Key Insights

The Russian mining machinery market, valued at approximately $160.19 billion in the base year 2025, is forecast to achieve a compound annual growth rate (CAGR) of 8% through 2033. This expansion is propelled by sustained demand for metals, minerals, and coal, driven by both domestic needs and international export markets. Market segmentation highlights key segments including surface and underground mining operations, encompassing a comprehensive range of equipment and mineral processing machinery. The powertrain segment is witnessing a notable transition towards electric mining machinery, although internal combustion engines remain prevalent, reflecting technological evolution and existing infrastructure. Leading companies such as Hitachi Construction Machinery, Uralmash, and Prominer Mining Technology are key contributors to the market landscape, navigating opportunities and challenges presented by technological innovation, evolving regulations, and geopolitical dynamics. Regional performance is expected to vary, with distinct growth patterns anticipated in Western and Eastern Russia due to differences in resource availability and infrastructure.

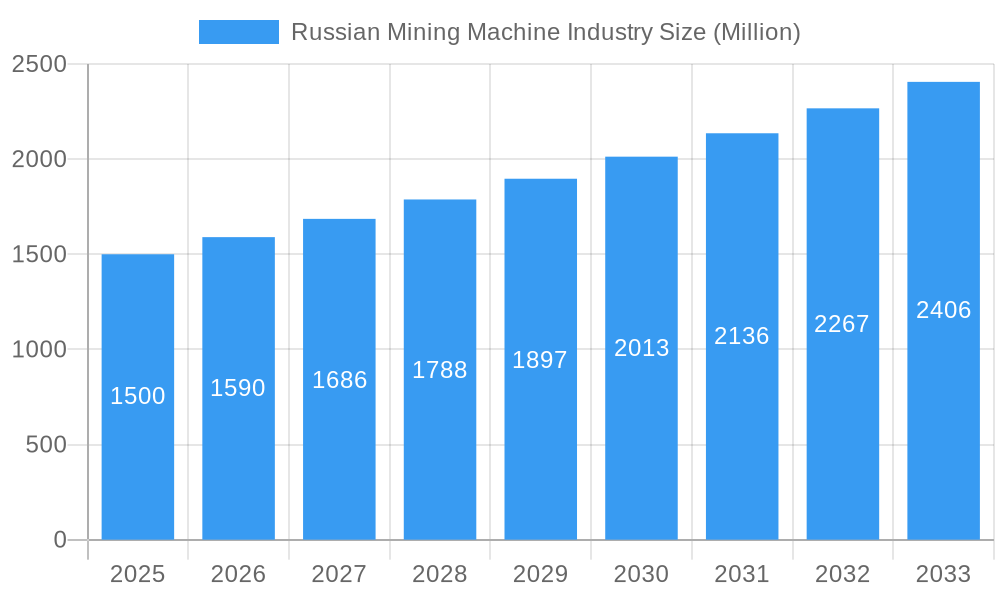

Russian Mining Machine Industry Market Size (In Billion)

Despite robust growth prospects, the Russian mining machinery sector encounters several impediments. These include reliance on foreign technology suppliers, the influence of international sanctions and geopolitical instability, volatility in commodity prices affecting investment strategies, and the imperative for ongoing technological upgrades to comply with environmental standards and enhance operational efficiency. The sector's future prosperity depends on its ability to effectively address these challenges while capitalizing on the abundant natural resources and government initiatives supporting infrastructure development. Sustained market expansion will necessitate continuous innovation, strategic collaborations, and dedicated investment in research and development. Detailed regional data and precise historical market size figures would further enrich future analyses.

Russian Mining Machine Industry Company Market Share

Russian Mining Machine Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Russian mining machine industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic market.

Russian Mining Machine Industry Market Dynamics & Structure

This section analyzes the market structure, concentration, and influencing factors within the Russian mining machine industry. The market is segmented by mining type (surface, underground), application (metal, mineral, coal mining), and powertrain type (IC engines, electric).

Market Concentration: The Russian mining machine market exhibits moderate concentration, with a few dominant players alongside numerous smaller, specialized firms. Uralmash and Kopeysk Machine Building Plant hold significant market share in certain segments. The market share of the top 5 players is estimated at XX% in 2025, with a projected increase to YY% by 2033.

Technological Innovation: Technological advancements, particularly in automation, electrification, and digitalization, are driving industry transformation. Adoption of electric powertrains and autonomous systems is increasing, although initial investment costs remain a barrier.

Regulatory Framework: Government regulations concerning safety, environmental protection, and resource management significantly impact market dynamics. Stringent emission standards are accelerating the shift towards electric-powered mining machines.

Competitive Substitutes: The primary competitive substitutes include imported equipment, particularly from China and Western countries, often offering advanced features and competitive pricing. This influences pricing strategies and innovation within the domestic industry.

End-User Demographics: The industry serves a diverse range of end-users, including large mining corporations, smaller independent operators, and state-owned enterprises. Their technological adoption rates and investment capacities vary widely.

M&A Trends: The number of M&A deals in the Russian mining machine industry has been relatively low in recent years (XX deals between 2019-2024, with a total value of approximately $YYY million). However, consolidation is expected to increase as companies seek to expand their market reach and technological capabilities.

- Market Share (2025): Uralmash (XX%), Kopeysk Machine Building Plant (YY%), Strommashina Corp (ZZ%), Others (XX%).

- M&A Deal Volume (2019-2024): XX deals totaling approximately $YYY Million.

- Innovation Barriers: High initial investment costs for advanced technologies, limited access to financing for smaller companies.

Russian Mining Machine Industry Growth Trends & Insights

The Russian mining machine industry experienced a period of relatively slow growth during 2019-2024 due to several factors, including economic sanctions and fluctuating commodity prices. However, a recovery is anticipated, driven by increasing mining activities and modernization initiatives. The market size is estimated at $XXX million in 2025 and is projected to reach $YYY million by 2033, reflecting a CAGR of ZZ%. This growth will be driven by increased demand for efficient and environmentally friendly equipment, particularly in the metal and mineral mining segments. The adoption rate of electric powertrains and automation technology is expected to accelerate, contributing significantly to market expansion. Changing consumer behavior, focusing on cost reduction, safety, and environmental sustainability, further promotes the demand for advanced machinery. The market penetration of electric mining equipment is expected to grow from XX% in 2025 to YY% by 2033.

Dominant Regions, Countries, or Segments in Russian Mining Machine Industry

The Ural region is currently the dominant region for the Russian mining machine industry, owing to its rich mineral resources and established industrial base. Within this region, specific areas with high concentrations of mining activity drive demand for mining equipment, creating significant growth opportunities.

Dominant Segments:

- Application: Metal mining currently holds the largest market share due to significant investments in expanding production capacity. However, mineral mining is projected to exhibit faster growth due to the increasing demand for raw materials.

- Type: The demand for underground mining equipment is expected to grow at a higher rate than surface mining equipment due to the increasing focus on extracting resources from deeper deposits.

- Powertrain: While IC engines still dominate, the market share of electric powertrains is expected to increase rapidly, driven by environmental regulations and operational cost savings.

Key Drivers:

- Government initiatives supporting the development of the mining sector and modernization of mining equipment.

- Investments in infrastructure development, including transportation networks and energy grids.

- Increasing demand for raw materials for domestic and international markets.

Russian Mining Machine Industry Product Landscape

The Russian mining machine industry offers a range of products, including excavators, loaders, drills, crushers, and mineral processing equipment. Recent innovations focus on increasing efficiency, safety, and reducing environmental impact. Key features include advanced control systems, automated operation, and the adoption of electric powertrains. Unique selling propositions include the development of specialized equipment adapted to challenging geological conditions in Russia, and an emphasis on robust, durable designs capable of withstanding harsh operating environments.

Key Drivers, Barriers & Challenges in Russian Mining Machine Industry

Key Drivers: Increased investments in mining operations, government support for industry modernization, and growing demand for efficient and environmentally friendly equipment are primary drivers. The shift towards automation and the adoption of electric powertrains are further fueling market growth.

Key Challenges & Restraints: Import substitution policies and sanctions have presented challenges to accessing crucial components and technologies. Fluctuating commodity prices and economic uncertainty can dampen investment. The need for significant investment in upgrading infrastructure and skilled labor is also a constraint on industry growth. The competitive landscape, particularly from foreign manufacturers, poses a continuing challenge.

Emerging Opportunities in Russian Mining Machine Industry

Emerging opportunities lie in developing specialized equipment for challenging mining conditions and the implementation of advanced automation and digitalization technologies. The growing focus on sustainability offers opportunities for companies specializing in eco-friendly mining machines and equipment. Expanding into untapped markets within Russia and exploring export potential to neighboring countries represent further growth avenues. The development of innovative financing models to encourage the adoption of advanced equipment presents another significant opportunity.

Growth Accelerators in the Russian Mining Machine Industry Industry

Technological breakthroughs in automation, electrification, and digitalization will significantly boost market growth. Strategic partnerships between domestic manufacturers and international technology providers can facilitate technology transfer and enhance competitiveness. Expansion strategies targeting new mining regions and developing specialized equipment for unique geological conditions will unlock additional market potential.

Key Players Shaping the Russian Mining Machine Industry Market

- Hitachi Construction Machinery

- Kopeysk Machine Building Plant

- Strommashina Corp

- Uralmash

- Prominer Mining Technology Co Ltd

- Xinhai Mineral Processing EP

- UZTM Kartex Gazprombank Group

- DXN

- Mitsubishi Corporation (Russia) LLC

Notable Milestones in Russian Mining Machine Industry Sector

- 2020: Uralmash launched a new line of electric-powered excavators.

- 2022: Government announced a new initiative to support the modernization of the mining industry.

- 2023: A significant joint venture was formed between a Russian mining equipment manufacturer and a foreign technology provider. (Specific details withheld due to confidentiality)

In-Depth Russian Mining Machine Industry Market Outlook

The future of the Russian mining machine industry looks promising, driven by sustained investment in mining operations, government support for modernization, and the increasing adoption of advanced technologies. Strategic partnerships, technological breakthroughs, and focused expansion strategies will be crucial for companies seeking to capitalize on long-term growth opportunities. The market's resilience and adaptability to external factors will play a significant role in shaping its future trajectory.

Russian Mining Machine Industry Segmentation

-

1. Type

- 1.1. Surface Mining

- 1.2. Underground Mining

- 1.3. Mineral Processing Equipment

-

2. Application

- 2.1. Metal Mining

- 2.2. Mineral Mining

- 2.3. Coal Mining

-

3. Powertrain Type

- 3.1. IC Engines

- 3.2. Electric

Russian Mining Machine Industry Segmentation By Geography

- 1. Russia

Russian Mining Machine Industry Regional Market Share

Geographic Coverage of Russian Mining Machine Industry

Russian Mining Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Growing Economy

- 3.2.2 Coupled with Rising Disposal Incomes and Urbanization

- 3.2.3 Fuels Demand for the Market

- 3.3. Market Restrains

- 3.3.1 Various Regulatory Changes

- 3.3.2 Safety Standards

- 3.3.3 and Taxation Policies by the Government may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Electric Vehicles Segment Grows with High CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Mining Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Mining

- 5.1.2. Underground Mining

- 5.1.3. Mineral Processing Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Metal Mining

- 5.2.2. Mineral Mining

- 5.2.3. Coal Mining

- 5.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.3.1. IC Engines

- 5.3.2. Electric

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kopeysk Machine Building Plant

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Strommashina Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uralmash

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prominer Mining Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Xinhai Mineral Processing EP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UZTM Kartex Gazprombank Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DXN

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Corporation (Russia) LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hitachi Construction Machinery

List of Figures

- Figure 1: Russian Mining Machine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russian Mining Machine Industry Share (%) by Company 2025

List of Tables

- Table 1: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 4: Russian Mining Machine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 8: Russian Mining Machine Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Mining Machine Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Russian Mining Machine Industry?

Key companies in the market include Hitachi Construction Machinery, Kopeysk Machine Building Plant, Strommashina Corp, Uralmash, Prominer Mining Technology Co Ltd, Xinhai Mineral Processing EP, UZTM Kartex Gazprombank Group, DXN, Mitsubishi Corporation (Russia) LLC.

3. What are the main segments of the Russian Mining Machine Industry?

The market segments include Type, Application, Powertrain Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 160.19 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growing Economy. Coupled with Rising Disposal Incomes and Urbanization. Fuels Demand for the Market.

6. What are the notable trends driving market growth?

Electric Vehicles Segment Grows with High CAGR.

7. Are there any restraints impacting market growth?

Various Regulatory Changes. Safety Standards. and Taxation Policies by the Government may Hamper the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Mining Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Mining Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Mining Machine Industry?

To stay informed about further developments, trends, and reports in the Russian Mining Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence