Key Insights

The Latin American automotive carbon fiber composites market is experiencing robust expansion, driven by the increasing demand for lightweight vehicles to enhance fuel efficiency and reduce emissions. The region's automotive sector is undergoing a significant transformation, with manufacturers prioritizing advanced materials to improve vehicle performance and comply with evolving environmental regulations. This trend accelerates the adoption of carbon fiber composites, valued for their superior strength-to-weight ratio over conventional materials like steel and aluminum. Key applications span structural assemblies, powertrain components, and interior/exterior parts. The market is segmented by production type, including hand layup, resin transfer molding, vacuum infusion processing, and injection molding. While hand layup serves niche applications, automated methods like injection molding are gaining prominence for high-volume production and cost-effectiveness. Leading global suppliers are actively participating in this dynamic market, leveraging their material science and manufacturing expertise. Despite the initial cost barrier, ongoing R&D aims to reduce production expenses and broaden composite applications. Brazil, Mexico, and Argentina are the primary markets driving regional growth.

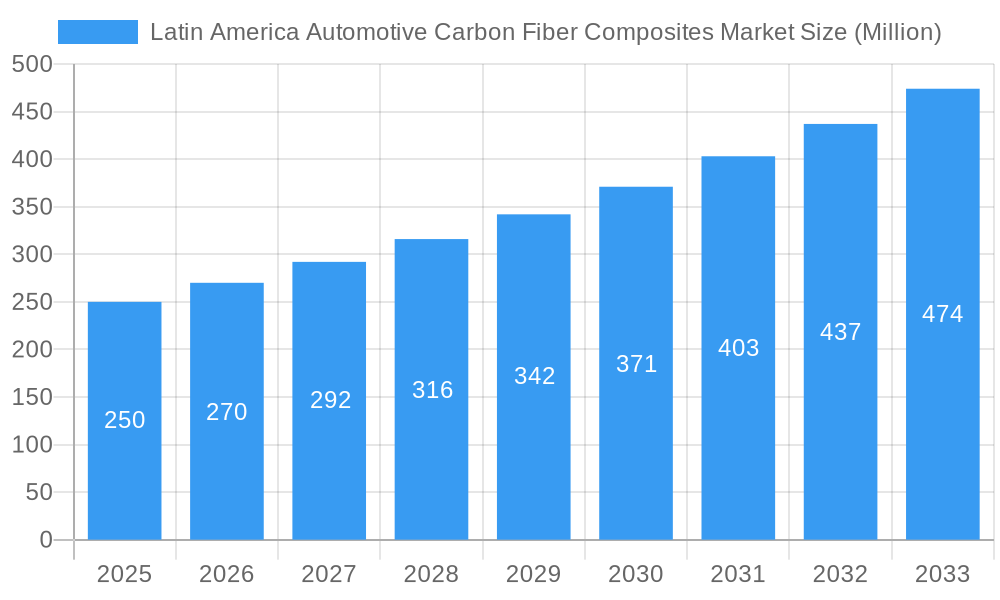

Latin America Automotive Carbon Fiber Composites Market Market Size (In Billion)

The Latin American automotive carbon fiber composites market is projected for significant growth from 2025 to 2033. With a projected CAGR of 10.9%, the market size is estimated to reach $25.6 billion by 2025. This upward trajectory is supported by government initiatives promoting sustainable transportation, the growing adoption of electric vehicles which benefit from lightweighting, and increasingly sophisticated automotive designs. Challenges, including the need for skilled labor and robust supply chains, are being addressed to ensure sustained growth. Future market development will focus on advanced manufacturing techniques and cost-effective solutions for broader adoption in mass-market vehicles.

Latin America Automotive Carbon Fiber Composites Market Company Market Share

Latin America Automotive Carbon Fiber Composites Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America Automotive Carbon Fiber Composites market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by production type (Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding) and application type (Structural Assembly, Powertrain Components, Interiors, Exteriors). Key players analyzed include Mitsubishi Rayon, 3M, Teijin, Huntsman, Owens Corning, Azko Nobel, MRC Zoltek, Formosa Plastic, Reichhold, and Toray. The report projects a market value of xx Million by 2033.

Latin America Automotive Carbon Fiber Composites Market Dynamics & Structure

The Latin American automotive carbon fiber composites market is characterized by moderate concentration, with a few dominant players and several regional specialists. Technological innovation, driven by the need for lightweight and high-strength materials in vehicles, is a key driver. Stringent emission regulations are further propelling adoption. While glass fiber composites remain a significant substitute, carbon fiber's superior performance characteristics are gradually increasing its market share. The end-user demographic is largely comprised of established automotive manufacturers and their supply chains. M&A activity has been relatively low in recent years, but strategic partnerships are increasingly common.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on developing cost-effective manufacturing processes and enhancing material properties.

- Regulatory Framework: Stringent emission standards and safety regulations drive demand for lightweight materials.

- Competitive Substitutes: Glass fiber composites, aluminum alloys.

- End-User Demographics: Primarily established automotive OEMs and Tier-1 suppliers.

- M&A Trends: Limited M&A activity; increasing strategic partnerships and collaborations.

Latin America Automotive Carbon Fiber Composites Market Growth Trends & Insights

The Latin American automotive carbon fiber composites market is poised for significant expansion, fueled by a dual imperative: the escalating demand for fuel-efficient vehicles and the increasing integration of advanced materials in modern automotive design. This market, which witnessed a notable expansion from [Insert Specific XX Million figure] in 2019 to [Insert Specific XX Million figure] in 2024, is projected to maintain its robust trajectory. The market is anticipated to experience a Compound Annual Growth Rate (CAGR) of [Insert Specific XX%] from 2025 through 2033. Key contributors to this growth include substantial advancements in manufacturing technologies, such as the widespread adoption of automated fiber placement and other innovative techniques that are significantly enhancing cost-effectiveness and optimizing production cycles. Furthermore, a growing consumer consciousness towards lighter, more fuel-efficient automobiles serves as a powerful demand driver. Despite these positive trends, the inherent high initial cost of carbon fiber composites continues to present a considerable hurdle to their mass adoption. Additionally, a scarcity of skilled labor and the underdeveloped infrastructure in certain regional segments pose ongoing challenges to the market's full potential.

Dominant Regions, Countries, or Segments in Latin America Automotive Carbon Fiber Composites Market

Brazil and Mexico are the dominant markets within Latin America, accounting for approximately xx% and xx% of the total market share in 2025, respectively. This dominance is attributed to the presence of major automotive manufacturing hubs and a relatively well-developed automotive supply chain. The structural assembly segment holds the largest market share, followed by powertrain components and interiors.

- Brazil: Strong automotive industry, established manufacturing base, and government support for green technologies.

- Mexico: Large automotive production facilities, proximity to North American markets, and investment in infrastructure.

- Structural Assembly: Highest demand due to the significant weight reduction achievable in chassis and body structures.

- Production Type: Resin Transfer Molding (RTM) and Vacuum Infusion Processing (VIP) are gaining traction due to their cost-effectiveness.

Latin America Automotive Carbon Fiber Composites Market Product Landscape

The Latin American automotive carbon fiber composites market is characterized by a diverse array of advanced composite products meticulously engineered for a wide spectrum of automotive applications. Recent innovations are at the forefront, with the development of enhanced resin systems that significantly bolster performance and extend product durability. Concurrently, the evolution of sophisticated manufacturing processes, including highly efficient automated fiber placement techniques, is paving the way for high-volume production capabilities. Key selling propositions that resonate strongly with the industry and consumers alike encompass substantial weight reduction, leading to improved fuel economy, augmented safety features, and unparalleled design flexibility that allows for more innovative and aerodynamic vehicle aesthetics.

Key Drivers, Barriers & Challenges in Latin America Automotive Carbon Fiber Composites Market

Key Drivers:

- The escalating global and regional imperative for lightweight vehicles, directly contributing to enhanced fuel efficiency and the reduction of harmful emissions.

- The increasing integration and sophistication of Advanced Driver-Assistance Systems (ADAS), which often benefit from the lightweight and structural integrity offered by composites.

- Proactive government regulations and incentive programs worldwide that champion the adoption of sustainable and eco-friendly materials in automotive manufacturing.

- Growing investments in research and development by leading automotive manufacturers and composite material suppliers to overcome cost barriers and enhance performance.

- The pursuit of enhanced vehicle performance and occupant safety through the utilization of materials with superior strength-to-weight ratios.

Key Barriers & Challenges:

- The substantial initial investment required for carbon fiber composite materials and their associated manufacturing processes, which often exceeds that of traditional materials like steel and aluminum.

- A persistent deficit in the availability of skilled labor with specialized expertise in composite design, manufacturing, and repair, coupled with limited specialized manufacturing infrastructure in certain regions.

- The inherent complexities and potential vulnerabilities within the global supply chain for carbon fiber precursors and resins, leading to potential disruptions and price volatility.

- Intensifying competition from alternative lightweight materials, such as advanced high-strength steels (AHSS), aluminum alloys, and magnesium alloys, which offer varying degrees of cost-effectiveness and performance benefits.

- The need for standardized recycling and end-of-life management solutions for carbon fiber composites to address environmental concerns and improve material circularity.

Emerging Opportunities in Latin America Automotive Carbon Fiber Composites Market

Significant opportunities exist in exploring applications in electric vehicles, where lightweighting is crucial for extending battery range. The development of cost-effective recycling and reuse methods for carbon fiber composites will unlock further market expansion. Increased investment in research and development focused on improving material properties and processing techniques will be key to future growth.

Growth Accelerators in the Latin America Automotive Carbon Fiber Composites Market Industry

The long-term growth trajectory of the Latin American automotive carbon fiber composites market will be significantly propelled by continued technological advancements in manufacturing. The widespread implementation and refinement of techniques like automated fiber placement, alongside advancements in resin chemistry and composite design, will be pivotal. Strategic collaborations and partnerships between pioneering automotive manufacturers and leading composite material suppliers are expected to foster a culture of innovation, accelerate product development cycles, and crucially, drive down production costs. Furthermore, strategic market expansion into previously untapped or underpenetrated regions within Latin America, particularly those exhibiting burgeoning automotive manufacturing capabilities and a growing middle class, will unlock substantial new avenues for market penetration and growth.

Key Players Shaping the Latin America Automotive Carbon Fiber Composites Market Market

- Mitsubishi Rayon

- 3M

- Teijin

- Huntsman

- Owens Corning

- Azko Nobel

- MRC Zoltek

- Formosa Plastic

- Reichhold

- Toray

Notable Milestones in Latin America Automotive Carbon Fiber Composites Market Sector

- 2022 (Q3): A prominent automotive Original Equipment Manufacturer (OEM) in Brazil successfully launched a new vehicle model featuring innovative carbon fiber composite components, highlighting performance and design advancements.

- 2023 (Q1): A significant investment led to the establishment of a state-of-the-art carbon fiber composite manufacturing facility in Mexico, aimed at bolstering regional production capacity and supply chain capabilities.

- 2024 (Q2): A strategic partnership was forged between a leading global composite material supplier and a major automotive Tier-1 supplier in Brazil, focusing on joint development and the integration of advanced composite solutions for upcoming vehicle platforms.

- Ongoing: Increased focus on the development of cost-effective, recyclable, and bio-based carbon fiber composites to address sustainability concerns and broaden market appeal.

In-Depth Latin America Automotive Carbon Fiber Composites Market Market Outlook

The Latin American automotive carbon fiber composites market exhibits strong growth potential driven by increasing demand for lightweight vehicles, technological innovations, and supportive government policies. Strategic investments in manufacturing infrastructure and the development of skilled labor are crucial to fully realizing this potential. The market is poised for significant expansion, with a multitude of opportunities for both established players and new entrants.

Latin America Automotive Carbon Fiber Composites Market Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vacuum Infusion Processing

- 1.4. Injection Molding

-

2. Application type

- 2.1. Structural Assembly

- 2.2. Powertrain Components

- 2.3. Interiors

- 2.4. Exteriors

-

3. Geography

- 3.1. Brazil

- 3.2. Mexico

- 3.3. Argentina

- 3.4. Rest of Latin America

Latin America Automotive Carbon Fiber Composites Market Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Argentina

- 4. Rest of Latin America

Latin America Automotive Carbon Fiber Composites Market Regional Market Share

Geographic Coverage of Latin America Automotive Carbon Fiber Composites Market

Latin America Automotive Carbon Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Electrical Cars Sales Will Drive the Carbon Fiber Automotive Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vacuum Infusion Processing

- 5.1.4. Injection Molding

- 5.2. Market Analysis, Insights and Forecast - by Application type

- 5.2.1. Structural Assembly

- 5.2.2. Powertrain Components

- 5.2.3. Interiors

- 5.2.4. Exteriors

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Argentina

- 5.3.4. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Mexico

- 5.4.3. Argentina

- 5.4.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. Brazil Latin America Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 6.1.1. Hand Layup

- 6.1.2. Resin Transfer Molding

- 6.1.3. Vacuum Infusion Processing

- 6.1.4. Injection Molding

- 6.2. Market Analysis, Insights and Forecast - by Application type

- 6.2.1. Structural Assembly

- 6.2.2. Powertrain Components

- 6.2.3. Interiors

- 6.2.4. Exteriors

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Mexico

- 6.3.3. Argentina

- 6.3.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 7. Mexico Latin America Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 7.1.1. Hand Layup

- 7.1.2. Resin Transfer Molding

- 7.1.3. Vacuum Infusion Processing

- 7.1.4. Injection Molding

- 7.2. Market Analysis, Insights and Forecast - by Application type

- 7.2.1. Structural Assembly

- 7.2.2. Powertrain Components

- 7.2.3. Interiors

- 7.2.4. Exteriors

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Mexico

- 7.3.3. Argentina

- 7.3.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 8. Argentina Latin America Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 8.1.1. Hand Layup

- 8.1.2. Resin Transfer Molding

- 8.1.3. Vacuum Infusion Processing

- 8.1.4. Injection Molding

- 8.2. Market Analysis, Insights and Forecast - by Application type

- 8.2.1. Structural Assembly

- 8.2.2. Powertrain Components

- 8.2.3. Interiors

- 8.2.4. Exteriors

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Mexico

- 8.3.3. Argentina

- 8.3.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 9. Rest of Latin America Latin America Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 9.1.1. Hand Layup

- 9.1.2. Resin Transfer Molding

- 9.1.3. Vacuum Infusion Processing

- 9.1.4. Injection Molding

- 9.2. Market Analysis, Insights and Forecast - by Application type

- 9.2.1. Structural Assembly

- 9.2.2. Powertrain Components

- 9.2.3. Interiors

- 9.2.4. Exteriors

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Mexico

- 9.3.3. Argentina

- 9.3.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Mitsubishi Rayon

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 3M

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Teijin

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Huntsman

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Owens Corning

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Azko Nobel

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 MRC Zoltek

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Formosa Plastic

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Reichhold

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Toray

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Mitsubishi Rayon

List of Figures

- Figure 1: Latin America Automotive Carbon Fiber Composites Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Automotive Carbon Fiber Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 2: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Application type 2020 & 2033

- Table 3: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 6: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Application type 2020 & 2033

- Table 7: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 10: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Application type 2020 & 2033

- Table 11: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 14: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Application type 2020 & 2033

- Table 15: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 18: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Application type 2020 & 2033

- Table 19: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Automotive Carbon Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Automotive Carbon Fiber Composites Market?

The projected CAGR is approximately 10.9%.

2. Which companies are prominent players in the Latin America Automotive Carbon Fiber Composites Market?

Key companies in the market include Mitsubishi Rayon, 3M, Teijin, Huntsman, Owens Corning, Azko Nobel, MRC Zoltek, Formosa Plastic, Reichhold, Toray.

3. What are the main segments of the Latin America Automotive Carbon Fiber Composites Market?

The market segments include Production Type, Application type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

Electrical Cars Sales Will Drive the Carbon Fiber Automotive Market.

7. Are there any restraints impacting market growth?

Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Automotive Carbon Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Automotive Carbon Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Automotive Carbon Fiber Composites Market?

To stay informed about further developments, trends, and reports in the Latin America Automotive Carbon Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence