Key Insights

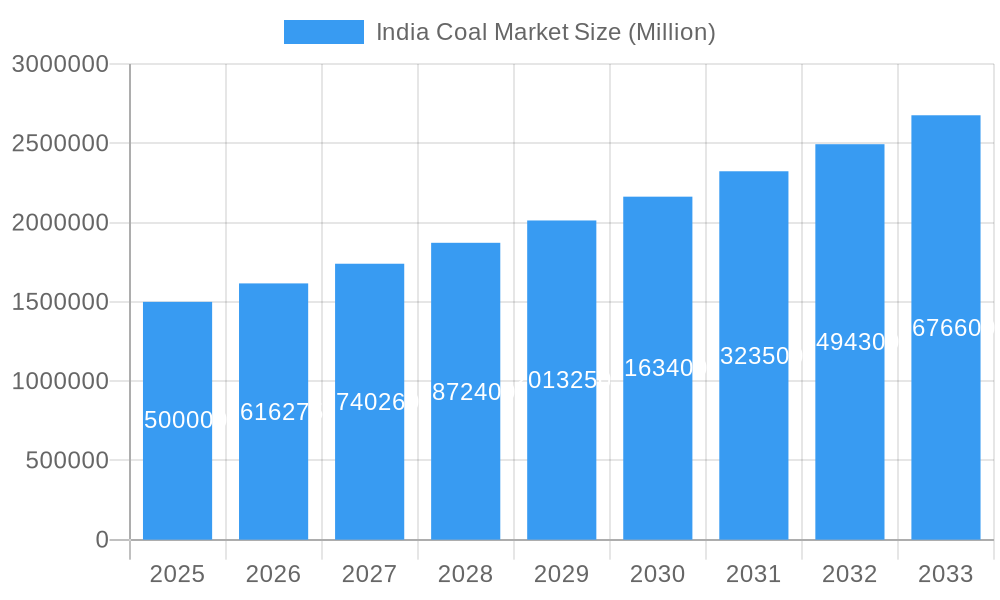

The India coal market, projected to reach $1.04 billion by 2025, is set to witness substantial growth with a compound annual growth rate (CAGR) of 7.57% between 2025 and 2033. This expansion is principally driven by escalating demand from the power generation sector, where thermal coal remains essential for electricity production. Furthermore, the persistent requirement for coking coal in the steel industry, supporting India's ongoing infrastructure development and industrialization, is a key growth catalyst. Nevertheless, the market navigates challenges including environmental concerns related to coal's carbon footprint, increasing regulatory support for renewable energy, and volatile international coal prices. These factors underscore the importance of diversification within the coal sector, such as adopting cleaner coal technologies, for sustained market development.

India Coal Market Market Size (In Billion)

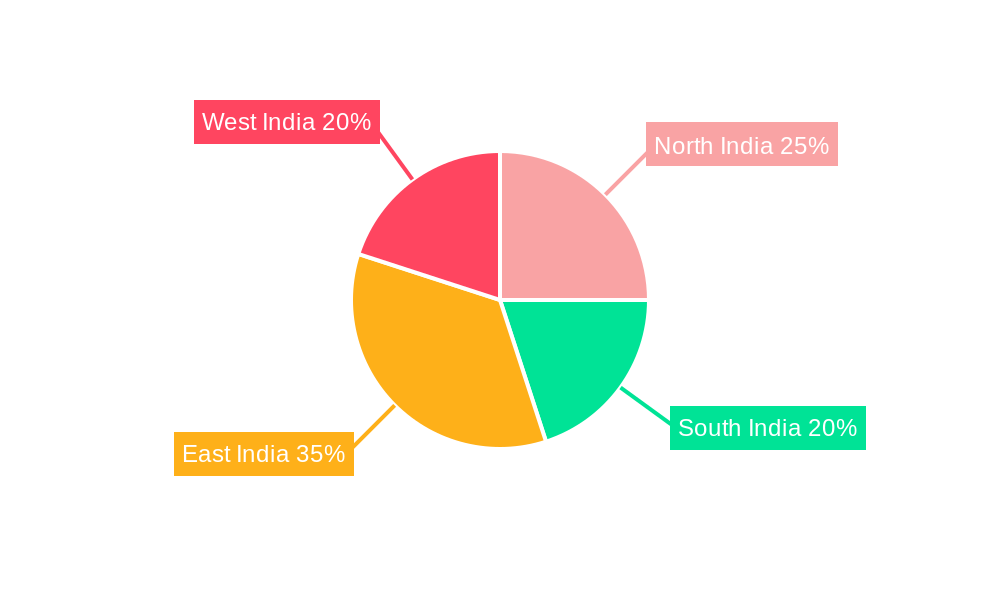

Segment analysis indicates that power generation (thermal coal) and coking feedstock (coking coal) represent the dominant market segments. The "Others" category, comprising industrial processes and household use, contributes a smaller but significant portion. Geographically, the market spans North, South, East, and West India, with regional variations influenced by coal reserves, industrial hubs, and energy infrastructure. Leading entities such as Coal India Limited, Adani Power Ltd, and NTPC Ltd are instrumental in shaping market trends through their production, distribution, and consumption activities. The 2025-2033 forecast period offers considerable potential for strategic investments and innovative solutions, particularly those addressing environmental sustainability and operational efficiency.

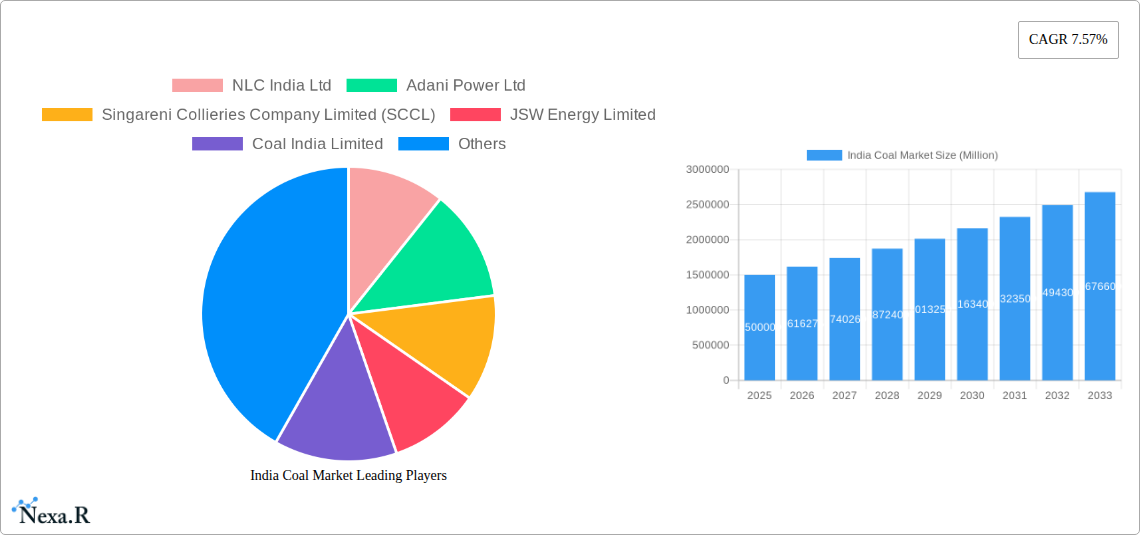

India Coal Market Company Market Share

India Coal Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India coal market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a focus on the base year 2025 and forecast period 2025-2033. This crucial industry analysis is designed for industry professionals, investors, and strategists seeking to understand the complexities and opportunities within the Indian coal sector. Key segments analyzed include Power Generation (Thermal Coal), Coking Feedstock (Coking Coal), and Others.

India Coal Market Dynamics & Structure

The Indian coal market is characterized by a moderate level of concentration, with Coal India Limited holding a significant market share. Technological innovation is driven by the need for improved efficiency and reduced environmental impact. Stringent regulatory frameworks govern coal mining and utilization, impacting market dynamics. Competitive substitutes include renewable energy sources, but coal remains dominant for power generation. The market exhibits a diverse end-user demographic, primarily encompassing power plants, steel mills, and other industrial consumers. M&A activity has been moderate in recent years, with deals primarily focused on enhancing production capacity and securing coal reserves.

- Market Concentration: Coal India Limited holds approximately xx% market share in 2025.

- Technological Innovation: Focus on improving mining techniques, coal beneficiation, and cleaner coal technologies.

- Regulatory Framework: Stringent environmental regulations and mining licenses impact market entry and operations.

- Competitive Substitutes: Increasing competition from renewable energy sources like solar and wind power.

- M&A Activity: An estimated xx million units worth of M&A deals occurred between 2019 and 2024.

- Innovation Barriers: High capital expenditure for technological upgrades and stringent environmental regulations.

India Coal Market Growth Trends & Insights

The Indian coal market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). The market size is projected to reach xx million units in 2025 and continue to grow at a CAGR of xx% during the forecast period (2025-2033), driven by increasing energy demand and industrialization. Technological advancements in coal mining and utilization have enhanced efficiency, while consumer behavior shows a continued reliance on coal-fired power generation. However, increasing environmental concerns and the push for renewable energy sources are creating challenges. Market penetration of cleaner coal technologies remains limited, with significant scope for future growth.

Dominant Regions, Countries, or Segments in India Coal Market

The Power Generation (Thermal Coal) segment dominates the Indian coal market, accounting for approximately xx% of total consumption in 2025. This is driven primarily by the significant role of coal in India's electricity generation. The eastern and central regions of India are leading coal-producing and consuming areas.

Key Drivers for Power Generation Segment:

- Rapid industrialization and increasing electricity demand.

- Existing infrastructure heavily reliant on coal-fired power plants.

- Relatively low cost compared to other energy sources (in 2025).

Dominance Factors:

- Established coal reserves and mining infrastructure in specific regions.

- Government policies supporting the power sector's development.

- Continued reliance on coal for baseload power generation.

India Coal Market Product Landscape

The Indian coal market offers a variety of coal types, ranging from thermal coal to coking coal, with variations in quality and calorific value. Recent innovations focus on improving coal quality through beneficiation processes and developing cleaner coal technologies to reduce environmental emissions. These technological advancements aim to enhance efficiency and reduce the carbon footprint of coal utilization.

Key Drivers, Barriers & Challenges in India Coal Market

Key Drivers:

- Increasing energy demand from industrial and residential sectors.

- Government support for infrastructure development requiring coal-based power generation.

- Relatively low cost of coal compared to other energy sources (in 2025).

Key Challenges and Restraints:

- Environmental concerns and regulations pushing for cleaner energy sources.

- Supply chain disruptions and logistical challenges in coal transportation.

- Competition from renewable energy sources and their decreasing costs. The impact of this competition is estimated to reduce the CAGR of coal consumption by approximately xx% by 2033.

Emerging Opportunities in India Coal Market

Emerging opportunities lie in the development and adoption of cleaner coal technologies, including carbon capture and storage (CCS) and improved coal beneficiation techniques. Furthermore, exploring untapped coal reserves and improving mining efficiencies can unlock significant growth potential. The development of advanced coal gasification technologies also presents opportunities for diversifying coal utilization.

Growth Accelerators in the India Coal Market Industry

Long-term growth will be significantly influenced by technological advancements in coal mining and utilization, leading to increased efficiency and reduced environmental impact. Strategic partnerships between coal producers and power generation companies, as well as government support for infrastructure development, will further accelerate growth. Expansion into new markets and regions with unmet energy demands also presents opportunities for market expansion.

Key Players Shaping the India Coal Market Market

- Coal India Limited

- NLC India Ltd

- Adani Power Ltd

- Singareni Collieries Company Limited (SCCL)

- JSW Energy Limited

- Jindal Steel & Power Ltd

- NTPC Ltd

Notable Milestones in India Coal Market Sector

- November 2022: NTPC Ltd. secured contracts for four additional coal-fired power projects, increasing energy generation capacity by 4.8 GW. This significantly boosted the demand for coal in the power generation sector.

- February 2023: The commissioning of the 2600 MW Singareni Thermal Power Plant (STPP) marked a significant development, establishing South India's first public sector coal-based power generating station.

In-Depth India Coal Market Market Outlook

The Indian coal market is poised for continued growth, albeit at a moderated pace, driven by persistent energy demand and industrial expansion. While facing challenges from environmental regulations and competition from renewable energy, strategic investments in cleaner coal technologies and infrastructure development will play a vital role in shaping future market potential. The focus on improving efficiency and reducing the environmental impact of coal utilization will be crucial for sustained growth.

India Coal Market Segmentation

-

1. Application

- 1.1. Power Generation (Thermal Coal)

- 1.2. Coking Feedstock (Coking Coal)

- 1.3. Others

India Coal Market Segmentation By Geography

- 1. India

India Coal Market Regional Market Share

Geographic Coverage of India Coal Market

India Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Coal Substituted with Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Increasing Thermal Power Generation is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation (Thermal Coal)

- 5.1.2. Coking Feedstock (Coking Coal)

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NLC India Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adani Power Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Singareni Collieries Company Limited (SCCL)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JSW Energy Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Coal India Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jindal Steel & Power Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NTPC Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 NLC India Ltd

List of Figures

- Figure 1: India Coal Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Coal Market Share (%) by Company 2025

List of Tables

- Table 1: India Coal Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: India Coal Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: India Coal Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Coal Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: India Coal Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: India Coal Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: India Coal Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Coal Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Coal Market?

The projected CAGR is approximately 7.57%.

2. Which companies are prominent players in the India Coal Market?

Key companies in the market include NLC India Ltd, Adani Power Ltd, Singareni Collieries Company Limited (SCCL), JSW Energy Limited, Coal India Limited, Jindal Steel & Power Ltd, NTPC Ltd.

3. What are the main segments of the India Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.04 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Increasing Thermal Power Generation is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Coal Substituted with Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

February 2023, the 2600 megawatt Singareni Thermal Power Plant (STPP) at Pegadapalli in Mancherial district is all set to become South India's first public sector coal-based power generating station and the country's first among State Public Sector Undertakings (PSU).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Coal Market?

To stay informed about further developments, trends, and reports in the India Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence