of established players like Blue Bird Corporation, Thomas Built Buses, and Lion Electric Co., alongside regional operators such as First Student Inc. and Student Transportation of America Inc. The market is witnessing a notable increase in the adoption of electric school buses, driven by governmental incentives and growing environmental awareness. Regional variations in market dynamics are expected, with regions like Eastern Canada potentially exhibiting faster growth due to higher population density and infrastructure development. However, Western Canada and Central Canada also present substantial growth opportunities, influenced by factors such as government funding for school transportation and the ongoing expansion of rural school districts. To maintain a competitive edge, manufacturers are focusing on technological innovation, including the integration of advanced safety features and telematics systems. The focus on operational efficiency and reduced emissions is transforming the industry. Continued investment in research and development, alongside strategic partnerships, will be crucial for players seeking to capitalize on the projected growth trajectory of this market.

Canada School Bus Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada school bus market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the parent market (School Transportation) and child markets (School Bus Manufacturers and School Bus Operators), offering valuable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The market size is presented in million units.

Canada School Bus Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Canadian school bus sector. The market is characterized by a moderate level of concentration, with key players such as Blue Bird Corporation, REV Group, and Thomas Built Buses holding significant market share. However, the emergence of electric vehicle manufacturers like The Lion Electric Co is disrupting the traditional internal combustion engine (ICE) dominated market.

- Market Concentration: xx% market share held by top 5 players in 2025.

- Technological Innovation: Shift towards electric and hybrid propulsion systems, advanced safety features (e.g., automatic reversing doors, pedestrian detection), and telematics integration are key drivers.

- Regulatory Framework: Government regulations concerning emissions, safety standards, and accessibility are significantly impacting market dynamics. xx new regulations expected by 2030.

- Competitive Substitutes: Limited direct substitutes exist, but alternative transportation solutions like ride-sharing services could pose indirect competition in specific contexts.

- End-User Demographics: The market is driven by the evolving needs of school districts and student transportation services, with increasing emphasis on safety, sustainability, and operational efficiency.

- M&A Trends: xx M&A deals observed between 2019-2024. Consolidation is expected to continue, driven by economies of scale and technological integration.

Canada School Bus Market Growth Trends & Insights

The Canadian school bus market is on an upward trajectory, projected for substantial growth throughout the forecast period (2025-2033). The market is anticipated to reach an impressive size of [Insert Estimated Million Units by 2033] units by 2033. This expansion is fueled by a confluence of powerful factors, including consistently rising school enrollment across the nation, robust government initiatives actively promoting the adoption of cleaner, electric school buses, and the ongoing necessity for fleet modernization and renewal. A discernible and accelerating shift is underway, moving away from traditional internal combustion engine (ICE) buses towards more sustainable hybrid and fully electric vehicles. This transition is predominantly driven by heightened environmental consciousness among stakeholders and the attractive incentives offered by various levels of government. Furthermore, consumer behavior is evolving, with an increasing emphasis placed on both the safety of students and the environmental footprint of school transportation services.

- Market Size Evolution: The market has demonstrated consistent growth, expanding from approximately [Insert Past Million Units in 2019] million units in 2019 to an estimated [Insert Past Million Units in 2024] million units in 2024, reflecting a Compound Annual Growth Rate (CAGR) of [Insert CAGR Percentage]%.

- Adoption Rates: The uptake of electric school buses is experiencing a significant surge. Projections indicate a market penetration of [Insert Projected Electric Bus Penetration Percentage]% by 2033, signaling a strong commitment to electrification.

- Technological Disruptions: The ongoing transition towards electric powertrains and the nascent exploration of autonomous vehicle technology are profoundly reshaping the market landscape. This necessitates substantial investments in charging infrastructure, advanced vehicle technology, and specialized training.

- Consumer Behavior Shifts: School districts and transportation providers are increasingly prioritizing a comprehensive suite of factors in their procurement decisions. This includes enhanced safety features, improved fuel efficiency to manage operational costs, and a stronger commitment to environmental sustainability in their fleet choices.

Dominant Regions, Countries, or Segments in Canada School Bus Market

The Ontario and Quebec regions are expected to dominate the Canadian school bus market, driven by higher school enrollments and infrastructure development. Within the segments, Type C school buses are currently the most prevalent, catering to the majority of student transportation needs. However, the market is showing significant growth in the electric and hybrid propulsion segments, fueled by government incentives and environmental concerns.

- Key Drivers (Ontario & Quebec):

- Higher school enrollments.

- Increased government funding for school transportation infrastructure.

- Favorable policies promoting the adoption of electric vehicles.

- Dominance Factors:

- High population density.

- Well-established school transportation systems.

- Robust infrastructure for charging electric vehicles (in the case of electric segments).

- Growth Potential:

- Significant opportunities exist for expansion in rural areas and smaller provinces through targeted government initiatives and private investments. Market size for Type C buses is expected to reach xx million units by 2033, while the electric segment is projected to grow to xx million units.

Canada School Bus Market Product Landscape

The Canadian school bus market offers a variety of bus types (Type A, B, C, and D), each designed for specific needs. Technological advancements are focused on enhancing safety, fuel efficiency, and passenger comfort. Key features include advanced driver-assistance systems (ADAS), improved seating arrangements, and enhanced security measures. The emergence of electric school buses introduces innovative features like quieter operation and reduced emissions. Unique selling propositions often revolve around safety features, environmental benefits, and overall operational efficiency.

Key Drivers, Barriers & Challenges in Canada School Bus Market

Key Drivers:

- Rising School Enrollment: A fundamental driver is the consistent increase in student populations across Canada, necessitating a larger and more modern school bus fleet.

- Government Incentives for Electric Bus Adoption: Favorable government policies, including grants, subsidies, and tax credits, are actively encouraging school districts and operators to transition to zero-emission vehicles.

- Growing Focus on Safety and Sustainability: Heightened awareness and demand for safer student transportation and a reduced environmental impact are compelling factors driving market evolution.

- Need for Fleet Renewal and Modernization: Many existing school bus fleets are aging, requiring replacement and upgrades to meet current safety standards and operational efficiencies.

Key Challenges and Restraints:

- High Initial Cost of Electric School Buses: The upfront purchase price of electric school buses remains a significant barrier for some budget-conscious school districts and operators.

- Limited Charging Infrastructure in Certain Regions: The availability and accessibility of robust charging infrastructure can be a challenge, particularly in rural or remote areas, impacting operational feasibility.

- Supply Chain Disruptions Impacting Component Availability: Global supply chain volatility can lead to delays and increased costs for essential components, affecting manufacturing and maintenance.

- Competition from Alternative Transportation Solutions: The increasing availability and appeal of alternative transportation methods, such as public transit improvements or ride-sharing services for older students, can present competitive pressures. This may lead to an estimated [Insert Estimated Percentage Reduction]% reduction in market growth in specific, highly competitive regions.

Emerging Opportunities in Canada School Bus Market

- Expansion into rural and remote areas.

- Development of autonomous driving capabilities.

- Integration of advanced telematics and data analytics.

- Growing demand for customized school bus solutions.

Growth Accelerators in the Canada School Bus Market Industry

Technological advancements are acting as potent growth catalysts within the Canadian school bus market. Innovations in electric vehicle battery technology, charging solutions, and the development of semi-autonomous features are making these vehicles more practical and appealing. Furthermore, strategic partnerships are forming between leading bus manufacturers, technology providers, and forward-thinking school districts. These collaborations are instrumental in piloting new technologies, streamlining implementation, and ensuring the successful integration of advanced school bus solutions. Government support remains a critical accelerator, manifesting through dedicated funding programs for fleet electrification, supportive regulatory frameworks that encourage sustainable transportation, and initiatives aimed at building out necessary infrastructure, all of which are paving the way for accelerated market expansion.

Key Players Shaping the Canada School Bus Market Market

- Rohrer Bus

- Blue Bird Corporation

- REV Group

- Navistar Inc (IC Bus)

- The Lion Electric Co

- The Thomas Bus

- MV Transit

- First Student Inc

- Toronto Student Transportation Group

- Von-Con Inc

- Student Transportation of America Inc

Notable Milestones in Canada School Bus Market Sector

- July 2021: Student Transportation of America launched an electric school bus program in Los Angeles, signaling a shift towards sustainable transportation.

- February 2020: Thomas Built Buses introduced the auto-reversing door feature, enhancing safety standards across its SafT-Liner C2 bus models. The company's subsequent development of pedestrian detection technology further solidified its commitment to safety innovation.

In-Depth Canada School Bus Market Market Outlook

The Canadian school bus market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and supportive government policies. Strategic partnerships, investment in charging infrastructure, and the adoption of electric and autonomous technologies will be crucial for realizing the market's full potential. The market is expected to witness significant expansion in the electric bus segment, with continued consolidation among key players.

Canada School Bus Market Segmentation

-

1. Propulsion

- 1.1. Internal Combustion Engine

- 1.2. Hybrid and Electric

-

2. Design Type

- 2.1. Type A

- 2.2. Type B

- 2.3. Type C

- 2.4. Type D

Canada School Bus Market Segmentation By Geography

- 1. Canada

Canada School Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Logistics Company may Drive the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Government Incentives for Buying New EV May Hamper the Market

- 3.4. Market Trends

- 3.4.1. Rising demand for electric school buses

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada School Bus Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion

- 5.1.1. Internal Combustion Engine

- 5.1.2. Hybrid and Electric

- 5.2. Market Analysis, Insights and Forecast - by Design Type

- 5.2.1. Type A

- 5.2.2. Type B

- 5.2.3. Type C

- 5.2.4. Type D

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Propulsion

- 6. Eastern Canada Canada School Bus Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada School Bus Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada School Bus Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 1 Rohrer Bus

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 5 Blue Bird Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 1 REV Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 2 Navistar Inc (IC Bus)

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 3 The Lion Electric Co

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 4 The Thomas Bus

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 3 MV Transit

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 4 First Student Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 School Bus Operator

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 5 Toronto Student Transportation Grou

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 6 Von-Con Inc

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 2 Student Transportation of America Inc

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 School Bus Manufacturer

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.1 1 Rohrer Bus

List of Figures

- Figure 1: Canada School Bus Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada School Bus Market Share (%) by Company 2024

List of Tables

- Table 1: Canada School Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada School Bus Market Revenue Million Forecast, by Propulsion 2019 & 2032

- Table 3: Canada School Bus Market Revenue Million Forecast, by Design Type 2019 & 2032

- Table 4: Canada School Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Canada School Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Eastern Canada Canada School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Canada Canada School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Central Canada Canada School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada School Bus Market Revenue Million Forecast, by Propulsion 2019 & 2032

- Table 10: Canada School Bus Market Revenue Million Forecast, by Design Type 2019 & 2032

- Table 11: Canada School Bus Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada School Bus Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Canada School Bus Market?

Key companies in the market include 1 Rohrer Bus, 5 Blue Bird Corporation, 1 REV Group, 2 Navistar Inc (IC Bus), 3 The Lion Electric Co, 4 The Thomas Bus, 3 MV Transit, 4 First Student Inc, School Bus Operator, 5 Toronto Student Transportation Grou, 6 Von-Con Inc, 2 Student Transportation of America Inc, School Bus Manufacturer.

3. What are the main segments of the Canada School Bus Market?

The market segments include Propulsion, Design Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Logistics Company may Drive the Growth of the Market.

6. What are the notable trends driving market growth?

Rising demand for electric school buses.

7. Are there any restraints impacting market growth?

Government Incentives for Buying New EV May Hamper the Market.

8. Can you provide examples of recent developments in the market?

In July 2021, Student Transportation of America launched an electric school bus program in Los Angeles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada School Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada School Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada School Bus Market?

To stay informed about further developments, trends, and reports in the Canada School Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence