Key Insights

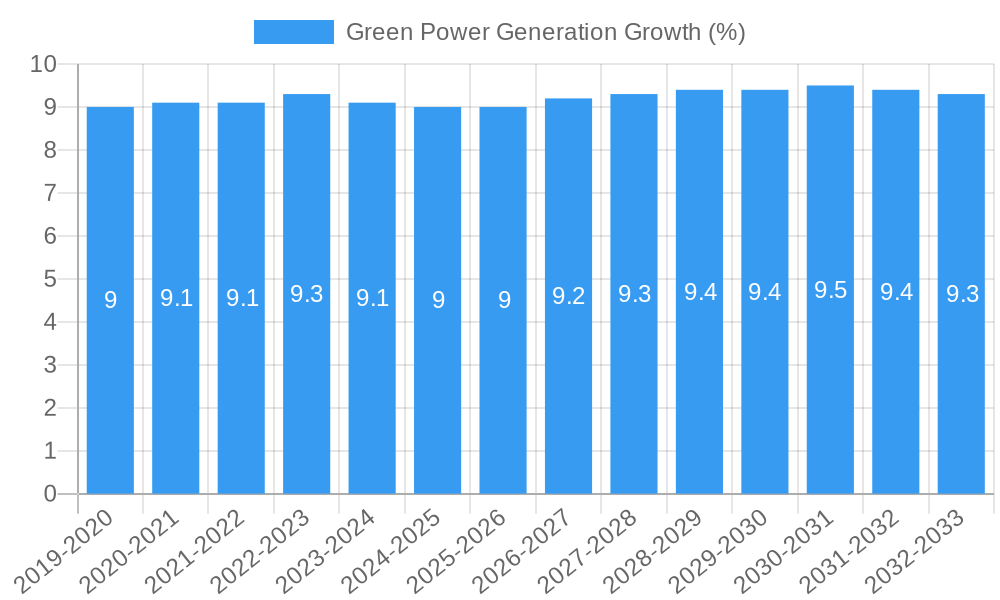

The global green power generation market is experiencing robust expansion, projected to reach approximately USD 1495 billion by 2025, with a significant Compound Annual Growth Rate (CAGR) of 9.7% expected to persist through the forecast period of 2025-2033. This growth is primarily fueled by an escalating global demand for sustainable energy solutions, driven by stringent government regulations aimed at curbing carbon emissions and promoting environmental protection. The increasing awareness among consumers and corporations about climate change is further bolstering investments in renewable energy sources. Technological advancements in photovoltaic and wind power generation, leading to improved efficiency and reduced costs, are key enablers of this market's upward trajectory. The integration of smart grid technologies and energy storage solutions is also playing a crucial role in enhancing the reliability and scalability of green power, making it a more viable alternative to traditional fossil fuels.

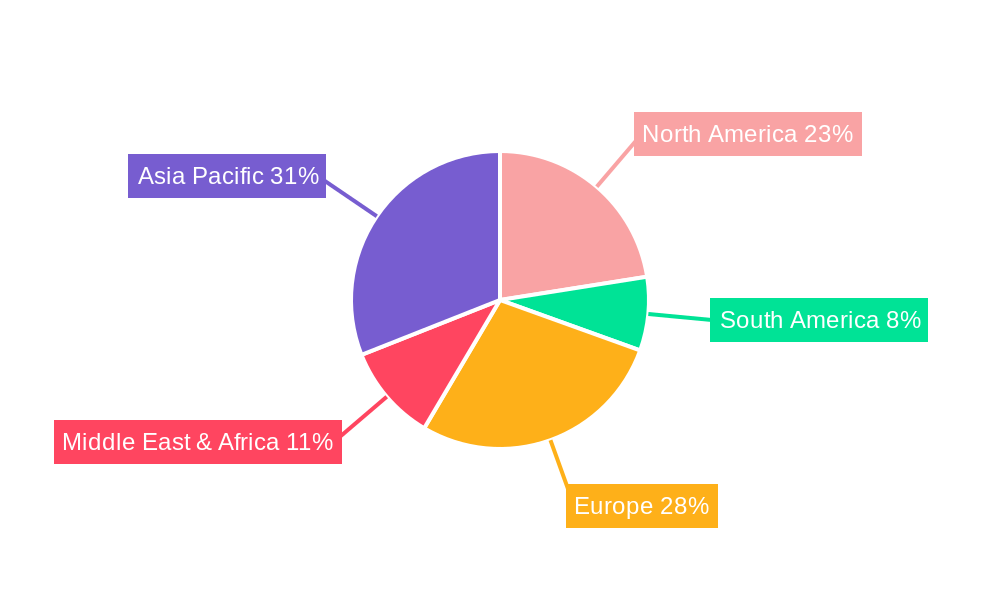

The market segmentation reveals a diversified landscape with key applications spanning industrial, commercial, and residential sectors, each exhibiting unique growth drivers and adoption rates. Photovoltaic and wind power generation dominate the types of green energy sources, owing to their declining costs and widespread availability. Biomass, geothermal, and other renewable sources are also carving out significant niches, driven by regional resource availability and specific energy needs. Geographically, the Asia Pacific region, particularly China and India, is anticipated to lead market growth due to supportive government policies, substantial investments, and a rapidly expanding industrial and urban infrastructure. Europe and North America are also major contributors, characterized by mature markets with a strong emphasis on policy-driven adoption and technological innovation. Despite the overwhelmingly positive outlook, challenges such as intermittency of renewable sources, grid integration complexities, and upfront capital investment costs in certain regions may pose minor headwinds, though ongoing innovation and supportive policies are steadily mitigating these concerns.

Here's the SEO-optimized report description for Green Power Generation, adhering to all your specifications:

Green Power Generation Market Dynamics & Structure

The green power generation market is characterized by dynamic growth and evolving structures, driven by increasing environmental consciousness and supportive government policies. Market concentration varies across different segments and regions, with established players like CHN ENERGY Investment Group, Iberdrola, and State Power Investment Corporation Limited holding significant shares in certain parent and child markets. Technological innovation remains a primary driver, particularly in photovoltaic and wind power generation, with ongoing advancements in efficiency and cost reduction. Robust regulatory frameworks, including renewable energy mandates and carbon pricing mechanisms, are accelerating adoption. While competitive product substitutes exist, such as advanced fossil fuel technologies, the long-term sustainability advantage of green energy is undeniable. End-user demographics are broadening, with significant uptake in industrial, commercial, and residential applications. Mergers and acquisitions (M&A) are a notable trend, with companies like E.ON and Enel Group actively consolidating their positions and expanding their portfolios. For instance, M&A deal volumes reached an estimated $150,000 million units in the historical period (2019-2024), signaling robust investor confidence. Innovation barriers, however, include high upfront investment costs and grid integration challenges, which are being addressed through continuous R&D and smart grid development.

- Market Concentration: Moderate to high in mature photovoltaic and wind segments, with a fragmented landscape in emerging areas.

- Technological Innovation: Driven by R&D in solar panel efficiency, wind turbine design, and energy storage solutions.

- Regulatory Frameworks: Supportive policies such as tax credits, feed-in tariffs, and emission standards are key enablers.

- Competitive Product Substitutes: Advanced fossil fuel technologies and nuclear energy present competition, but with different environmental footprints.

- End-User Demographics: Growing adoption across industrial, commercial, and residential sectors.

- M&A Trends: Active consolidation and strategic partnerships are reshaping the competitive landscape.

Green Power Generation Growth Trends & Insights

The global green power generation market is poised for substantial expansion, fueled by a confluence of factors that are reshaping the energy landscape. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period of 2025–2033, reaching an estimated $2,500,000 million units by 2033. This robust growth trajectory is underpinned by accelerating adoption rates across various applications, from large-scale industrial power needs to individual residential installations. Photovoltaic power generation, in particular, has seen dramatic cost reductions, making solar energy increasingly accessible and competitive. Wind power generation continues its strong ascent, with advancements in turbine technology leading to higher efficiencies and greater energy output. Biomass power generation is also gaining traction as a viable renewable source, especially in regions with abundant agricultural and forestry resources. Geothermal power generation, while more geographically specific, offers a stable and consistent baseload power supply.

Technological disruptions are at the forefront of this market evolution. Innovations in energy storage systems, such as advanced battery technologies and green hydrogen, are crucial for addressing the intermittency of solar and wind power, thereby enhancing grid stability and reliability. These advancements are enabling higher market penetration rates for renewable energy sources. Consumer behavior is also shifting significantly, with a growing preference for sustainable energy solutions driven by environmental concerns and the desire for energy independence. This is evident in the increasing demand for rooftop solar installations in the residential sector and corporate power purchase agreements (PPAs) for renewable energy in the commercial and industrial segments. The base year of 2025 marks a significant inflection point, with market dynamics showing strong momentum. The historical period (2019–2024) laid the groundwork for this accelerated growth, with steady increases in installed capacity and investment.

The interplay of supportive government policies, declining technology costs, and rising environmental awareness creates a powerful engine for sustained growth. Countries worldwide are setting ambitious renewable energy targets, further stimulating investment and innovation. The transition to a low-carbon economy is no longer a distant prospect but a present reality, with green power generation at its core. The report's analysis, leveraging data from 2019 to 2033, provides a comprehensive view of this transformative period, highlighting key market penetration metrics and the impact of emerging technologies. The estimated market size for 2025 is projected to be $950,000 million units, with significant growth anticipated in the subsequent forecast period.

Dominant Regions, Countries, or Segments in Green Power Generation

The green power generation market is experiencing significant growth driven by a variety of factors across different regions and segments. Currently, Asia Pacific, particularly China, stands out as the dominant region, fueled by aggressive government support, massive investments in manufacturing capabilities, and a burgeoning demand for electricity to power its industrial and commercial sectors. China's ambitious renewable energy targets and substantial investments by key players like State Power Investment Corporation Limited, China Huaneng Group, and China Huadian Corporation have cemented its leadership. The sheer scale of installations for Photovoltaic Power Generation in this region, driven by declining costs and supportive policies, is unparalleled.

Within the parent market of green power generation, Photovoltaic Power Generation emerges as the leading type, dominating the global landscape. This is attributable to its scalability, modularity, and rapid technological advancements that have dramatically reduced its levelized cost of energy. China, a global manufacturing hub for solar panels, leads in both production and installation, supported by companies like Zhejiang Sunoren Solar Technology and CECEP Solar Energy Technology. The commercial and industrial application segments are experiencing particularly strong demand, as businesses increasingly seek to reduce their carbon footprints and energy costs through solar installations.

However, Wind Power Generation is also a critical and rapidly growing segment, especially in regions with favorable wind resources. Europe, led by countries like Germany and the UK, and North America, with the United States at the forefront, are significant players. Companies such as Iberdrola, E.ON, and NextEra Energy are heavily invested in large-scale wind farms, both onshore and offshore. The child market of offshore wind is experiencing particularly rapid growth due to higher and more consistent wind speeds.

Key drivers for this dominance include:

- Economic Policies: Government incentives, tax credits, and renewable energy mandates are crucial. For instance, the Inflation Reduction Act in the US has significantly boosted renewable energy investments.

- Infrastructure Development: Investments in grid modernization and expansion are essential for integrating large-scale renewable energy sources.

- Technological Advancements: Continuous improvements in solar panel efficiency and wind turbine technology have made these sources more competitive.

- Environmental Regulations: Stringent emission standards and climate change mitigation goals are pushing industries towards cleaner energy alternatives.

- Market Share: Photovoltaic power generation accounts for an estimated 45% of the total green power generation market in 2025, followed by wind power at approximately 35%.

The Industrial Application segment within green power generation is a significant growth engine, driven by large energy consumers seeking cost savings and sustainability credentials. Companies like Sinopec and KAISHAN GROUP are increasingly exploring renewable energy solutions to power their operations. The residential segment is also expanding, albeit at a slower pace, with growing interest in distributed solar generation. The estimated market share for the industrial application in 2025 is XX%, commercial is XX%, and residential is XX%.

Green Power Generation Product Landscape

The green power generation product landscape is characterized by a continuous stream of innovations designed to enhance efficiency, reduce costs, and improve grid integration. In photovoltaic power generation, advancements in solar panel technology, such as PERC (Passivated Emitter Rear Cell) and heterojunction technologies, are yielding higher energy conversion efficiencies, pushing towards 23% for commercially available panels. Battery storage solutions, particularly lithium-ion and emerging solid-state batteries, are crucial for addressing the intermittency of renewables, offering improved energy density and faster charging capabilities with capacities reaching up to 1,000 MWh for utility-scale applications. Wind turbine technology continues to evolve with larger rotor diameters and taller towers, enabling greater energy capture. Smart inverters and advanced grid management software are also critical product developments, facilitating seamless integration of diverse renewable energy sources into existing power grids. These technological leaps are enabling unique selling propositions of enhanced reliability, lower operational costs, and a reduced environmental impact.

Key Drivers, Barriers & Challenges in Green Power Generation

Key Drivers:

- Government Policies & Incentives: Favorable regulations, tax credits, and renewable energy mandates are instrumental in driving market growth. For example, the widespread adoption of feed-in tariffs has significantly boosted solar and wind installations globally.

- Declining Technology Costs: Continuous innovation and economies of scale have led to substantial reductions in the cost of solar panels and wind turbines, making them increasingly competitive with traditional energy sources.

- Environmental Concerns & Climate Change Mitigation: Growing awareness of climate change and the imperative to reduce greenhouse gas emissions are powerful motivators for transitioning to green energy.

- Energy Security & Independence: Renewable energy sources offer a path to reduce reliance on volatile fossil fuel markets and enhance national energy security.

Barriers & Challenges:

- Intermittency & Grid Integration: The variable nature of solar and wind power poses challenges for grid stability, requiring significant investment in energy storage and grid modernization.

- High Upfront Investment Costs: Despite declining costs, the initial capital expenditure for large-scale green power projects can still be substantial, requiring significant financing.

- Supply Chain Disruptions: Geopolitical factors and the concentration of manufacturing for certain components (e.g., solar panels) can lead to supply chain vulnerabilities.

- Regulatory Hurdles & Permitting: Complex and time-consuming permitting processes and evolving regulatory landscapes can slow down project development.

- Land Use & Siting Issues: Large-scale solar and wind farms require significant land area, which can lead to environmental and community opposition.

Emerging Opportunities in Green Power Generation

Emerging opportunities in the green power generation market are abundant, driven by evolving consumer preferences and technological advancements. The burgeoning demand for green hydrogen, produced through electrolysis powered by renewable energy, presents a significant opportunity for decarbonizing heavy industries and transportation sectors. Decentralized energy systems, including microgrids and rooftop solar with integrated battery storage, are gaining traction, offering greater resilience and energy independence for communities and businesses. The integration of artificial intelligence (AI) and the Internet of Things (IoT) in energy management systems promises to optimize energy generation, distribution, and consumption, leading to greater efficiency and cost savings. Furthermore, the growing emphasis on circular economy principles is spurring innovations in the recycling and repurposing of solar panels and wind turbine components, creating new value chains.

Growth Accelerators in the Green Power Generation Industry

Several key catalysts are accelerating the growth of the green power generation industry. Technological breakthroughs in energy storage solutions, such as solid-state batteries and advanced flow batteries, are crucial for overcoming the intermittency of renewable sources and enabling higher penetration rates. Strategic partnerships and collaborations between technology providers, energy developers, and financial institutions are vital for mobilizing the significant capital required for large-scale projects. Market expansion strategies, including entering new geographical markets with untapped renewable potential and developing innovative business models (e.g., Power Purchase Agreements, Energy-as-a-Service), are also driving growth. Moreover, increasing corporate commitments to sustainability and net-zero emissions targets are creating substantial demand for renewable energy procurement.

Key Players Shaping the Green Power Generation Market

- CHN ENERGY Investment Group

- Iberdrola

- State Power Investment Corporation Limited

- China Huaneng Group

- China Huadian Corporation

- China Datang Corporation Renewable Power Co., Limited

- China Resources Power Holdings Company Limited

- China Three Gorges Corporation

- E.ON

- ACCIONA

- Nyocor Co., Ltd

- Zhejiang Sunoren Solar Technology

- CECEP Solar Energy Technology

- Zhejiang Provincial New Energy Investment Group

- Jiawei Renewable Energy

- China Ruifeng Renewable Energy Holdings Limited

- China Suntien Green Energy Corporation Limited

- Risen Energy Co., Ltd

- Topray Solar

- Jiangsu Zhongli Group

- Jiangsu Linyang Energy

- Clenergy Technology

- Beijing Energy International Holding

- Beijing Enterprises Clean Energy Group Limited

- OCI COMPANY

- NextEra Energy

- CGN Wind Energy Limited

- Drax Group

- Orsted

- Enel Group

- Engie

- EPH

- EDF

- RWE

- CEZ

- Babcock & Wilcox

- Ameresco, Inc

- John Wood Group

- Vattenfall AB

- Sinopec

- KAISHAN GROUP

- China Power Investment Corporation

- Calpine Corp

- Ormat Technologies Inc

- CFE

- KenGen

- Contact Energy Ltd

- PT Pertamina (Persero)

- Berkshire Hathaway Inc

Notable Milestones in Green Power Generation Sector

- 2019: Significant global increase in offshore wind capacity installations, with multiple large-scale projects commencing operations.

- 2020: COVID-19 pandemic leads to temporary slowdowns but highlights the resilience of the renewable energy sector; substantial growth in solar PV installations despite disruptions.

- 2021: Record investments in renewable energy projects globally, driven by climate commitments and economic recovery efforts.

- 2022: Supply chain challenges and rising material costs impact project timelines and costs, but innovation in manufacturing and sourcing begins to emerge.

- 2023: Breakthroughs in battery storage technology promise to significantly enhance grid reliability and accelerate the adoption of intermittent renewables.

- 2024: Increased focus on green hydrogen production and its integration into industrial and transportation sectors gains momentum.

- 2025: Anticipated to be a pivotal year with accelerated deployment of renewable energy projects and a substantial increase in market share across various applications.

In-Depth Green Power Generation Market Outlook

The future outlook for the green power generation market is exceptionally strong, characterized by sustained high growth and transformative potential. Growth accelerators, including relentless technological innovation in energy storage, the development of smart grids, and robust government support mechanisms, will continue to propel the market forward. Strategic partnerships between industry leaders and emerging technology providers will foster a more dynamic and efficient ecosystem. Market expansion into new geographies and the development of novel business models will unlock further potential, catering to diverse energy needs. The increasing commitment from corporations to achieve net-zero emissions is a significant demand driver, ensuring a consistent and expanding customer base for renewable energy solutions. The industry is not only poised for quantitative growth in installed capacity and market value but also for qualitative advancements that will redefine the global energy paradigm.

Green Power Generation Segmentation

-

1. Application

- 1.1. Industrial

- 1.2. Commercial

- 1.3. Residential

-

2. Types

- 2.1. Photovoltaic Power Generation

- 2.2. Wind Power Generation

- 2.3. Biomass Power Generation

- 2.4. Geothermal Power Generation

- 2.5. Others

Green Power Generation Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Green Power Generation REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Green Power Generation Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industrial

- 5.1.2. Commercial

- 5.1.3. Residential

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Photovoltaic Power Generation

- 5.2.2. Wind Power Generation

- 5.2.3. Biomass Power Generation

- 5.2.4. Geothermal Power Generation

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Green Power Generation Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Industrial

- 6.1.2. Commercial

- 6.1.3. Residential

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Photovoltaic Power Generation

- 6.2.2. Wind Power Generation

- 6.2.3. Biomass Power Generation

- 6.2.4. Geothermal Power Generation

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Green Power Generation Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Industrial

- 7.1.2. Commercial

- 7.1.3. Residential

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Photovoltaic Power Generation

- 7.2.2. Wind Power Generation

- 7.2.3. Biomass Power Generation

- 7.2.4. Geothermal Power Generation

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Green Power Generation Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Industrial

- 8.1.2. Commercial

- 8.1.3. Residential

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Photovoltaic Power Generation

- 8.2.2. Wind Power Generation

- 8.2.3. Biomass Power Generation

- 8.2.4. Geothermal Power Generation

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Green Power Generation Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Industrial

- 9.1.2. Commercial

- 9.1.3. Residential

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Photovoltaic Power Generation

- 9.2.2. Wind Power Generation

- 9.2.3. Biomass Power Generation

- 9.2.4. Geothermal Power Generation

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Green Power Generation Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Industrial

- 10.1.2. Commercial

- 10.1.3. Residential

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Photovoltaic Power Generation

- 10.2.2. Wind Power Generation

- 10.2.3. Biomass Power Generation

- 10.2.4. Geothermal Power Generation

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 CHN ENERGY Investment Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Iberdrola

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 State Power Investment Corporation Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Huaneng Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Huadian Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Datang Corporation Renewable Power Co.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 China Resources Power Holdings Company Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 China Three Gorges Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 E.ON

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ACCIONA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nyocor Co.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Zhejiang Sunoren Solar Technology

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 CECEP Solar Energy Technology

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Zhejiang Provincial New Energy Investment Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Jiawei Renewable Energy

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 China Ruifeng Renewable Energy Holdings Limited

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 China Suntien Green Energy Corporation Limited

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Risen Energy Co.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Topray Solar

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Jiangsu Zhongli Group

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Jiangsu Linyang Energy

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Clenergy Technology

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Beijing Energy International Holding

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Beijing Enterprises Clean Energy Group Limited

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 OCI COMPANY

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 NextEra Energy

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 CGN Wind Energy Limited

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 Drax Group

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 Orsted

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 Enel Group

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.34 Engie

- 11.2.34.1. Overview

- 11.2.34.2. Products

- 11.2.34.3. SWOT Analysis

- 11.2.34.4. Recent Developments

- 11.2.34.5. Financials (Based on Availability)

- 11.2.35 EPH

- 11.2.35.1. Overview

- 11.2.35.2. Products

- 11.2.35.3. SWOT Analysis

- 11.2.35.4. Recent Developments

- 11.2.35.5. Financials (Based on Availability)

- 11.2.36 EDF

- 11.2.36.1. Overview

- 11.2.36.2. Products

- 11.2.36.3. SWOT Analysis

- 11.2.36.4. Recent Developments

- 11.2.36.5. Financials (Based on Availability)

- 11.2.37 RWE

- 11.2.37.1. Overview

- 11.2.37.2. Products

- 11.2.37.3. SWOT Analysis

- 11.2.37.4. Recent Developments

- 11.2.37.5. Financials (Based on Availability)

- 11.2.38 CEZ

- 11.2.38.1. Overview

- 11.2.38.2. Products

- 11.2.38.3. SWOT Analysis

- 11.2.38.4. Recent Developments

- 11.2.38.5. Financials (Based on Availability)

- 11.2.39 Babcock & Wilcox

- 11.2.39.1. Overview

- 11.2.39.2. Products

- 11.2.39.3. SWOT Analysis

- 11.2.39.4. Recent Developments

- 11.2.39.5. Financials (Based on Availability)

- 11.2.40 Ameresco

- 11.2.40.1. Overview

- 11.2.40.2. Products

- 11.2.40.3. SWOT Analysis

- 11.2.40.4. Recent Developments

- 11.2.40.5. Financials (Based on Availability)

- 11.2.41 Inc

- 11.2.41.1. Overview

- 11.2.41.2. Products

- 11.2.41.3. SWOT Analysis

- 11.2.41.4. Recent Developments

- 11.2.41.5. Financials (Based on Availability)

- 11.2.42 John Wood Group

- 11.2.42.1. Overview

- 11.2.42.2. Products

- 11.2.42.3. SWOT Analysis

- 11.2.42.4. Recent Developments

- 11.2.42.5. Financials (Based on Availability)

- 11.2.43 Vattenfall AB

- 11.2.43.1. Overview

- 11.2.43.2. Products

- 11.2.43.3. SWOT Analysis

- 11.2.43.4. Recent Developments

- 11.2.43.5. Financials (Based on Availability)

- 11.2.44 Sinopec

- 11.2.44.1. Overview

- 11.2.44.2. Products

- 11.2.44.3. SWOT Analysis

- 11.2.44.4. Recent Developments

- 11.2.44.5. Financials (Based on Availability)

- 11.2.45 KAISHAN GROUP

- 11.2.45.1. Overview

- 11.2.45.2. Products

- 11.2.45.3. SWOT Analysis

- 11.2.45.4. Recent Developments

- 11.2.45.5. Financials (Based on Availability)

- 11.2.46 China Power Investment Corporation

- 11.2.46.1. Overview

- 11.2.46.2. Products

- 11.2.46.3. SWOT Analysis

- 11.2.46.4. Recent Developments

- 11.2.46.5. Financials (Based on Availability)

- 11.2.47 Calpine Corp

- 11.2.47.1. Overview

- 11.2.47.2. Products

- 11.2.47.3. SWOT Analysis

- 11.2.47.4. Recent Developments

- 11.2.47.5. Financials (Based on Availability)

- 11.2.48 Ormat Technologies Inc

- 11.2.48.1. Overview

- 11.2.48.2. Products

- 11.2.48.3. SWOT Analysis

- 11.2.48.4. Recent Developments

- 11.2.48.5. Financials (Based on Availability)

- 11.2.49 CFE

- 11.2.49.1. Overview

- 11.2.49.2. Products

- 11.2.49.3. SWOT Analysis

- 11.2.49.4. Recent Developments

- 11.2.49.5. Financials (Based on Availability)

- 11.2.50 KenGen

- 11.2.50.1. Overview

- 11.2.50.2. Products

- 11.2.50.3. SWOT Analysis

- 11.2.50.4. Recent Developments

- 11.2.50.5. Financials (Based on Availability)

- 11.2.51 Contact Energy Ltd

- 11.2.51.1. Overview

- 11.2.51.2. Products

- 11.2.51.3. SWOT Analysis

- 11.2.51.4. Recent Developments

- 11.2.51.5. Financials (Based on Availability)

- 11.2.52 PT Pertamina (Persero)

- 11.2.52.1. Overview

- 11.2.52.2. Products

- 11.2.52.3. SWOT Analysis

- 11.2.52.4. Recent Developments

- 11.2.52.5. Financials (Based on Availability)

- 11.2.53 Berkshire Hathaway Inc

- 11.2.53.1. Overview

- 11.2.53.2. Products

- 11.2.53.3. SWOT Analysis

- 11.2.53.4. Recent Developments

- 11.2.53.5. Financials (Based on Availability)

- 11.2.1 CHN ENERGY Investment Group

List of Figures

- Figure 1: Global Green Power Generation Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Green Power Generation Revenue (million), by Application 2024 & 2032

- Figure 3: North America Green Power Generation Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Green Power Generation Revenue (million), by Types 2024 & 2032

- Figure 5: North America Green Power Generation Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Green Power Generation Revenue (million), by Country 2024 & 2032

- Figure 7: North America Green Power Generation Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Green Power Generation Revenue (million), by Application 2024 & 2032

- Figure 9: South America Green Power Generation Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Green Power Generation Revenue (million), by Types 2024 & 2032

- Figure 11: South America Green Power Generation Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Green Power Generation Revenue (million), by Country 2024 & 2032

- Figure 13: South America Green Power Generation Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Green Power Generation Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Green Power Generation Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Green Power Generation Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Green Power Generation Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Green Power Generation Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Green Power Generation Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Green Power Generation Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Green Power Generation Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Green Power Generation Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Green Power Generation Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Green Power Generation Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Green Power Generation Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Green Power Generation Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Green Power Generation Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Green Power Generation Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Green Power Generation Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Green Power Generation Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Green Power Generation Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Green Power Generation Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Green Power Generation Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Green Power Generation Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Green Power Generation Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Green Power Generation Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Green Power Generation Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Green Power Generation Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Green Power Generation Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Green Power Generation Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Green Power Generation Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Green Power Generation Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Green Power Generation Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Green Power Generation Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Green Power Generation Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Green Power Generation Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Green Power Generation Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Green Power Generation Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Green Power Generation Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Green Power Generation Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Green Power Generation Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Green Power Generation?

The projected CAGR is approximately 9.7%.

2. Which companies are prominent players in the Green Power Generation?

Key companies in the market include CHN ENERGY Investment Group, Iberdrola, State Power Investment Corporation Limited, China Huaneng Group, China Huadian Corporation, China Datang Corporation Renewable Power Co., Limited, China Resources Power Holdings Company Limited, China Three Gorges Corporation, E.ON, ACCIONA, Nyocor Co., Ltd, Zhejiang Sunoren Solar Technology, CECEP Solar Energy Technology, Zhejiang Provincial New Energy Investment Group, Jiawei Renewable Energy, China Ruifeng Renewable Energy Holdings Limited, China Suntien Green Energy Corporation Limited, Risen Energy Co., Ltd, Topray Solar, Jiangsu Zhongli Group, Jiangsu Linyang Energy, Clenergy Technology, Beijing Energy International Holding, Beijing Enterprises Clean Energy Group Limited, OCI COMPANY, NextEra Energy, CGN Wind Energy Limited, Drax Group, Orsted, Enel Group, Engie, EPH, EDF, RWE, CEZ, Babcock & Wilcox, Ameresco, Inc, John Wood Group, Vattenfall AB, Sinopec, KAISHAN GROUP, China Power Investment Corporation, Calpine Corp, Ormat Technologies Inc, CFE, KenGen, Contact Energy Ltd, PT Pertamina (Persero), Berkshire Hathaway Inc.

3. What are the main segments of the Green Power Generation?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 1494990 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Green Power Generation," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Green Power Generation report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Green Power Generation?

To stay informed about further developments, trends, and reports in the Green Power Generation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence