Key Insights

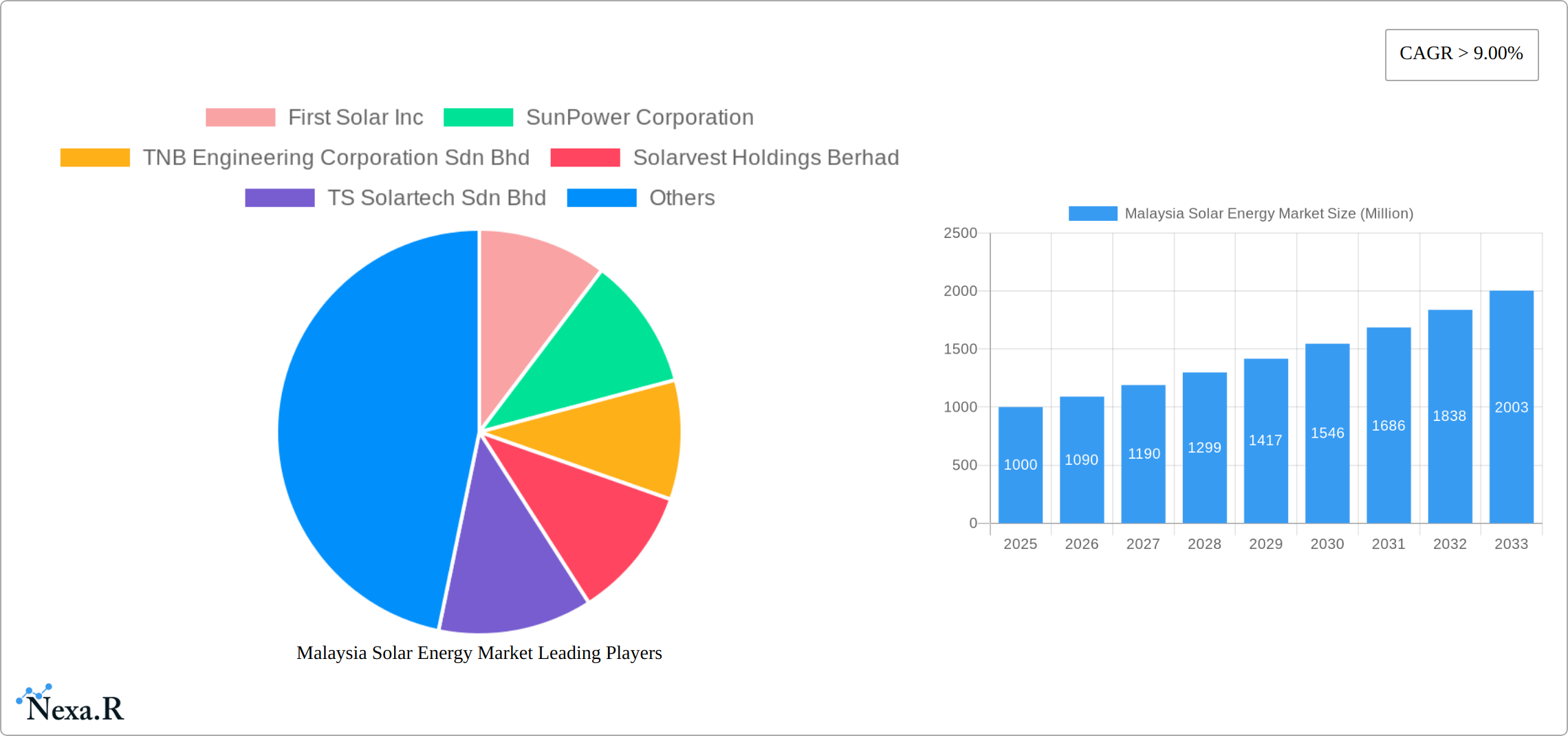

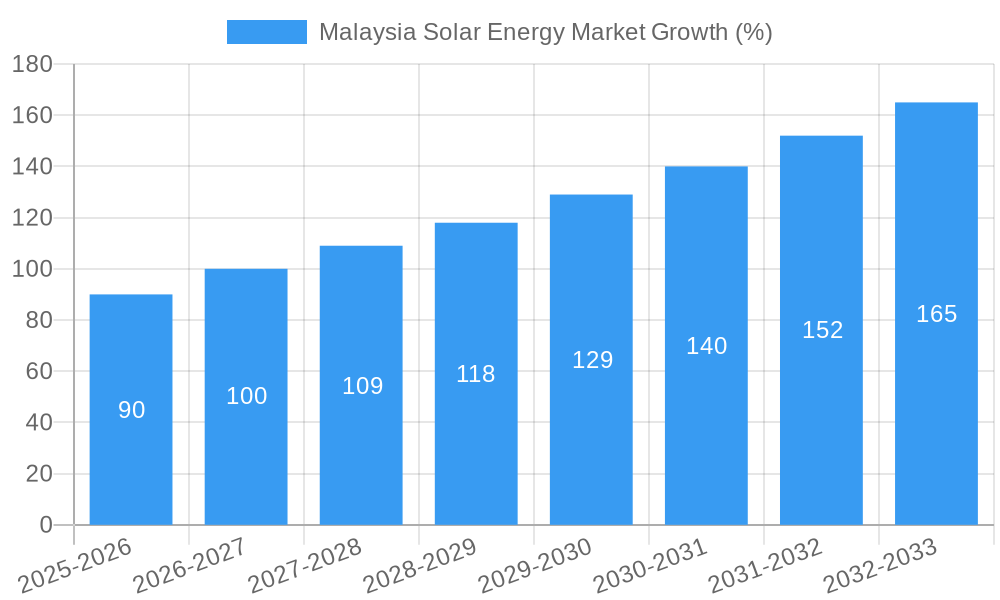

The Malaysian solar energy market is experiencing robust growth, driven by the government's strong commitment to renewable energy targets and increasing concerns about energy security and environmental sustainability. With a Compound Annual Growth Rate (CAGR) exceeding 9% from 2019 to 2033, the market is poised for significant expansion. The residential sector, fueled by decreasing solar panel prices and supportive government incentives, is a key driver of market growth. Commercial and industrial (C&I) segments are also witnessing considerable uptake, driven by the potential for cost savings and improved energy efficiency. Utility-scale solar projects, though slower to develop compared to the residential and C&I segments, are likely to gain traction in the coming years, spurred by large-scale renewable energy procurement initiatives. While challenges remain, such as land availability and grid infrastructure limitations, the overall market outlook remains positive. Key players like First Solar, SunPower, and local companies such as Solarvest Holdings and TNB Engineering are actively contributing to this growth, fostering both domestic manufacturing and project development.

The market's growth trajectory indicates a substantial increase in market size over the forecast period. Estimating from the provided CAGR and assuming a 2025 market size of approximately RM 1 billion (based on typical market sizes for comparable developing nations with similar renewable energy adoption rates), the market is projected to significantly expand by 2033. This growth will be underpinned by continuous technological advancements, leading to cost reductions and efficiency improvements in solar energy technologies. Furthermore, increasing public awareness of environmental concerns and the economic benefits of solar energy will further stimulate demand across all market segments. The government's policy support, including feed-in tariffs and streamlined permitting processes, will also play a crucial role in sustaining this growth momentum. However, consistent policy implementation and addressing infrastructural challenges are critical for realizing the market's full potential.

Malaysia Solar Energy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Malaysian solar energy market, encompassing market dynamics, growth trends, key players, and future outlook. The study covers the historical period (2019-2024), the base year (2025), and forecasts until 2033, offering invaluable insights for industry professionals, investors, and policymakers. This report segments the market into Residential, Commercial & Industrial (C&I), and Utility end-users, providing granular analysis of each sector. The total market size is projected to reach xx Million units by 2033.

Keywords: Malaysia solar energy market, solar PV market Malaysia, renewable energy Malaysia, solar power Malaysia, Malaysian solar industry, C&I solar Malaysia, residential solar Malaysia, utility-scale solar Malaysia, solar energy investment Malaysia, MEnTARI program, CGPP, VPPA, First Solar, SunPower, TNB Engineering, Solarvest Holdings, TS Solartech, Hasilwan, Canadian Solar, Ditrolic Energy, JA Solar, Plus Xnergy.

Malaysia Solar Energy Market Dynamics & Structure

The Malaysian solar energy market exhibits a moderately concentrated structure, with several key players dominating various segments. Technological innovation is a significant driver, spurred by advancements in PV technology and energy storage solutions. The regulatory landscape, including government incentives like the MEnTARI program and the CGPP, plays a crucial role in market growth. However, competition from established energy sources and intermittent solar power generation present challenges. Mergers and acquisitions are increasingly common, as larger companies consolidate their market share.

- Market Concentration: Moderate, with a few dominant players holding xx% market share in 2025.

- Technological Innovation: Focus on increasing efficiency, reducing costs, and improving energy storage capabilities.

- Regulatory Framework: Supportive government policies like MEnTARI and CGPP stimulate market expansion.

- Competitive Substitutes: Traditional fossil fuels remain a significant competitor.

- End-User Demographics: Growing adoption across residential, C&I, and utility sectors.

- M&A Trends: Increasing consolidation through acquisitions and joint ventures to enhance market presence. xx M&A deals were recorded between 2019 and 2024.

Malaysia Solar Energy Market Growth Trends & Insights

The Malaysian solar energy market has witnessed significant growth between 2019 and 2024, driven by increasing electricity demand, rising energy costs, and supportive government policies. The compound annual growth rate (CAGR) during this period was xx%. Technological advancements, such as the development of more efficient solar panels, have further accelerated market adoption. Consumer behavior is shifting towards environmentally friendly energy solutions, fueling demand for solar energy systems. The market penetration rate reached xx% in 2024 and is projected to increase to xx% by 2033. This growth trajectory is expected to continue, with the market size reaching xx Million units by 2033. Further analysis reveals a significant increase in private sector investments in solar energy.

Dominant Regions, Countries, or Segments in Malaysia Solar Energy Market

Malaysia's solar energy market is experiencing significant growth, with the Commercial & Industrial (C&I) sector leading the charge. This dominance is fueled by a confluence of factors: government incentives specifically targeting businesses, escalating industrial energy costs, and a growing emphasis on corporate social responsibility (CSR). The residential sector also exhibits robust expansion, driven by the decreasing cost of solar panels and supportive government subsidies. Meanwhile, utility-scale solar projects are steadily progressing, significantly bolstered by large-scale initiatives under the MEnTARI program and the increasing adoption of renewable energy mandates. This multifaceted growth is shaping a dynamic market landscape.

- Key Drivers (C&I): Government incentives (e.g., tax breaks, feed-in tariffs), high energy costs, CSR initiatives, readily available financing options, and increasing energy security concerns.

- Key Drivers (Residential): Declining solar panel costs, government subsidies (e.g., Net Energy Metering schemes), increased consumer awareness of environmental benefits and long-term cost savings, and easier access to financing.

- Key Drivers (Utility): Government support through programs like LSS4 and the feed-in tariff system, increasing renewable portfolio standards (RPS) targets, and the need for diversified energy sources.

- Market Share (Projected 2025): While precise figures require further market research, the C&I segment is anticipated to maintain the largest market share, followed by the Residential and Utility sectors. Detailed projections will be available in [Link to Report/Source].

Malaysia Solar Energy Market Product Landscape

The Malaysian solar energy market offers a diverse range of products, including monocrystalline and polycrystalline solar panels, inverters, and energy storage systems. Technological advancements are focused on improving efficiency, durability, and aesthetics. The latest generation of solar panels boasts higher power output and improved energy conversion rates. These advancements, coupled with innovative financing options, are driving market expansion and enhancing customer adoption.

Key Drivers, Barriers & Challenges in Malaysia Solar Energy Market

Key Drivers:

- Strong government support through schemes like MEnTARI, Green Technology Financing Scheme (GTFS), and the Clean Energy Programme (CGPP).

- Continuous decrease in solar panel costs and improvements in panel efficiency, leading to greater affordability.

- Rising awareness of environmental sustainability and the need to reduce carbon footprint amongst both consumers and businesses.

- Increasing electricity demand and volatile energy prices, creating a compelling economic case for solar adoption.

- Technological advancements in energy storage solutions, mitigating the intermittency challenge of solar power.

Challenges & Barriers:

- Intermittency of solar power and dependence on existing grid infrastructure for reliable power supply. This necessitates grid modernization and investment in smart grids.

- Limited land availability, especially for large-scale utility projects, and the need for careful site selection and land-use planning.

- Potential supply chain disruptions impacting the cost and timely availability of solar components, highlighting the need for diversified sourcing.

- Navigating regulatory complexities and bureaucratic processes for project approvals and permits. Streamlining these processes is crucial to reduce project delays (currently averaging xx%).

- Lack of skilled workforce and the need for training and development programs to support the growing industry.

Emerging Opportunities in Malaysia Solar Energy Market

- Significant demand for off-grid and hybrid solar solutions in rural and remote areas, improving access to electricity for underserved communities.

- Integration of solar energy with smart home technologies, offering enhanced energy management and efficiency.

- Expansion of solar energy applications in agriculture (e.g., irrigation, greenhouse heating) and water pumping, boosting agricultural productivity and water security.

- Development of solar-powered electric vehicle (EV) charging stations, supporting the growth of Malaysia's EV infrastructure.

- Growth in the corporate Power Purchase Agreements (PPAs), allowing businesses to access clean energy without upfront capital investment.

Growth Accelerators in the Malaysia Solar Energy Market Industry

The sustained growth of Malaysia's solar energy market hinges on several key factors. Continued and enhanced government support for renewable energy initiatives is paramount, alongside consistent technological innovation to improve efficiency and reduce costs. Strategic partnerships between domestic and international companies will foster technology transfer and expertise. The widespread adoption of energy storage solutions will effectively address the intermittency challenge of solar power. Furthermore, increased private sector investments and the development of innovative financing mechanisms, such as green bonds and crowdfunding, will be essential in unlocking the market's full potential.

Key Players Shaping the Malaysia Solar Energy Market Market

- First Solar Inc

- SunPower Corporation

- TNB Engineering Corporation Sdn Bhd

- Solarvest Holdings Berhad

- TS Solartech Sdn Bhd

- Hasilwan (M) Sdn Bhd

- Canadian Solar Inc

- Ditrolic Energy

- JA SOLAR Technology Co Ltd

- Plus Xnergy Holding Sdn Bhd

Notable Milestones in Malaysia Solar Energy Market Sector

- October 2022: The Malaysian government announced the 600 MW Corporate Green Power Program (CGPP) utilizing the VPPA mechanism, significantly boosting investment in solar energy projects.

- January 2023: Advancecon Holdings Bhd's USD 5.13 million investment in an LSS4 project demonstrates continued private sector confidence in the Malaysian solar market.

In-Depth Malaysia Solar Energy Market Market Outlook

The Malaysian solar energy market is poised for continued strong growth throughout the forecast period (2025-2033). Government support, technological advancements, and increasing private sector investment will drive market expansion. Opportunities exist across all segments, particularly in C&I and residential markets. Strategic partnerships and innovative business models will be crucial for success in this rapidly evolving market. The market is expected to surpass xx Million units by 2033.

Malaysia Solar Energy Market Segmentation

-

1. End-User

- 1.1. Residential

- 1.2. Commercial and Industrial (C&I)

- 1.3. Utility

Malaysia Solar Energy Market Segmentation By Geography

- 1. Malaysia

Malaysia Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Offshore Oil and Gas Exploration and Production Activities4.; Growing Demand for Energy

- 3.3. Market Restrains

- 3.3.1. High Upfront Costs

- 3.4. Market Trends

- 3.4.1. The Utility Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Residential

- 5.1.2. Commercial and Industrial (C&I)

- 5.1.3. Utility

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 First Solar Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SunPower Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TNB Engineering Corporation Sdn Bhd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solarvest Holdings Berhad

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TS Solartech Sdn Bhd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hasilwan (M) Sdn Bhd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canadian Solar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ditrolic Energy*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JA SOLAR Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Plus Xnergy Holding Sdn Bhd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 First Solar Inc

List of Figures

- Figure 1: Malaysia Solar Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Solar Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Solar Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Malaysia Solar Energy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Malaysia Solar Energy Market Volume Gigawatt Forecast, by End-User 2019 & 2032

- Table 5: Malaysia Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Malaysia Solar Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 7: Malaysia Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Malaysia Solar Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 9: Malaysia Solar Energy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Malaysia Solar Energy Market Volume Gigawatt Forecast, by End-User 2019 & 2032

- Table 11: Malaysia Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Malaysia Solar Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Solar Energy Market?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Malaysia Solar Energy Market?

Key companies in the market include First Solar Inc, SunPower Corporation, TNB Engineering Corporation Sdn Bhd, Solarvest Holdings Berhad, TS Solartech Sdn Bhd, Hasilwan (M) Sdn Bhd, Canadian Solar Inc, Ditrolic Energy*List Not Exhaustive, JA SOLAR Technology Co Ltd, Plus Xnergy Holding Sdn Bhd.

3. What are the main segments of the Malaysia Solar Energy Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Offshore Oil and Gas Exploration and Production Activities4.; Growing Demand for Energy.

6. What are the notable trends driving market growth?

The Utility Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

High Upfront Costs.

8. Can you provide examples of recent developments in the market?

January 2023: Advancecon Holdings Bhd announced its strategy to invest USD 5.13 million to fund the development of a solar photovoltaic (PV) project under the Large Scale Solar 4 (LSS4) program under the MEnTARI program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Solar Energy Market?

To stay informed about further developments, trends, and reports in the Malaysia Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence