Key Insights

The PCMCIA adapter market is poised for significant expansion, projected to reach an estimated market size of approximately $450 million by 2025, driven by a Compound Annual Growth Rate (CAGR) of around 12%. This robust growth is primarily fueled by the continued demand for seamless data transfer and connectivity solutions across a spectrum of devices. The persistent use of legacy equipment in industrial, scientific, and specialized professional environments, coupled with the need to bridge the gap between older PCMCIA-equipped systems and modern computing infrastructure, forms a core driver. Furthermore, the increasing emphasis on data integrity and secure transfer, particularly in critical sectors like healthcare and manufacturing, where PCMCIA cards often store essential data, underpins market vitality. The market is segmented by application, with "Mobile Devices" and "Fixed Equipment" representing significant segments, and by type, including "Transfer to Computer," "Mobile Phone Transfer," and "Other Equipment," each catering to distinct user needs and scenarios.

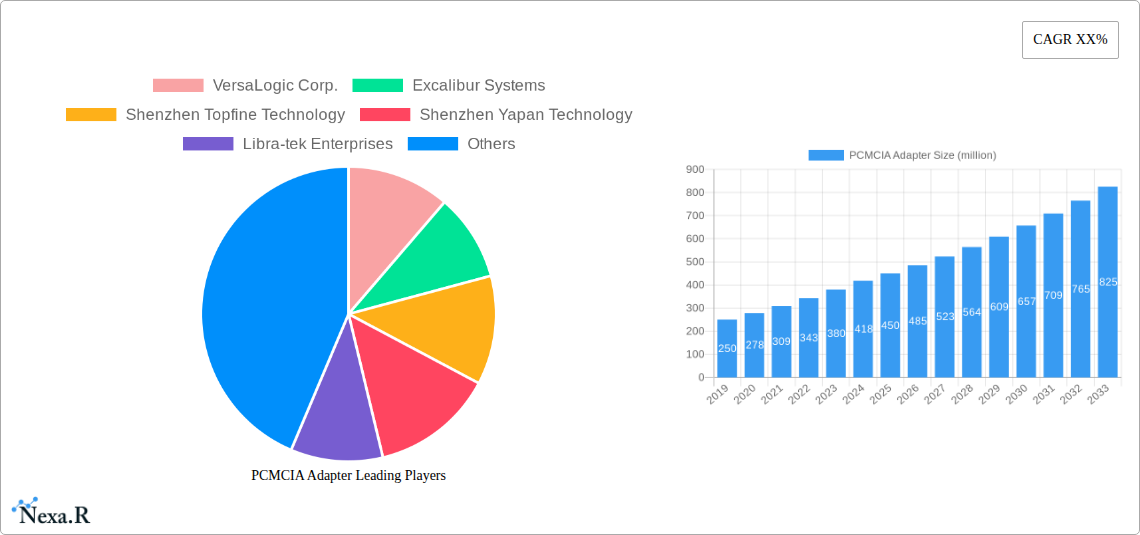

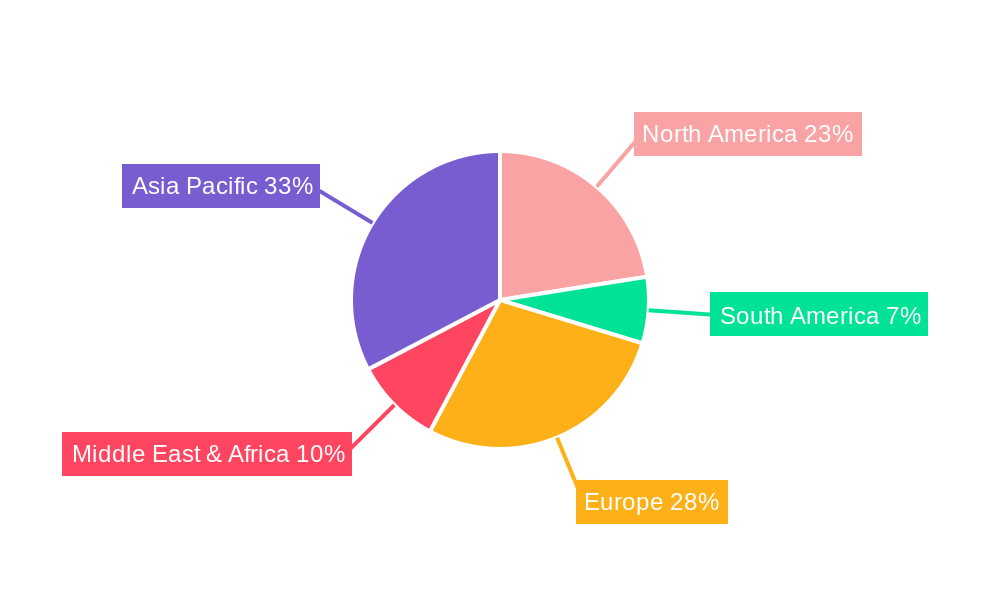

Despite the overall positive outlook, certain factors could temper the market's trajectory. The widespread adoption of newer connectivity standards and the phasing out of PCMCIA slots in mainstream consumer electronics present a notable restraint. However, the specialized nature of many PCMCIA applications means these adapters will remain indispensable for a considerable period. Emerging trends like the development of high-speed PCMCIA adapters and specialized solutions for niche industrial automation and embedded systems are expected to further bolster the market. Geographically, the Asia Pacific region, particularly China, is anticipated to be a major hub for both production and consumption, owing to its vast manufacturing base and the prevalent use of industrial equipment. North America and Europe, with their established industrial sectors and strong emphasis on upgrading existing infrastructure, will also contribute significantly to market growth. The competitive landscape features a mix of established players and emerging companies, all vying to innovate and meet the evolving demands for reliable PCMCIA connectivity.

PCMCIA Adapter Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a holistic analysis of the global PCMCIA Adapter market, offering critical insights for industry stakeholders. Covering the historical period of 2019-2024 and extending to a detailed forecast for 2025-2033, with a base and estimated year of 2025, this report delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and the competitive ecosystem. Leveraging high-traffic keywords, this report is optimized for maximum search engine visibility and engagement with industry professionals, including those in parent and child markets seeking comprehensive data. All quantitative values are presented in millions of units.

PCMCIA Adapter Market Dynamics & Structure

The PCMCIA Adapter market exhibits a moderately concentrated structure, characterized by a blend of established players and emerging manufacturers, particularly from regions like Shenzhen, China. Technological innovation remains a primary driver, with ongoing efforts to enhance data transfer speeds, compatibility with legacy systems, and miniaturization of form factors. Regulatory frameworks, while not overly restrictive for this niche market, primarily revolve around electrical safety and compliance standards. Competitive product substitutes are limited due to the specialized nature of PCMCIA interfaces, yet advancements in USB and Thunderbolt technologies indirectly influence demand by offering more universal connectivity solutions. End-user demographics span industrial automation, specialized computing, and legacy equipment maintenance, indicating a mature but persistent demand base. Merger and acquisition (M&A) trends are relatively subdued, reflecting the stable nature of the market.

- Market Concentration: Moderate, with key players holding significant shares, especially in specific application segments.

- Technological Innovation: Focus on improved data throughput, wider device compatibility, and ruggedized designs for industrial applications.

- Regulatory Frameworks: Primarily centered on electrical safety certifications (e.g., CE, FCC) and RoHS compliance.

- Competitive Substitutes: Indirect competition from universal serial bus (USB) and Thunderbolt adapters, particularly in newer computing environments.

- End-User Demographics: Industrial sector, embedded systems manufacturers, older computer system users, and specialized equipment integrators.

- M&A Trends: Limited activity, suggesting a mature market with stable ownership structures.

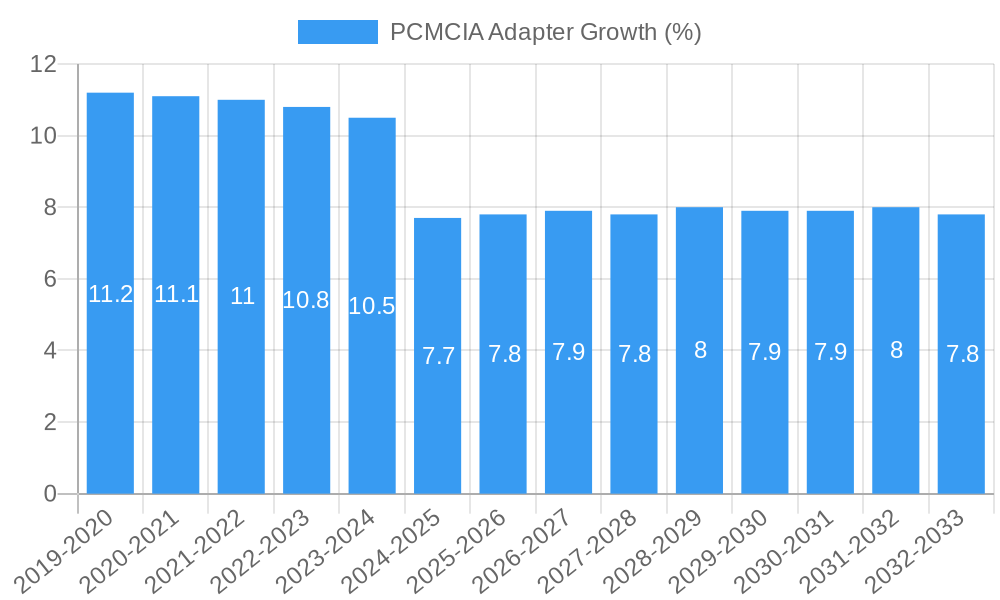

PCMCIA Adapter Growth Trends & Insights

The global PCMCIA Adapter market has demonstrated consistent growth throughout the historical period (2019-2024), driven by the persistent need to interface with legacy industrial equipment and specialized computing systems. The market size evolved from approximately 5.2 million units in 2019 to an estimated 6.8 million units in 2024, showcasing a Compound Annual Growth Rate (CAGR) of approximately 5.5%. This growth is underpinned by the extensive installed base of machinery and systems that still rely on PCMCIA interfaces for data storage, network connectivity, and I/O expansion. As of the base year 2025, the market is projected to reach approximately 7.1 million units, with a robust CAGR of 5.2% anticipated for the forecast period of 2025-2033.

Technological disruptions, while not rendering PCMCIA obsolete, have led to the development of more sophisticated adapters capable of higher data transfer rates and supporting newer PCMCIA standards. Consumer behavior shifts are less pronounced in this segment, as the demand is largely driven by industrial and professional applications rather than mass consumer markets. Instead, the focus remains on reliability, durability, and compatibility. Market penetration within its core niche remains high, as for many legacy systems, a PCMCIA adapter is the only viable solution for necessary connectivity. The estimated market size in 2025 is expected to be 7.1 million units, with projections reaching 11.5 million units by 2033. The average selling price is expected to remain relatively stable, with minor increases driven by specialized features and higher-end industrial-grade products. The adoption rate for new PCMCIA adapter installations is directly tied to the lifespan of existing industrial machinery and the integration of new systems that might still incorporate PCMCIA slots for specific functionalities, such as industrial control systems and medical devices.

Dominant Regions, Countries, or Segments in PCMCIA Adapter

The Fixed Equipment segment, within the Application category, is a primary driver of growth and dominance in the PCMCIA Adapter market. This segment encompasses industrial automation, networking infrastructure, medical devices, and other specialized systems that often feature or require PCMCIA interfaces for connectivity and data management. Asia Pacific, particularly China, stands out as the leading region due to its robust manufacturing capabilities and a significant installed base of industrial machinery. The dominance of Fixed Equipment is propelled by several key factors:

- Industrial Automation: The widespread adoption of automation in manufacturing plants globally necessitates reliable data transfer and control interfaces, where PCMCIA cards have historically played a crucial role.

- Legacy System Support: Many critical industrial control systems, diagnostic equipment, and older server architectures continue to operate with PCMCIA slots, creating a sustained demand for compatible adapters.

- Embedded Systems: PCMCIA adapters are integrated into embedded systems for applications such as data logging, power management, and specialized I/O, particularly in ruggedized or niche environments.

- Economic Policies and Infrastructure: Governments in developing economies, especially in Asia, have invested heavily in industrial infrastructure, further bolstering the demand for equipment that utilizes established interface technologies like PCMCIA.

- Market Share and Growth Potential: The Fixed Equipment segment is estimated to hold over 60% of the total PCMCIA adapter market share in 2025, with a projected growth rate of approximately 5.0% CAGR. This segment's resilience is attributed to the high cost and complexity of upgrading entire industrial systems, making adapters a cost-effective solution for extending their operational life.

Within the Types segment, "Transfer to Computer" remains a dominant category, facilitating the migration of data from PCMCIA storage media (like ATA cards) to modern computing systems. This is critical for data recovery, archiving, and system maintenance. The market share for this type is estimated to be around 55% in 2025. The "Other Equipment" category also shows significant traction, encompassing specialized industrial and scientific instruments that utilize PCMCIA for specific functionalities.

PCMCIA Adapter Product Landscape

The PCMCIA Adapter market is characterized by a focus on functionality and reliability over rapid innovation. Key product developments include adapters supporting various PCMCIA standards (Type I, II, III) and offering diverse interfaces such as CFast, SD, and SATA, enabling data transfer from legacy PCMCIA cards to modern computers. Performance metrics are primarily defined by data transfer speeds, which can range from a few megabytes per second to hundreds of megabytes per second depending on the adapter and the connected PCMCIA card. Unique selling propositions include robust build quality for industrial environments, backward compatibility with older systems, and specialized drivers for specific operating systems. Technological advancements are incremental, aiming to improve signal integrity and ensure seamless data flow between older and newer hardware.

Key Drivers, Barriers & Challenges in PCMCIA Adapter

Key Drivers:

- Legacy System Integration: The substantial installed base of industrial machinery and specialized equipment that rely on PCMCIA interfaces is the primary growth driver.

- Cost-Effectiveness of Upgrades: For many organizations, upgrading entire systems is prohibitively expensive, making PCMCIA adapters a practical and economical solution for connectivity.

- Niche Applications: Continued use in sectors like industrial automation, medical devices, and embedded systems ensures a steady demand.

- Data Recovery and Archiving: The need to access and preserve data stored on older PCMCIA media fuels demand for transfer adapters.

Key Barriers & Challenges:

- Declining Relevance in Consumer Electronics: The shift to USB and other modern interfaces in personal computing has diminished the broader consumer market for PCMCIA.

- Limited Technological Advancement: The mature nature of PCMCIA technology means innovation is incremental, with less potential for significant performance breakthroughs.

- Supply Chain Volatility: Sourcing components for older technologies can sometimes lead to supply chain disruptions and price fluctuations.

- Competition from Emulation Software: In some instances, software-based emulation can partially substitute hardware adapters, though often with performance limitations.

- Obsolescence of PCMCIA Cards Themselves: As the underlying PCMCIA cards become harder to source or fail, the demand for adapters will eventually face a natural decline.

- Market Size: The relatively niche market size can make it less attractive for large-scale investment compared to rapidly growing technology sectors.

Emerging Opportunities in PCMCIA Adapter

Emerging opportunities lie in the development of advanced adapters with enhanced security features for industrial data transfer, and ruggedized versions designed for extreme environments. The increasing focus on IoT and smart manufacturing may also present opportunities for PCMCIA adapters that facilitate the integration of older sensors and control systems into modern IoT networks. Furthermore, the provision of comprehensive technical support and custom solutions for specialized industrial applications can create a competitive advantage. The development of PCMCIA to cloud connectivity solutions, while highly specialized, could also unlock new avenues.

Growth Accelerators in the PCMCIA Adapter Industry

Growth in the PCMCIA adapter industry is primarily accelerated by the ongoing need for backward compatibility in critical infrastructure. Strategic partnerships between adapter manufacturers and industrial equipment providers can ensure continued product relevance. Market expansion strategies focusing on regions with a strong manufacturing base and significant investment in industrial automation, such as Southeast Asia and Eastern Europe, will be crucial. The development of higher-performance adapters that support faster data transfer protocols and broader operating system compatibility can also act as significant growth catalysts.

Key Players Shaping the PCMCIA Adapter Market

- VersaLogic Corp.

- Excalibur Systems

- Shenzhen Topfine Technology

- Shenzhen Yapan Technology

- Libra-tek Enterprises

- Dongguan Jinbaoli Electronic

- Shenzhen YILIANWANG Technology

- Dragon Well Electronics Company Limited

- Premier Cable

- Zhuhai Eadersay Technology

- Shenzhen MUP Industrial

- Pisonic Electronic (Zhuhai) Limited

Notable Milestones in PCMCIA Adapter Sector

- 2019: Continued demand for industrial automation solutions drives steady sales of PCMCIA-to-Ethernet adapters.

- 2020: Global supply chain disruptions impact component availability, leading to slight price increases.

- 2021: Increased focus on data security in industrial settings prompts development of PCMCIA adapters with enhanced encryption capabilities.

- 2022: Some manufacturers begin offering PCMCIA to M.2 NVMe adapters to bridge legacy storage to modern systems.

- 2023: Continued demand for legacy medical equipment maintenance sustains the market for specialized PCMCIA diagnostic adapters.

- 2024: Manufacturers actively focus on improving compatibility with Windows 11 and other newer operating systems for PCMCIA card readers.

In-Depth PCMCIA Adapter Market Outlook

- 2019: Continued demand for industrial automation solutions drives steady sales of PCMCIA-to-Ethernet adapters.

- 2020: Global supply chain disruptions impact component availability, leading to slight price increases.

- 2021: Increased focus on data security in industrial settings prompts development of PCMCIA adapters with enhanced encryption capabilities.

- 2022: Some manufacturers begin offering PCMCIA to M.2 NVMe adapters to bridge legacy storage to modern systems.

- 2023: Continued demand for legacy medical equipment maintenance sustains the market for specialized PCMCIA diagnostic adapters.

- 2024: Manufacturers actively focus on improving compatibility with Windows 11 and other newer operating systems for PCMCIA card readers.

In-Depth PCMCIA Adapter Market Outlook

The PCMCIA Adapter market outlook remains positive, albeit niche, driven by the sustained need for backward compatibility in critical industrial and specialized applications. Growth accelerators include the ongoing investment in industrial automation globally, particularly in emerging economies, and the cost-effectiveness of adapter solutions over full system replacements. Strategic partnerships and focused market expansion in regions with robust manufacturing sectors will be key to capitalizing on future growth. While consumer electronics have moved on, the professional and industrial segments will continue to rely on PCMCIA adapters, ensuring a steady, if specialized, market for the foreseeable future. The market is projected to reach approximately 11.5 million units by 2033, exhibiting a stable growth trajectory driven by these enduring factors.

PCMCIA Adapter Segmentation

-

1. Application

- 1.1. Mobile Devices

- 1.2. Fixed Equipment

-

2. Types

- 2.1. Transfer to Computer

- 2.2. Mobile Phone Transfer

- 2.3. Other Equipment

PCMCIA Adapter Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

PCMCIA Adapter REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PCMCIA Adapter Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Mobile Devices

- 5.1.2. Fixed Equipment

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Transfer to Computer

- 5.2.2. Mobile Phone Transfer

- 5.2.3. Other Equipment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America PCMCIA Adapter Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Mobile Devices

- 6.1.2. Fixed Equipment

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Transfer to Computer

- 6.2.2. Mobile Phone Transfer

- 6.2.3. Other Equipment

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America PCMCIA Adapter Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Mobile Devices

- 7.1.2. Fixed Equipment

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Transfer to Computer

- 7.2.2. Mobile Phone Transfer

- 7.2.3. Other Equipment

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe PCMCIA Adapter Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Mobile Devices

- 8.1.2. Fixed Equipment

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Transfer to Computer

- 8.2.2. Mobile Phone Transfer

- 8.2.3. Other Equipment

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa PCMCIA Adapter Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Mobile Devices

- 9.1.2. Fixed Equipment

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Transfer to Computer

- 9.2.2. Mobile Phone Transfer

- 9.2.3. Other Equipment

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific PCMCIA Adapter Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Mobile Devices

- 10.1.2. Fixed Equipment

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Transfer to Computer

- 10.2.2. Mobile Phone Transfer

- 10.2.3. Other Equipment

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 VersaLogic Corp.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Excalibur Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shenzhen Topfine Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shenzhen Yapan Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Libra-tek Enterprises

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dongguan Jinbaoli Electronic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shenzhen YILIANWANG Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dragon Well Electronics Company Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Premier Cable

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zhuhai Eadersay Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shenzhen MUP Industrial

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pisonic Electronic (Zhuhai) Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 VersaLogic Corp.

List of Figures

- Figure 1: Global PCMCIA Adapter Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global PCMCIA Adapter Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America PCMCIA Adapter Revenue (million), by Application 2024 & 2032

- Figure 4: North America PCMCIA Adapter Volume (K), by Application 2024 & 2032

- Figure 5: North America PCMCIA Adapter Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America PCMCIA Adapter Volume Share (%), by Application 2024 & 2032

- Figure 7: North America PCMCIA Adapter Revenue (million), by Types 2024 & 2032

- Figure 8: North America PCMCIA Adapter Volume (K), by Types 2024 & 2032

- Figure 9: North America PCMCIA Adapter Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America PCMCIA Adapter Volume Share (%), by Types 2024 & 2032

- Figure 11: North America PCMCIA Adapter Revenue (million), by Country 2024 & 2032

- Figure 12: North America PCMCIA Adapter Volume (K), by Country 2024 & 2032

- Figure 13: North America PCMCIA Adapter Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America PCMCIA Adapter Volume Share (%), by Country 2024 & 2032

- Figure 15: South America PCMCIA Adapter Revenue (million), by Application 2024 & 2032

- Figure 16: South America PCMCIA Adapter Volume (K), by Application 2024 & 2032

- Figure 17: South America PCMCIA Adapter Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America PCMCIA Adapter Volume Share (%), by Application 2024 & 2032

- Figure 19: South America PCMCIA Adapter Revenue (million), by Types 2024 & 2032

- Figure 20: South America PCMCIA Adapter Volume (K), by Types 2024 & 2032

- Figure 21: South America PCMCIA Adapter Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America PCMCIA Adapter Volume Share (%), by Types 2024 & 2032

- Figure 23: South America PCMCIA Adapter Revenue (million), by Country 2024 & 2032

- Figure 24: South America PCMCIA Adapter Volume (K), by Country 2024 & 2032

- Figure 25: South America PCMCIA Adapter Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America PCMCIA Adapter Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe PCMCIA Adapter Revenue (million), by Application 2024 & 2032

- Figure 28: Europe PCMCIA Adapter Volume (K), by Application 2024 & 2032

- Figure 29: Europe PCMCIA Adapter Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe PCMCIA Adapter Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe PCMCIA Adapter Revenue (million), by Types 2024 & 2032

- Figure 32: Europe PCMCIA Adapter Volume (K), by Types 2024 & 2032

- Figure 33: Europe PCMCIA Adapter Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe PCMCIA Adapter Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe PCMCIA Adapter Revenue (million), by Country 2024 & 2032

- Figure 36: Europe PCMCIA Adapter Volume (K), by Country 2024 & 2032

- Figure 37: Europe PCMCIA Adapter Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe PCMCIA Adapter Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa PCMCIA Adapter Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa PCMCIA Adapter Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa PCMCIA Adapter Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa PCMCIA Adapter Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa PCMCIA Adapter Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa PCMCIA Adapter Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa PCMCIA Adapter Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa PCMCIA Adapter Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa PCMCIA Adapter Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa PCMCIA Adapter Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa PCMCIA Adapter Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa PCMCIA Adapter Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific PCMCIA Adapter Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific PCMCIA Adapter Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific PCMCIA Adapter Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific PCMCIA Adapter Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific PCMCIA Adapter Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific PCMCIA Adapter Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific PCMCIA Adapter Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific PCMCIA Adapter Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific PCMCIA Adapter Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific PCMCIA Adapter Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific PCMCIA Adapter Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific PCMCIA Adapter Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global PCMCIA Adapter Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global PCMCIA Adapter Volume K Forecast, by Region 2019 & 2032

- Table 3: Global PCMCIA Adapter Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global PCMCIA Adapter Volume K Forecast, by Application 2019 & 2032

- Table 5: Global PCMCIA Adapter Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global PCMCIA Adapter Volume K Forecast, by Types 2019 & 2032

- Table 7: Global PCMCIA Adapter Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global PCMCIA Adapter Volume K Forecast, by Region 2019 & 2032

- Table 9: Global PCMCIA Adapter Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global PCMCIA Adapter Volume K Forecast, by Application 2019 & 2032

- Table 11: Global PCMCIA Adapter Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global PCMCIA Adapter Volume K Forecast, by Types 2019 & 2032

- Table 13: Global PCMCIA Adapter Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global PCMCIA Adapter Volume K Forecast, by Country 2019 & 2032

- Table 15: United States PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global PCMCIA Adapter Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global PCMCIA Adapter Volume K Forecast, by Application 2019 & 2032

- Table 23: Global PCMCIA Adapter Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global PCMCIA Adapter Volume K Forecast, by Types 2019 & 2032

- Table 25: Global PCMCIA Adapter Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global PCMCIA Adapter Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global PCMCIA Adapter Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global PCMCIA Adapter Volume K Forecast, by Application 2019 & 2032

- Table 35: Global PCMCIA Adapter Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global PCMCIA Adapter Volume K Forecast, by Types 2019 & 2032

- Table 37: Global PCMCIA Adapter Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global PCMCIA Adapter Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global PCMCIA Adapter Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global PCMCIA Adapter Volume K Forecast, by Application 2019 & 2032

- Table 59: Global PCMCIA Adapter Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global PCMCIA Adapter Volume K Forecast, by Types 2019 & 2032

- Table 61: Global PCMCIA Adapter Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global PCMCIA Adapter Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global PCMCIA Adapter Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global PCMCIA Adapter Volume K Forecast, by Application 2019 & 2032

- Table 77: Global PCMCIA Adapter Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global PCMCIA Adapter Volume K Forecast, by Types 2019 & 2032

- Table 79: Global PCMCIA Adapter Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global PCMCIA Adapter Volume K Forecast, by Country 2019 & 2032

- Table 81: China PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific PCMCIA Adapter Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific PCMCIA Adapter Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PCMCIA Adapter?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the PCMCIA Adapter?

Key companies in the market include VersaLogic Corp., Excalibur Systems, Shenzhen Topfine Technology, Shenzhen Yapan Technology, Libra-tek Enterprises, Dongguan Jinbaoli Electronic, Shenzhen YILIANWANG Technology, Dragon Well Electronics Company Limited, Premier Cable, Zhuhai Eadersay Technology, Shenzhen MUP Industrial, Pisonic Electronic (Zhuhai) Limited.

3. What are the main segments of the PCMCIA Adapter?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PCMCIA Adapter," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PCMCIA Adapter report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PCMCIA Adapter?

To stay informed about further developments, trends, and reports in the PCMCIA Adapter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence