Key Insights

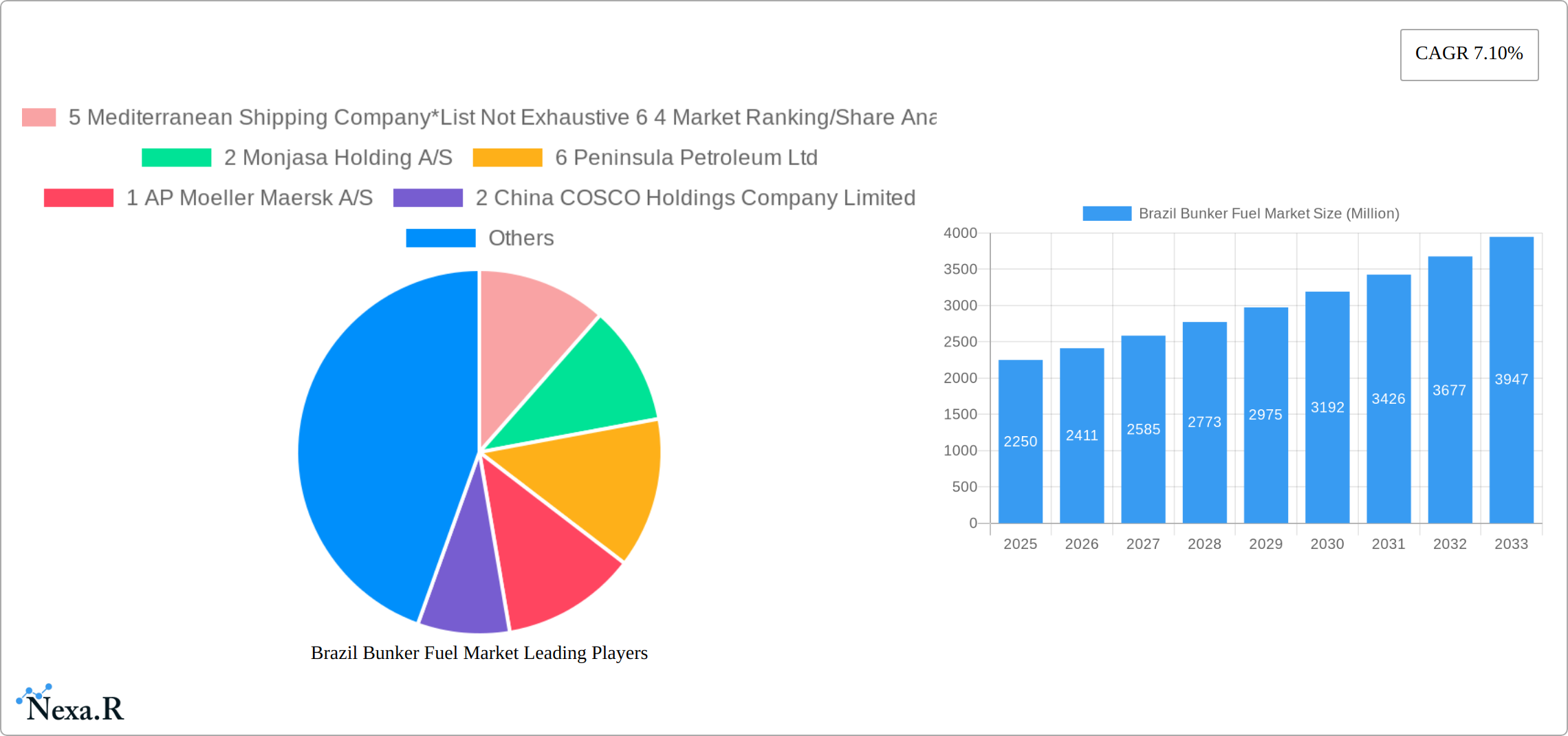

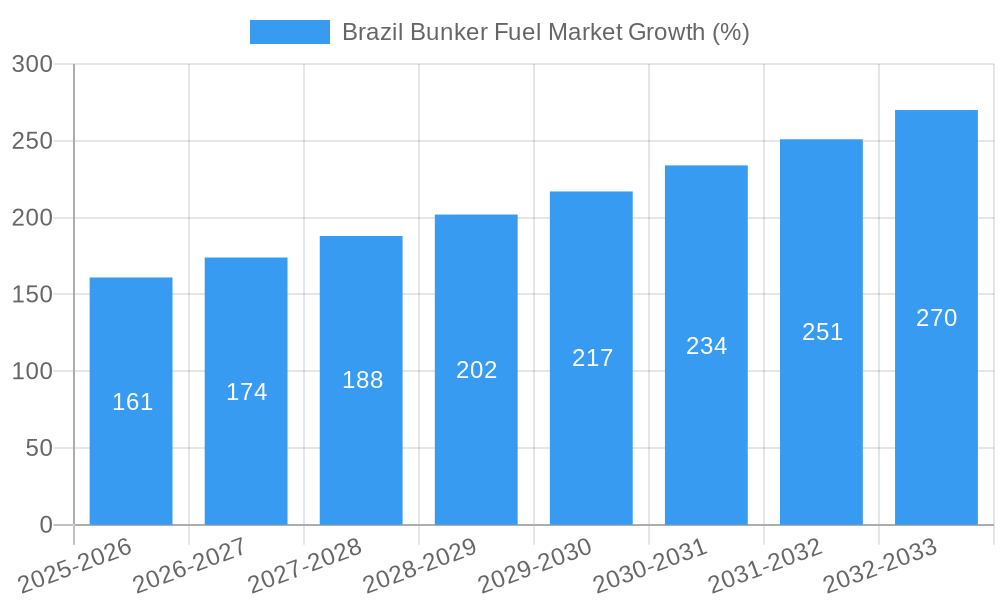

The Brazil Bunker Fuel Market, valued at $2.25 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.10% from 2025 to 2033. This expansion is fueled by several key factors. The increasing volume of maritime trade through Brazilian ports, particularly those handling significant container and bulk cargo, necessitates a substantial supply of bunker fuel. Furthermore, the growing adoption of liquefied natural gas (LNG) as a marine fuel, while still a relatively small segment, presents a significant opportunity for market expansion in the coming years, though it could also slightly impact the growth of traditional fuel types. Stringent environmental regulations, promoting the use of cleaner fuels like Very Low Sulfur Fuel Oil (VLSFO), are also shaping market dynamics, pushing a transition from High Sulfur Fuel Oil (HSFO). The market segmentation is characterized by a mix of vessel types (containers, tankers, general cargo, bulk carriers), with containers and tankers potentially dominating due to Brazil's import-export activity. Major players like AP Moeller Maersk A/S, CMA CGM Group, and Bunker Holding A/S are actively engaged in this market, benefiting from Brazil's strategic location and growing maritime commerce. However, potential economic fluctuations and global fuel price volatility could present challenges to sustained growth. The competitive landscape is marked by a mix of large international players and regional fuel suppliers, reflecting the diverse needs of the maritime industry in Brazil.

The forecast period (2025-2033) anticipates continued growth, though it's reasonable to anticipate some moderation toward the latter half of this period due to factors such as potential market saturation and a degree of price sensitivity among fuel consumers. Sustained investment in port infrastructure and Brazil's continued involvement in global trade will be pivotal in determining the overall trajectory of market expansion. The strategic focus on environmentally friendly fuels will likely reshape the market landscape, incentivizing investments in cleaner fuel infrastructure and driving innovation in fuel technology. Furthermore, the government's policy approach towards the maritime sector and its emphasis on sustainability will significantly influence the future of the Brazil Bunker Fuel Market.

This comprehensive report provides an in-depth analysis of the Brazil Bunker Fuel Market, encompassing market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and stakeholders seeking to understand the complexities and opportunities within this dynamic market. The report analyzes the parent market (Brazil Maritime Fuel Market) and child markets (by vessel type and fuel type) for a more granular understanding. Market values are presented in millions.

Brazil Bunker Fuel Market Market Dynamics & Structure

The Brazilian bunker fuel market is characterized by moderate concentration, with several major players holding significant market share. Technological innovation, driven by stricter environmental regulations and the pursuit of fuel efficiency, is reshaping the landscape. The regulatory framework, encompassing emission control areas (ECAs) and evolving fuel standards, significantly influences market dynamics. Competitive substitutes, such as LNG, are emerging, posing both challenges and opportunities. The end-user demographics, primarily comprising ship owners and operators, influence demand patterns. M&A activities are contributing to market consolidation.

- Market Concentration: Moderately concentrated, with the top 5 players accounting for approximately xx% of the market share in 2025.

- Technological Innovation: Focus on cleaner fuels (VLSFO, LNG) and efficient bunkering solutions. Innovation barriers include high upfront investment costs and infrastructure limitations.

- Regulatory Framework: Stringent environmental regulations drive adoption of low-sulfur fuels.

- Competitive Substitutes: LNG is emerging as a significant competitor, particularly for larger vessels.

- M&A Trends: Consolidation is expected to continue, leading to larger, more integrated players. xx M&A deals were recorded in the historical period (2019-2024).

Brazil Bunker Fuel Market Growth Trends & Insights

The Brazilian bunker fuel market experienced significant growth during the historical period (2019-2024), driven by increasing maritime trade and stricter environmental regulations. The market is expected to continue growing at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx million by 2033. Technological disruptions, such as the adoption of LNG and the development of alternative fuels, are influencing growth trajectory. Changing consumer behavior, driven by sustainability concerns and cost optimization, is another key factor. Market penetration of low-sulfur fuels (VLSFO) is increasing rapidly, surpassing xx% by 2025.

Dominant Regions, Countries, or Segments in Brazil Bunker Fuel Market

The Southeast region dominates the Brazilian bunker fuel market, driven by the concentration of major ports and industrial activities. Tankers and containers are the leading vessel types, reflecting the dominance of import-export activities. VLSFO is the fastest-growing fuel type, owing to stricter environmental regulations.

- Key Drivers: Robust maritime trade, expanding port infrastructure, and government investments in logistics.

- Dominance Factors: High vessel traffic, strategic port locations, and favorable economic conditions.

- Growth Potential: Significant growth opportunities in Northern and Northeast regions, particularly with the development of LNG bunkering infrastructure.

By Vessel Type:

- Tankers: xx Million

- Containers: xx Million

- Bulk Carriers: xx Million

- General Cargo: xx Million

- Other Vessel Types: xx Million

By Fuel Type:

- VLSFO: xx Million

- HSFO: xx Million

- MGO: xx Million

- Other Fuel Types: xx Million

Brazil Bunker Fuel Market Product Landscape

The Brazilian bunker fuel market is characterized by a dynamic product landscape, offering a spectrum of fuel types designed to meet the evolving demands of diverse vessel classes and increasingly stringent environmental mandates. Leading suppliers are prioritizing innovation aimed at enhancing fuel efficiency, significantly reducing harmful emissions (such as SOx and NOx), and optimizing overall vessel operational performance. Key differentiators within the market often revolve around robust quality assurance protocols, dependable and integrated supply chain management, and competitive pricing strategies. Technological advancements are at the forefront, with a notable focus on developing sophisticated, low-sulfur fuel blends, alternative marine fuels like LNG and biofuels, and sophisticated digital solutions that streamline and optimize bunkering operations, from scheduling to delivery verification.

Key Drivers, Barriers & Challenges in Brazil Bunker Fuel Market

Key Drivers:

- The robust growth in Brazil's international and domestic maritime trade, directly correlating with the nation's expanding economy and increasing reliance on seaborne logistics.

- The escalating enforcement of global and national environmental regulations (e.g., IMO 2020 sulfur caps and future emission standards), which are compelling a significant shift towards cleaner, lower-sulfur, and alternative marine fuels.

- Substantial ongoing investments in modernizing and expanding Brazil's port infrastructure and logistical networks, facilitating smoother and more efficient vessel operations and fuel supply.

- The growing interest and adoption of cleaner energy alternatives, including LNG, presenting new avenues for fuel providers and vessel operators.

Key Challenges & Restraints:

- The inherent volatility in global crude oil prices, which directly impacts the cost of bunker fuels, creating price uncertainty for stakeholders and affecting profitability.

- Significant infrastructure limitations in certain key Brazilian ports and coastal regions, which can impede the efficiency, accessibility, and timely execution of bunkering operations.

- The substantial capital expenditure required for upgrading existing bunkering infrastructure to accommodate new fuel types (like LNG), as well as the investment needed for adopting cutting-edge technologies and sustainable practices.

- Navigating complex regulatory frameworks and ensuring compliance across various jurisdictions within Brazil can pose administrative and operational hurdles.

Emerging Opportunities in Brazil Bunker Fuel Market

- Significant growth potential in the development and adoption of Liquefied Natural Gas (LNG) bunkering infrastructure, driven by environmental imperatives and increasing vessel suitability for LNG.

- The strategic expansion of comprehensive bunkering services, including the provision of diverse fuel types and value-added services, into currently less-developed or underserved maritime regions within Brazil.

- An accelerating global and national focus on sustainable and bio-based bunker fuels, such as biodiesel and other renewable alternatives, presenting lucrative opportunities for innovation and market penetration.

- The increasing demand for integrated digital solutions and smart bunkering technologies that enhance transparency, efficiency, and traceability throughout the supply chain.

- The potential for partnerships and collaborations between international fuel suppliers and local Brazilian entities to leverage expertise and market access.

Growth Accelerators in the Brazil Bunker Fuel Market Industry

Technological advancements in fuel production and bunkering technologies are driving market growth. Strategic partnerships between fuel suppliers, ship owners, and port operators are streamlining operations and enhancing efficiency. Expansion into new markets and diversification of fuel offerings contribute to long-term growth.

Key Players Shaping the Brazil Bunker Fuel Market Market

- AP Moeller Maersk A/S

- China COSCO Holdings Company Limited

- Bunker Holding A/S

- Ocean Network Express

- TotalEnergies SA

- Mediterranean Shipping Company

- Monjasa Holding A/S

- Peninsula Petroleum Ltd

- World Fuel Services Corp

- CMA CGM Group

Notable Milestones in Brazil Bunker Fuel Market Sector

- September 2023: Acelen, in collaboration with Bunker One, achieved a significant milestone by launching Brazil's first dedicated outside anchorage bunkering operation at the strategically important Port of Itaqui, enhancing supply flexibility.

- November 2022: Nimofast Brasil SA and Kanfer Shipping AS announced a pivotal collaboration aimed at developing and implementing LNG bunkering solutions across Brazil, with initial operations projected to commence from 2025.

- Ongoing Development: Continued advancements in the accessibility and availability of very low sulfur fuel oil (VLSFO) and ultra-low sulfur fuel oil (ULSFO) across major Brazilian ports to meet international regulatory requirements.

- Emerging Trends: Increasing exploration and trials of sustainable biofuels and methanol as alternative marine fuels by various industry stakeholders operating within Brazil.

In-Depth Brazil Bunker Fuel Market Market Outlook

The Brazilian bunker fuel market is projected to experience robust and sustained growth in the coming years. This expansion will be primarily propelled by the continuous increase in maritime trade volumes, driven by Brazil's significant role in global commodities and manufacturing, coupled with the ongoing implementation and enforcement of stringent environmental regulations that favor cleaner fuel alternatives. Furthermore, significant strategic investments in port infrastructure modernization and the adoption of advanced technologies will play a crucial role in facilitating this growth. The market is ripe with opportunities for both established international players and agile new entrants, particularly within the rapidly evolving LNG bunkering segment and the burgeoning domain of sustainable and bio-based marine fuels. Companies that can offer reliable supply, competitive pricing, and innovative solutions, while adeptly navigating regulatory landscapes, are best positioned to capitalize on the promising future of the Brazilian bunker fuel sector.

Brazil Bunker Fuel Market Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Other Fuel Types

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

Brazil Bunker Fuel Market Segmentation By Geography

- 1. Brazil

Brazil Bunker Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing LNG Trade4.; Rising Marine Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuations in Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Very Low Sulphur Fuel Oil (VLSFO) to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 5 Mediterranean Shipping Company*List Not Exhaustive 6 4 Market Ranking/Share Analysi

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 2 Monjasa Holding A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 6 Peninsula Petroleum Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 1 AP Moeller Maersk A/S

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 2 China COSCO Holdings Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ship Owners

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fuel Suppliers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 4 World Fuel Services Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 4 CMA CGM Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3 Bunker Holding A/S

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 5 TotalEnergies SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3 Ocean Network Express

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 5 Mediterranean Shipping Company*List Not Exhaustive 6 4 Market Ranking/Share Analysi

List of Figures

- Figure 1: Brazil Bunker Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Bunker Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Bunker Fuel Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 3: Brazil Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Brazil Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 5: Brazil Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 6: Brazil Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 7: Brazil Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Bunker Fuel Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 9: Brazil Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 11: Brazil Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 12: Brazil Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 13: Brazil Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 14: Brazil Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 15: Brazil Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Bunker Fuel Market?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Brazil Bunker Fuel Market?

Key companies in the market include 5 Mediterranean Shipping Company*List Not Exhaustive 6 4 Market Ranking/Share Analysi, 2 Monjasa Holding A/S, 6 Peninsula Petroleum Ltd, 1 AP Moeller Maersk A/S, 2 China COSCO Holdings Company Limited, Ship Owners, Fuel Suppliers, 4 World Fuel Services Corp, 4 CMA CGM Group, 3 Bunker Holding A/S, 5 TotalEnergies SA, 3 Ocean Network Express.

3. What are the main segments of the Brazil Bunker Fuel Market?

The market segments include Fuel Type, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.25 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing LNG Trade4.; Rising Marine Transportation.

6. What are the notable trends driving market growth?

Very Low Sulphur Fuel Oil (VLSFO) to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Fluctuations in Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

September 2023: Acelen, the largest bunker manufacturer in the Brazilian state of Bahia, joined with Bunker Holding's subsidiary Bunker One, which announced that it would provide the country's first outside anchorage bunkering operation. The anchorage area at the Port of Itaqui in São Marcos Bay (MA) can accommodate vessels, including tankers and large cargo ships.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Bunker Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Bunker Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Bunker Fuel Market?

To stay informed about further developments, trends, and reports in the Brazil Bunker Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence