Key Insights

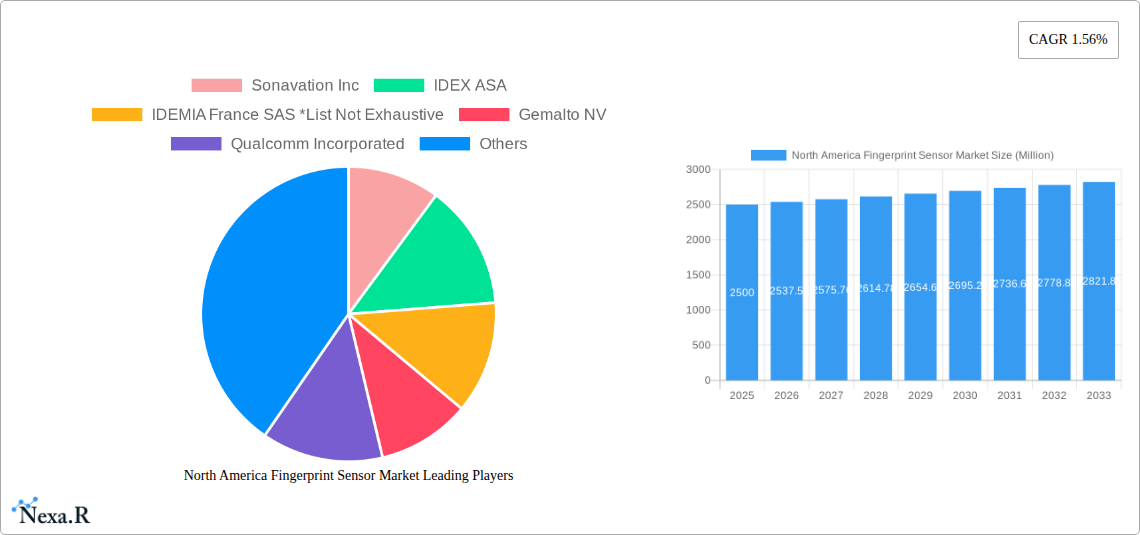

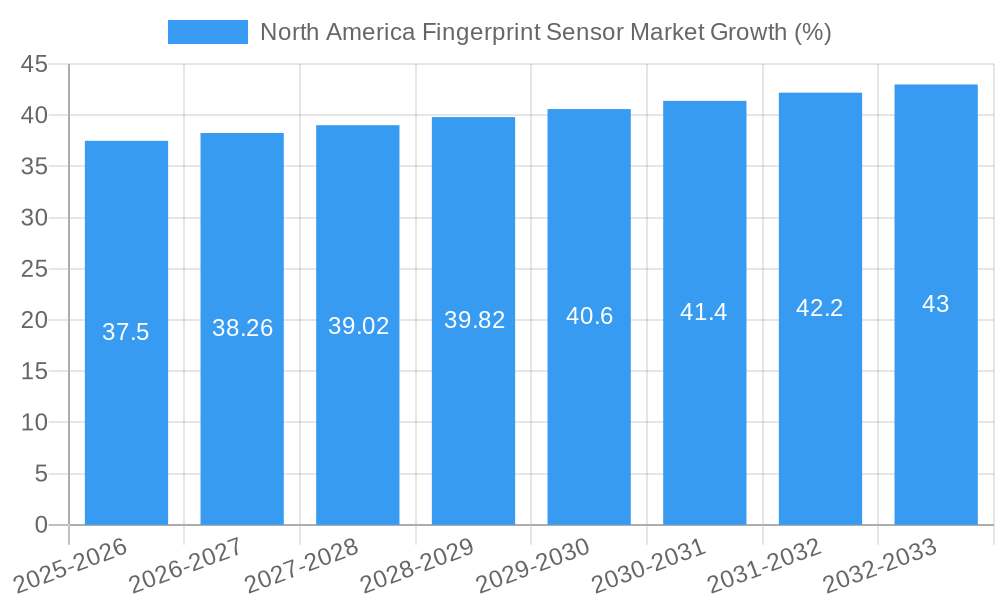

The North America fingerprint sensor market, encompassing the United States, Canada, and Mexico, is experiencing steady growth, driven by increasing demand across diverse sectors. The market's Compound Annual Growth Rate (CAGR) of 1.56% from 2019 to 2024 suggests a consistent expansion, projected to continue through 2033. Key growth drivers include the proliferation of smartphones and tablets incorporating biometric authentication, the rise of secure payment systems in the BFSI (Banking, Financial Services, and Insurance) sector, and the expanding adoption of fingerprint sensors in government and military applications emphasizing security and access control. The increasing integration of fingerprint technology into Internet of Things (IoT) devices, smartcards, and laptops further fuels market expansion. While specific market size figures for 2025 are unavailable, considering the 1.56% CAGR and a reasonable estimation of market size considering similar markets, a conservative estimate would place the North American market valuation in the billions of USD in 2025. The market segmentation by sensor type (optical, capacitive, thermal, ultrasonic) reveals a dynamic landscape, with each type catering to different application requirements and price points. Optical and capacitive sensors currently dominate the market due to their cost-effectiveness and established technology, while thermal and ultrasonic sensors show promise for niche applications demanding higher accuracy and security. The market is also segmented by end-user industries, with the consumer electronics sector driving the largest demand followed by the BFSI and government sectors, reflecting the increasing integration of biometrics across daily life.

The competitive landscape is characterized by a mix of established players like Qualcomm, Synaptics, and Fingerprint Cards AB, alongside emerging companies. This competition fosters innovation, driving advancements in sensor technology, miniaturization, and improved performance. Although restraining factors such as the inherent security concerns and privacy issues surrounding biometric data exist, robust regulatory frameworks and the development of advanced security protocols are progressively mitigating these concerns. Furthermore, the ongoing research and development efforts focused on enhancing sensor accuracy, speed, and reliability contribute to the market's sustained growth trajectory, promising further integration of fingerprint sensors into diverse applications in the coming years. Continued innovation in sensor technology will be critical to driving further market expansion.

North America Fingerprint Sensor Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the North America fingerprint sensor market, covering the period from 2019 to 2033. It segments the market by type (Optical, Capacitive, Thermal, Ultrasonic), application (Smartphones/Tablets, Laptops, Smartcards, IoT and Other Applications), and end-user industries (Military and Defense, Consumer Electronics, BFSI, Government, Other End-user Industries), across the United States and Canada. The report leverages extensive market research to offer critical insights for businesses and investors seeking to capitalize on this rapidly evolving sector. The market size in 2025 is estimated at xx Million units.

North America Fingerprint Sensor Market Dynamics & Structure

The North American fingerprint sensor market is characterized by a moderately concentrated landscape with several major players vying for market share. Technological innovation, particularly in miniaturization and improved accuracy, is a key driver. Stringent regulatory frameworks related to data privacy and security significantly influence market dynamics. Competitive pressure from alternative authentication technologies, such as facial recognition, exists but fingerprint sensors maintain a strong position due to their established reliability and cost-effectiveness. Consumer preference for enhanced security and convenience is a significant growth driver. The market also sees considerable M&A activity, with larger players acquiring smaller companies to expand their product portfolios and technological capabilities. In 2024, approximately xx M&A deals were recorded in this sector, indicating a consolidated trend.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on miniaturization, improved accuracy, and under-display sensor technology.

- Regulatory Frameworks: Stringent data privacy regulations impact implementation and adoption.

- Competitive Substitutes: Facial recognition and other biometric technologies pose competitive threats.

- End-User Demographics: Growing adoption across diverse sectors, driven by security and convenience needs.

- M&A Trends: Increasing consolidation through acquisitions to enhance product offerings and market reach.

- Innovation Barriers: High R&D costs and the need for specialized manufacturing capabilities.

North America Fingerprint Sensor Market Growth Trends & Insights

The North America fingerprint sensor market witnessed significant growth during the historical period (2019-2024), driven primarily by the increasing adoption of smartphones and other consumer electronics incorporating biometric authentication. The market size expanded from xx Million units in 2019 to xx Million units in 2024, registering a CAGR of xx%. This growth is expected to continue throughout the forecast period (2025-2033), albeit at a slightly moderated pace, driven by factors such as the increasing demand for secure authentication in various applications, government initiatives to enhance security infrastructure, and the proliferation of the Internet of Things (IoT). Technological advancements, such as improved sensor accuracy and the development of under-display sensors, are accelerating market expansion. However, challenges like supply chain disruptions and the emergence of alternative technologies could impact future growth.

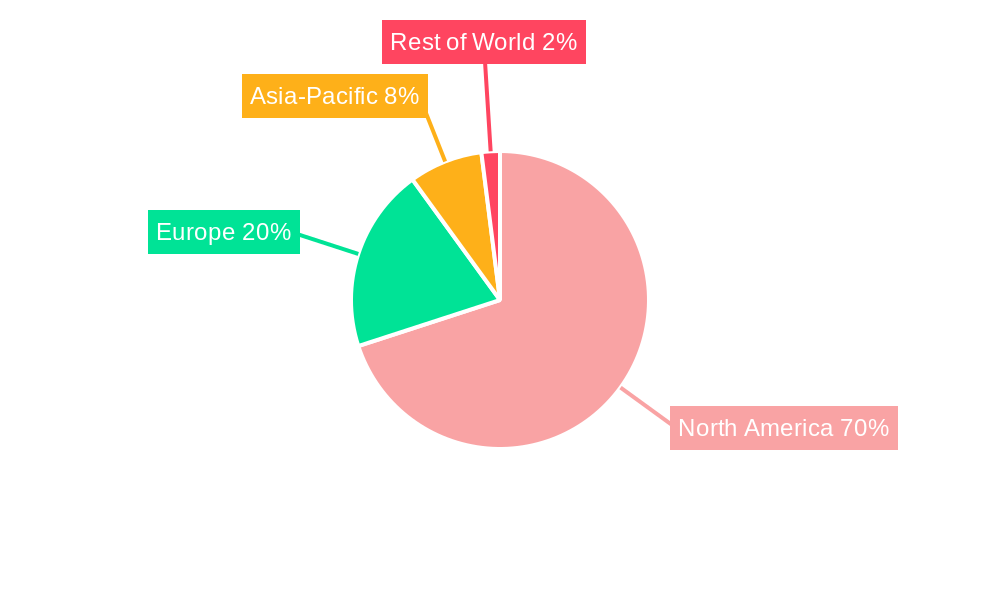

Dominant Regions, Countries, or Segments in North America Fingerprint Sensor Market

The United States dominates the North American fingerprint sensor market, accounting for approximately xx% of the total market share in 2024. This dominance is attributed to its large consumer electronics market, advanced technological infrastructure, and robust security regulations. Canada, while a smaller market compared to the US, also shows promising growth, driven by rising smartphone penetration and government investments in security infrastructure. Within the end-user segments, Consumer Electronics is the largest segment, followed by Government and BFSI (Banking, Financial Services, and Insurance). Capacitive fingerprint sensors hold the largest market share due to their cost-effectiveness and reliability.

- United States: Largest market share, driven by strong consumer electronics demand and advanced technological infrastructure.

- Canada: Growing market, boosted by increasing smartphone adoption and government security investments.

- Consumer Electronics: Dominant end-user segment, fueled by smartphone and laptop integration.

- Government: Significant growth due to security and identification needs.

- Capacitive Sensors: Largest market share in terms of type due to cost-effectiveness and reliability.

North America Fingerprint Sensor Market Product Landscape

The fingerprint sensor market features a diverse range of products, from optical and capacitive sensors to advanced ultrasonic and thermal solutions. Continuous innovation focuses on enhancing accuracy, speed, and security. Miniaturization allows for integration into increasingly smaller devices. Key selling propositions include ease of use, improved security, and seamless integration with existing systems. Under-display fingerprint sensors are gaining traction, offering a sleek user experience.

Key Drivers, Barriers & Challenges in North America Fingerprint Sensor Market

Key Drivers:

- Growing demand for enhanced security in various applications.

- Increasing adoption of smartphones and other consumer electronics.

- Rising investments in government and BFSI security infrastructure.

- Technological advancements leading to improved accuracy and reliability.

Challenges:

- Supply chain disruptions impacting production and availability.

- Stringent regulatory hurdles related to data privacy and security compliance.

- Competition from alternative authentication technologies such as facial recognition. This competition has resulted in a xx% decline in market share for fingerprint sensors in certain applications.

Emerging Opportunities in North America Fingerprint Sensor Market

Emerging opportunities exist in the integration of fingerprint sensors into IoT devices, wearables, and access control systems. The growing demand for contactless authentication solutions is creating new market segments. Innovative applications in healthcare, automotive, and other industries offer significant potential for growth. Advancements in under-display sensor technology will continue to fuel market expansion.

Growth Accelerators in the North America Fingerprint Sensor Market Industry

Technological advancements, strategic partnerships between sensor manufacturers and device makers, and expanding applications across diverse industries are key catalysts driving long-term growth. Government initiatives promoting digitalization and security infrastructure upgrades are also contributing to market expansion.

Key Players Shaping the North America Fingerprint Sensor Market Market

- Sonavation Inc

- IDEX ASA

- IDEMIA France SAS

- Gemalto NV

- Qualcomm Incorporated

- Fingerprint Cards AB

- Synaptics Inc

- NEC Corporation

- TDK Corporation

- Egis Technology Inc

Notable Milestones in North America Fingerprint Sensor Market Sector

- 2020: Increased adoption of under-display fingerprint sensors in high-end smartphones.

- 2022: Several key players launched advanced fingerprint sensors with improved security features.

- 2023: Significant investments in R&D for next-generation sensor technology. (Specific examples of investments unavailable for this report.)

- 2024: xx M&A deals, leading to market consolidation. (Specific deals unavailable for this report.)

In-Depth North America Fingerprint Sensor Market Market Outlook

The North American fingerprint sensor market is poised for continued growth, driven by technological innovation, increasing demand for secure authentication, and expanding applications across various sectors. Strategic partnerships, market expansion into new applications, and the adoption of advanced sensor technologies will be key determinants of future success. The market is expected to reach xx Million units by 2033, presenting significant opportunities for companies operating in this dynamic sector.

North America Fingerprint Sensor Market Segmentation

-

1. Type

- 1.1. Optical

- 1.2. Capacitive

- 1.3. Thermal

- 1.4. Ultrasonic

-

2. Application

- 2.1. Smartphones/Tablets

- 2.2. Laptops

- 2.3. Smartcards

- 2.4. IoT and Other Applications

-

3. End-user Industries

- 3.1. Military and Defense

- 3.2. Consumer Electronics

- 3.3. BFSI

- 3.4. Government

- 3.5. Other End-user Industries

North America Fingerprint Sensor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fingerprint Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Initiatives to Adopt Biometrics in Various Fields

- 3.3. Market Restrains

- 3.3.1 ; Increase in adoption of substitute technologies

- 3.3.2 such as face and iris scanning

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Industry to Augment the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fingerprint Sensor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Optical

- 5.1.2. Capacitive

- 5.1.3. Thermal

- 5.1.4. Ultrasonic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smartphones/Tablets

- 5.2.2. Laptops

- 5.2.3. Smartcards

- 5.2.4. IoT and Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Military and Defense

- 5.3.2. Consumer Electronics

- 5.3.3. BFSI

- 5.3.4. Government

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Fingerprint Sensor Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Fingerprint Sensor Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Fingerprint Sensor Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Fingerprint Sensor Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Sonavation Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IDEX ASA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IDEMIA France SAS *List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Gemalto NV

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Qualcomm Incorporated

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fingerprint Cards AB

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Synaptics Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 NEC Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 TDK Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Egis Technology Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Sonavation Inc

List of Figures

- Figure 1: North America Fingerprint Sensor Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Fingerprint Sensor Market Share (%) by Company 2024

List of Tables

- Table 1: North America Fingerprint Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Fingerprint Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Fingerprint Sensor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Fingerprint Sensor Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 5: North America Fingerprint Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Fingerprint Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Fingerprint Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Fingerprint Sensor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North America Fingerprint Sensor Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 14: North America Fingerprint Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fingerprint Sensor Market?

The projected CAGR is approximately 1.56%.

2. Which companies are prominent players in the North America Fingerprint Sensor Market?

Key companies in the market include Sonavation Inc, IDEX ASA, IDEMIA France SAS *List Not Exhaustive, Gemalto NV, Qualcomm Incorporated, Fingerprint Cards AB, Synaptics Inc, NEC Corporation, TDK Corporation, Egis Technology Inc.

3. What are the main segments of the North America Fingerprint Sensor Market?

The market segments include Type, Application, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Government Initiatives to Adopt Biometrics in Various Fields.

6. What are the notable trends driving market growth?

Consumer Electronics Industry to Augment the Market Growth.

7. Are there any restraints impacting market growth?

; Increase in adoption of substitute technologies. such as face and iris scanning.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fingerprint Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fingerprint Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fingerprint Sensor Market?

To stay informed about further developments, trends, and reports in the North America Fingerprint Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence