Key Insights

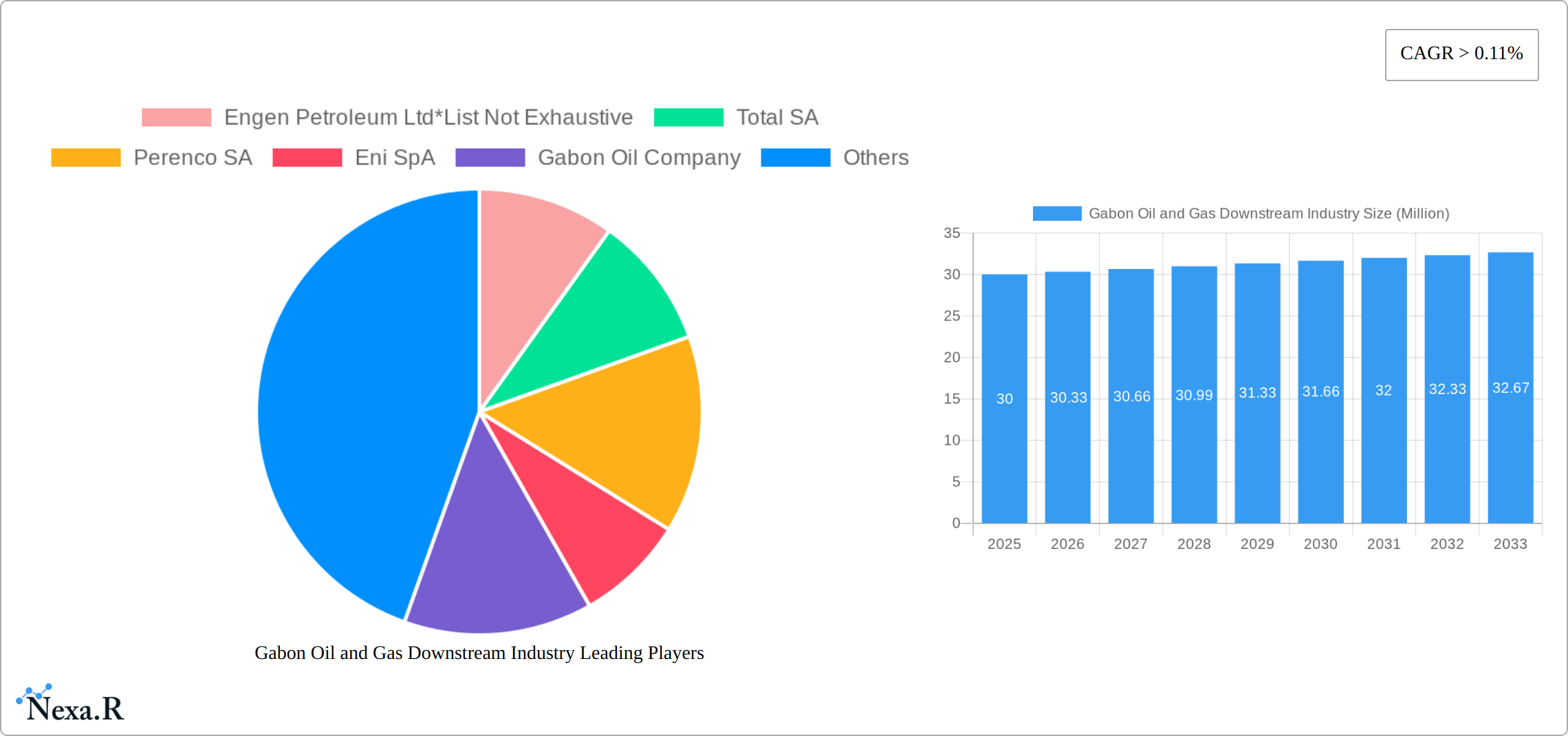

The Gabonese oil and gas downstream industry, encompassing refineries and petrochemical plants, presents a dynamic market landscape characterized by moderate growth. While precise market size figures for 2025 are unavailable, considering a CAGR of 0.11 and a likely market size in the tens of millions of USD (a common range for smaller national downstream markets), a reasonable estimation would place the 2025 market value between $20 million and $50 million USD. This range acknowledges the limited scale of the Gabonese market and the absence of precise data. Key drivers include Gabon's domestic fuel demand, growing industrialization, and strategic investments in infrastructure development. However, the market faces constraints such as limited refining capacity, dependence on imported refined products, and price volatility in the global oil market. Significant players like Engen Petroleum Ltd, TotalEnergies (formerly Total SA), Perenco SA, Eni SpA, and the Gabon Oil Company are shaping the competitive landscape, though market share distribution is not readily available and would require further dedicated research. The industry's future trajectory will largely depend on government policies promoting domestic refining, investments in petrochemical projects, and the ongoing global energy transition. Growth in the petrochemical segment could potentially accelerate this market, but further research is necessary to confirm this.

The forecast period (2025-2033) suggests a continuing, albeit slow, expansion of the Gabonese downstream oil and gas sector. The 0.11 CAGR indicates a modest annual increase in market value. This moderate growth reflects the inherent limitations of the Gabonese market, primarily its small size and the constraints mentioned earlier. Strategic investments in refinery upgrades or new capacity could significantly alter this trajectory, leading to more robust growth. Monitoring global oil prices, regional economic performance, and government policy shifts is crucial for understanding the future evolution of this market. The increasing global emphasis on renewable energy sources also poses a long-term challenge and is a critical consideration for future market projections.

Gabon Oil and Gas Downstream Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Gabon Oil and Gas Downstream Industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024. This report is crucial for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this dynamic market. Key segments analyzed include Refineries and Petrochemicals Plants.

Gabon Oil and Gas Downstream Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Gabonese downstream oil and gas sector. The market is characterized by a moderate level of concentration, with key players like Engen Petroleum Ltd, Total SA, Perenco SA, Eni SpA, and the Gabon Oil Company holding significant market share. However, the presence of smaller independent operators indicates a degree of competition.

- Market Concentration: xx% of the market is controlled by the top 5 players.

- Technological Innovation: Investment in refining technology and efficiency improvements is driving innovation, although access to advanced technologies may be constrained.

- Regulatory Framework: The government's regulatory policies significantly influence market activity, impacting investment and operations. Specific regulations concerning environmental standards, safety procedures, and pricing mechanisms are critical factors.

- Competitive Product Substitutes: The emergence of renewable energy sources and biofuels presents a growing challenge to traditional petroleum products.

- End-User Demographics: The primary end-users are the domestic market and regional export markets. Demand patterns are influenced by economic activity and infrastructure development.

- M&A Trends: The number of M&A deals in the Gabonese downstream sector during the historical period was xx, with a total value of xx Million. Future M&A activity is predicted to be driven by consolidation and expansion strategies.

Gabon Oil and Gas Downstream Industry Growth Trends & Insights

The Gabonese downstream oil and gas market has demonstrated a dynamic trajectory, characterized by moderate yet consistent growth from 2019 to 2024. The market size in 2024 is estimated at [Insert Specific Market Size in Million], with a Compound Annual Growth Rate (CAGR) of [Insert Specific CAGR %] during the historical period. This expansion was propelled by a confluence of factors, including a rising domestic appetite for refined products and the inherent volatility of international crude oil prices. Looking ahead, the forecast period (2025-2033) anticipates sustained growth, underpinned by strategic investments in crucial infrastructure development, the nation's overall economic expansion, and promising prospects for new refining and petrochemical capacities. Technological advancements are poised to be a significant catalyst, with the integration of sophisticated refining technologies and efficiency-boosting measures expected to redefine market evolution. Concurrently, shifts in consumer behavior, such as a heightened emphasis on fuel efficiency standards and the potential embrace of alternative energy sources, present both formidable challenges and lucrative opportunities for the industry.

The projected market size for 2033 is estimated at [Insert Specific Market Size in Million], reflecting a projected CAGR of [Insert Specific CAGR %] for the forecast period.

Dominant Regions, Countries, or Segments in Gabon Oil and Gas Downstream Industry

The downstream oil and gas sector in Gabon is predominantly centered in the Libreville region and Port-Gentil. This concentration is a direct consequence of the established presence of key refineries and their associated industrial infrastructure. Currently, the refinery segment stands as the market's leading force, contributing approximately [Insert Specific Revenue Percentage]% of the total revenue.

- Key Drivers of Regional Dominance:

- Established Infrastructure: The existing network of refineries and pipelines acts as a significant enabler for regional dominance, fostering operational efficiency and accessibility.

- Supportive Government Policies: Government incentives and a strategic focus on infrastructure development are instrumental in stimulating and sustaining growth within these key regions.

- Strategic Proximity to Export Markets: Port-Gentil's advantageous coastal location significantly facilitates efficient export operations, bolstering its importance in the downstream value chain.

- Factors Contributing to Dominance: The high concentration of refining capacity, coupled with proximity to major maritime ports and well-developed logistical networks, collectively solidifies the dominance of these regions. Furthermore, the petrochemicals segment exhibits substantial growth potential, driven by an escalating demand for petrochemical derivatives in vital sectors such as construction and manufacturing.

Gabon Oil and Gas Downstream Industry Product Landscape

The product spectrum within Gabon's downstream oil and gas industry is comprehensive, encompassing a range of essential refined petroleum products such as gasoline, diesel, and jet fuel, alongside a growing array of petrochemicals and their associated derivatives. A continuous thrust towards innovation is evident, focusing on enhancing fuel quality, minimizing environmental emissions, and optimizing operational efficiencies. Notable advancements include the widespread adoption of cleaner processing technologies and refined techniques designed to meet stringent international environmental standards. The industry is also demonstrating commendable progress in the development of value-added products, a trend that is actively contributing to the ongoing evolution and diversification of the market.

Key Drivers, Barriers & Challenges in Gabon Oil and Gas Downstream Industry

Key Drivers: The growth trajectory of the Gabonese downstream oil and gas market is primarily propelled by a combination of robust domestic demand, lucrative regional export opportunities, and significant government investments in infrastructure enhancement. Additionally, the forging of strategic alliances between international and national entities plays a crucial role in fostering technological transfer and bolstering capacity-building initiatives.

Key Barriers & Challenges: The industry faces considerable headwinds, including increasing competition from alternative fuels, the inherent volatility of global oil prices, the need to modernize aging infrastructure, and the ever-evolving landscape of environmental regulations. The profound impact of international price fluctuations on profitability and investment decisions cannot be overstated. Furthermore, the susceptibility of supply chains to disruptions poses a significant operational risk.

Emerging Opportunities in Gabon Oil and Gas Downstream Industry

Emerging opportunities include expanding petrochemical production, investing in renewable energy integration within refineries, and exploring opportunities in the export of value-added petrochemical products. Furthermore, strategic partnerships with international companies may unlock access to advanced technology and expertise.

Growth Accelerators in the Gabon Oil and Gas Downstream Industry Industry

Long-term growth will be driven by substantial investments in upgrading existing refinery infrastructure and building new capacities. Technological advancements in refining and petrochemical processes will enhance efficiency and reduce environmental impact. Government incentives and support for private sector investment are essential for sustained growth.

Key Players Shaping the Gabon Oil and Gas Downstream Industry Market

- Engen Petroleum Ltd

- TotalEnergies SE (formerly Total SA)

- Perenco SA

- Eni SpA

- Gabon Oil Company (GOC)

Notable Milestones in Gabon Oil and Gas Downstream Industry Sector

- June 2022: Vaalco Energy anticipates increased reserves and production following the activation of its third offshore well.

- November 2022: BW Energy initiates its drilling campaign for an offshore development project, targeting first oil in late Q1 2023.

In-Depth Gabon Oil and Gas Downstream Industry Market Outlook

The Gabonese downstream oil and gas industry presents a promising outlook, driven by sustained domestic demand, export potential, and strategic investments in infrastructure modernization and technological upgrades. Strategic partnerships with international players will play a crucial role in realizing the industry's full potential. The market's future trajectory hinges on successful navigation of environmental regulations, price volatility, and technological advancements.

Gabon Oil and Gas Downstream Industry Segmentation

-

1. Refineries

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Petrochemicals Plants

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

Gabon Oil and Gas Downstream Industry Segmentation By Geography

- 1. Gabon

Gabon Oil and Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 0.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Oil Refining Capacity Growth to Remain Stagnant

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Gabon Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Gabon

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Engen Petroleum Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Total SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Perenco SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eni SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gabon Oil Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Engen Petroleum Ltd*List Not Exhaustive

List of Figures

- Figure 1: Gabon Oil and Gas Downstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Gabon Oil and Gas Downstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 3: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 4: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 7: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 8: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gabon Oil and Gas Downstream Industry?

The projected CAGR is approximately > 0.11%.

2. Which companies are prominent players in the Gabon Oil and Gas Downstream Industry?

Key companies in the market include Engen Petroleum Ltd*List Not Exhaustive, Total SA, Perenco SA, Eni SpA, Gabon Oil Company.

3. What are the main segments of the Gabon Oil and Gas Downstream Industry?

The market segments include Refineries, Petrochemicals Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Oil Refining Capacity Growth to Remain Stagnant.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

June 2022: Houston-based Vaalco Energy expects a surge in reserves and production after its third well in 2022 goes online later this month, as it completes the drilling of another well offshore in Gabon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gabon Oil and Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gabon Oil and Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gabon Oil and Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the Gabon Oil and Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence