Key Insights

The North American Vehicle Tolling Systems market is poised for significant expansion, driven by escalating traffic congestion in urban centers and the imperative for optimized transportation management. The market, valued at $10334.9 million in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.3% through 2033. This robust growth trajectory is attributed to the widespread adoption of Electronic Toll Collection (ETC) systems, which deliver enhanced efficiency and convenience over traditional tolling methods. Government investments in infrastructure upgrades and the deployment of advanced tolling technologies are central to improving traffic flow, mitigating emissions, and bolstering revenue streams. The ETC segment is anticipated to lead the market, with applications across bridges, roads, and tunnels contributing substantially to overall revenue. Leading industry players, including Mitsubishi Heavy Industries Limited and Thales Group, are actively innovating and expanding their market reach through strategic collaborations and technological advancements.

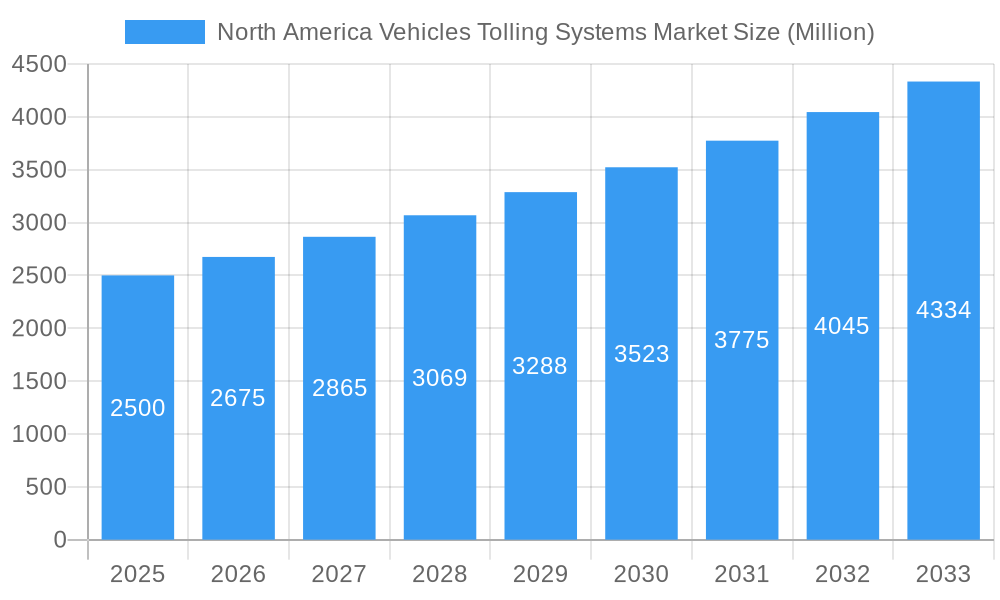

North America Vehicles Tolling Systems Market Market Size (In Billion)

Despite promising growth, the market encounters certain obstacles. Substantial upfront investment for ETC system deployment and ongoing maintenance can impede adoption, particularly for smaller municipalities. Additionally, data privacy and security concerns associated with electronic transactions necessitate stringent protocols and vigilant oversight. Nevertheless, the long-term outlook for the North American Vehicle Tolling Systems market remains highly favorable, supported by continuous technological innovation, increasing urbanization, and governmental commitment to efficient transportation networks. The growing prevalence of integrated tolling systems, ensuring seamless interoperability across diverse roadways and jurisdictions, further stimulates market growth. While both barrier and entry/exit toll collection segments are expected to see considerable development, the ETC segment is likely to retain its dominant position, driven by consumer demand for contactless payment solutions.

North America Vehicles Tolling Systems Market Company Market Share

North America Vehicles Tolling Systems Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Vehicles Tolling Systems Market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. The parent market is the broader North American transportation infrastructure market, while the child market is specifically electronic toll collection systems. The market size is valued in million units.

North America Vehicles Tolling Systems Market Dynamics & Structure

The North American vehicles tolling systems market is characterized by moderate concentration, with a few major players holding significant market share, alongside numerous smaller, specialized providers. Technological innovation, particularly in electronic toll collection (ETC) systems, is a key driver. Stringent regulatory frameworks and evolving safety standards influence market growth. Competitive substitutes include alternative transportation methods and less advanced tolling technologies. End-user demographics are expanding with increased vehicle ownership and the shift toward autonomous driving technology which will impact future tolling systems' design and operation. Mergers and acquisitions (M&A) activity has been moderate, consolidating the market and leading to technological advancements and geographic expansion.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on ETC systems, AI-powered traffic management, and integration with smart city initiatives.

- Regulatory Framework: Stringent safety and security standards, evolving data privacy regulations.

- Competitive Substitutes: Public transportation, alternative fuel vehicles.

- M&A Activity: xx deals recorded between 2019 and 2024, resulting in xx% increase in market concentration.

- Innovation Barriers: High initial investment costs, integration complexities, cybersecurity concerns.

North America Vehicles Tolling Systems Market Growth Trends & Insights

The North American vehicles tolling systems market is experiencing a period of dynamic expansion, underpinned by the continuous growth of urbanization, ambitious infrastructure development projects, and proactive government strategies aimed at optimizing traffic flow and congestion management. The market demonstrated a robust Compound Annual Growth Rate (CAGR) of [Insert Historical CAGR % Here, e.g., 8.5%] during the historical period (2019-2024) and is strategically positioned for sustained growth, projecting a CAGR of [Insert Forecast CAGR % Here, e.g., 10.2%] over the forecast period (2025-2033). The escalating adoption of Electronic Toll Collection (ETC) systems stands as a primary catalyst for this upward trend, driven by the unparalleled convenience, enhanced efficiency, and time-saving benefits they offer to motorists. Further propelling this market expansion are cutting-edge technological advancements, most notably the seamless integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into sophisticated tolling infrastructure, enabling smarter operations and real-time data analysis. Concurrently, evolving consumer preferences are gravitating towards cashless transaction environments and the pursuit of frictionless, expedient travel experiences, which inherently favor the widespread adoption of ETC solutions. The market penetration of ETC systems has witnessed a significant uplift, rising from approximately [Insert 2019 Penetration % Here, e.g., 45%] in 2019 to an estimated [Insert 2024 Penetration % Here, e.g., 68%] by 2024, with projections indicating it will reach an impressive [Insert 2033 Penetration % Here, e.g., 85%] by 2033.

Dominant Regions, Countries, or Segments in North America Vehicles Tolling Systems Market

Geographically, the Northeastern and Western regions of the United States are currently at the vanguard of market expansion. This leadership is attributed to a confluence of factors including exceptionally high traffic densities, expansive and well-established highway networks, and substantial ongoing investments in critical infrastructure enhancements. Within these leading regions, states like California, Texas, and New York are recognized as pivotal contributors to market growth. Examining the market by segments, Electronic Toll Collection (ETC) emerges as the unequivocally fastest-growing segment, progressively outperforming traditional Barrier Toll Collection and Entry/Exit Toll Collection systems. This dominance is a direct consequence of ETC's superior efficiency, cost-effectiveness, and enhanced user experience. In terms of Application Type, the "Roads" segment commands a leading position, reflecting the pervasive and fundamental requirement for tolling systems on major arterial routes and highways.

- Leading Regions: Northeastern and Western United States, characterized by high traffic volumes and extensive highway infrastructure.

- Key Contributing Countries/States: California, Texas, and New York are at the forefront of market adoption and development.

- Fastest Growing Segment (Toll Collection Type): Electronic Toll Collection (ETC) continues to lead due to its advanced technology and operational benefits.

- Dominant Application Type: The "Roads" segment accounts for the largest share, driven by the essential need for traffic management and revenue generation on highways.

- Key Market Drivers: Significant government investments in infrastructure modernization, the escalating challenge of traffic congestion in urban centers, and a mounting demand for streamlined and efficient travel solutions.

North America Vehicles Tolling Systems Market Product Landscape

The market offers a diverse range of products, including various ETC systems (e.g., RFID, license plate recognition), barrier toll collection systems, and integrated traffic management solutions. Product innovations focus on improving accuracy, reducing congestion, enhancing security, and integrating with smart city technologies. Unique selling propositions center on ease of use, cost-effectiveness, reliability, and data analytics capabilities. Technological advancements involve the use of AI, machine learning, and cloud computing to optimize system performance and enhance user experience.

Key Drivers, Barriers & Challenges in North America Vehicles Tolling Systems Market

Key Drivers:

- The persistent trend of urbanization and a corresponding increase in vehicle ownership are significantly boosting the demand for efficient traffic management solutions.

- Proactive government initiatives focused on infrastructure development, coupled with the strategic implementation of smart city projects, are creating a fertile ground for tolling system expansion.

- Continuous and rapid technological advancements in ETC systems, including the adoption of machine learning and advanced data analytics, are enhancing their functionality and appeal.

- The growing emphasis on sustainability and reducing vehicle emissions is indirectly supporting tolling systems that can optimize traffic flow and minimize idling times.

Challenges and Restraints:

- The substantial initial investment required for the deployment of advanced ETC infrastructure, including hardware, software, and maintenance, can pose a significant barrier.

- Heightened concerns surrounding cybersecurity vulnerabilities and the imperative to ensure robust data privacy for users of tolling systems present ongoing challenges.

- Achieving seamless interoperability between the diverse range of tolling systems currently deployed across different jurisdictions remains a complex hurdle.

- The critical need for comprehensive and accessible customer support, along with effective public education campaigns to foster understanding and acceptance of tolling technologies, requires continuous effort.

- Potential public resistance to new tolling implementations or increased toll rates can also act as a restraint.

Emerging Opportunities in North America Vehicles Tolling Systems Market

Emerging opportunities include the integration of tolling systems with other smart city technologies (e.g., traffic management systems, parking solutions), expansion into less-developed areas, the rise of autonomous vehicle technology requiring advanced tolling solutions and the development of hybrid tolling solutions combining ETC and traditional methods.

Growth Accelerators in the North America Vehicles Tolling Systems Market Industry

The long-term trajectory of the North American vehicles tolling systems market is poised for accelerated growth, propelled by a suite of potent growth accelerators. Ongoing and future technological innovations, such as the development and implementation of AI-powered traffic optimization algorithms, sophisticated advanced sensor technologies for real-time data capture, and the evolution of vehicle-to-infrastructure (V2I) communication, will significantly enhance system capabilities. Strategic collaborations and partnerships between leading tolling providers, technology companies, and automotive manufacturers are fostering an ecosystem of innovation and market penetration. Furthermore, the expansion of market reach into currently under-served or emerging geographic areas, coupled with government commitment to bolstering infrastructure development and championing smart city agendas, will act as powerful catalysts, driving widespread adoption and further solidifying the market's robust growth prospects.

Key Players Shaping the North America Vehicles Tolling Systems Market Market

- Mitsubishi Heavy Industries Limited

- International Road Dynamics Inc

- Emovis Gmb

- Thales Group

- Nedap NV

- TansCore Atlantic LLC

- Cintra

- Magnetic Autocontrol GmbH

Notable Milestones in North America Vehicles Tolling Systems Market Sector

- 2020: A significant surge in the adoption of contactless and mobile payment methods within existing ETC systems, driven by public health concerns and evolving consumer habits.

- 2021: The successful launch and integration of several innovative AI-powered traffic management solutions that work in tandem with tolling systems to optimize traffic flow and predict congestion.

- 2022: Marked by substantial investments in upgrading existing tolling infrastructure to incorporate next-generation technologies, enhancing speed, accuracy, and data processing capabilities.

- 2023: Witnessed the strategic expansion of comprehensive ETC systems into new and previously underserved geographic areas, increasing accessibility and user adoption.

- 2024: The introduction of new, stringent regulations and industry standards focused on fortifying data security protocols and enhancing user privacy within tolling systems, building greater trust and confidence.

- Projected for 2025-2033: Anticipated advancements in dynamic pricing models, increased integration with autonomous vehicle technologies, and the development of multimodal transportation payment solutions.

In-Depth North America Vehicles Tolling Systems Market Market Outlook

The North American vehicles tolling systems market is poised for continued growth, driven by technological innovation, increasing urbanization, and government support for infrastructure development. Strategic opportunities exist in developing advanced tolling solutions for autonomous vehicles, enhancing cybersecurity measures, and expanding market reach into underserved regions. The focus on efficient, user-friendly, and secure tolling systems will be crucial in shaping the future of the market.

North America Vehicles Tolling Systems Market Segmentation

-

1. Toll Collection Type

- 1.1. Barrier Toll Collection

- 1.2. Entry/ExiT Toll Collection

- 1.3. Electronic Toll Collection

-

2. Application Type

- 2.1. Bridges

- 2.2. Roads

- 2.3. Tunnels

-

3. Geography

-

3.1. North America

- 3.1.1. United States Of America

- 3.1.2. Canada

- 3.1.3. Rest of North America

-

3.1. North America

North America Vehicles Tolling Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States Of America

- 1.2. Canada

- 1.3. Rest of North America

North America Vehicles Tolling Systems Market Regional Market Share

Geographic Coverage of North America Vehicles Tolling Systems Market

North America Vehicles Tolling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Promote Sales of Electric Vehicle

- 3.3. Market Restrains

- 3.3.1. High Initial Investment for Installing Electric Vehicle Charging Infrastructure

- 3.4. Market Trends

- 3.4.1. Electronic Toll Collection is Expected to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vehicles Tolling Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 5.1.1. Barrier Toll Collection

- 5.1.2. Entry/ExiT Toll Collection

- 5.1.3. Electronic Toll Collection

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Bridges

- 5.2.2. Roads

- 5.2.3. Tunnels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States Of America

- 5.3.1.2. Canada

- 5.3.1.3. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Heavy Industries Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Road Dynmics Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emovis Gmb

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thales Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nedap NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TansCore Atlantic LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cintra

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Magnetic Autocontrol GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Heavy Industries Limited

List of Figures

- Figure 1: North America Vehicles Tolling Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Vehicles Tolling Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Vehicles Tolling Systems Market Revenue million Forecast, by Toll Collection Type 2020 & 2033

- Table 2: North America Vehicles Tolling Systems Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: North America Vehicles Tolling Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: North America Vehicles Tolling Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Vehicles Tolling Systems Market Revenue million Forecast, by Toll Collection Type 2020 & 2033

- Table 6: North America Vehicles Tolling Systems Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: North America Vehicles Tolling Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: North America Vehicles Tolling Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Of America North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vehicles Tolling Systems Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the North America Vehicles Tolling Systems Market?

Key companies in the market include Mitsubishi Heavy Industries Limited, International Road Dynmics Inc, Emovis Gmb, Thales Group, Nedap NV, TansCore Atlantic LLC, Cintra, Magnetic Autocontrol GmbH.

3. What are the main segments of the North America Vehicles Tolling Systems Market?

The market segments include Toll Collection Type, Application Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 10334.9 million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Promote Sales of Electric Vehicle.

6. What are the notable trends driving market growth?

Electronic Toll Collection is Expected to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

High Initial Investment for Installing Electric Vehicle Charging Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vehicles Tolling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vehicles Tolling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vehicles Tolling Systems Market?

To stay informed about further developments, trends, and reports in the North America Vehicles Tolling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence