Key Insights

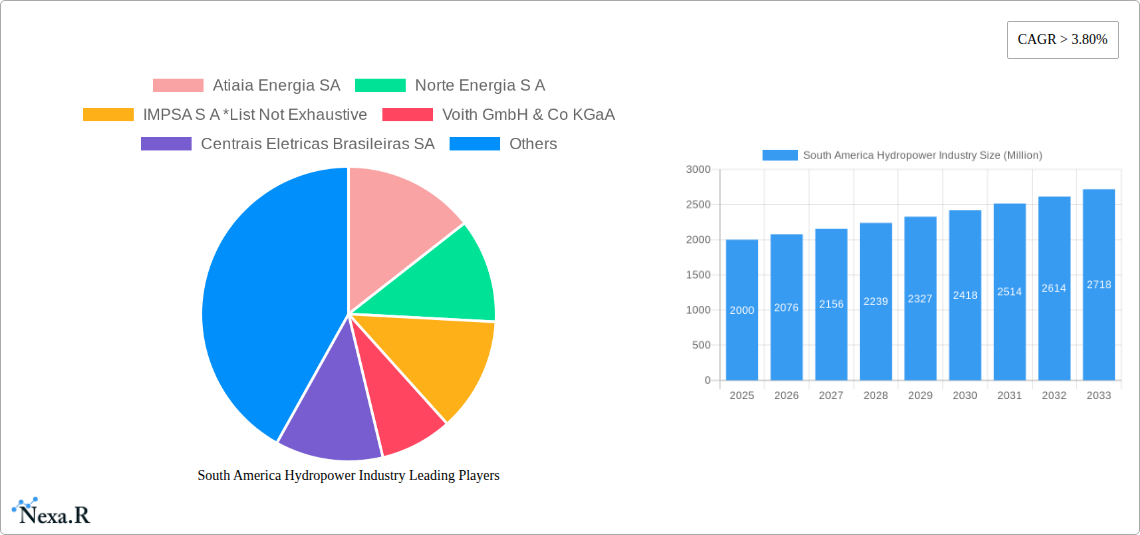

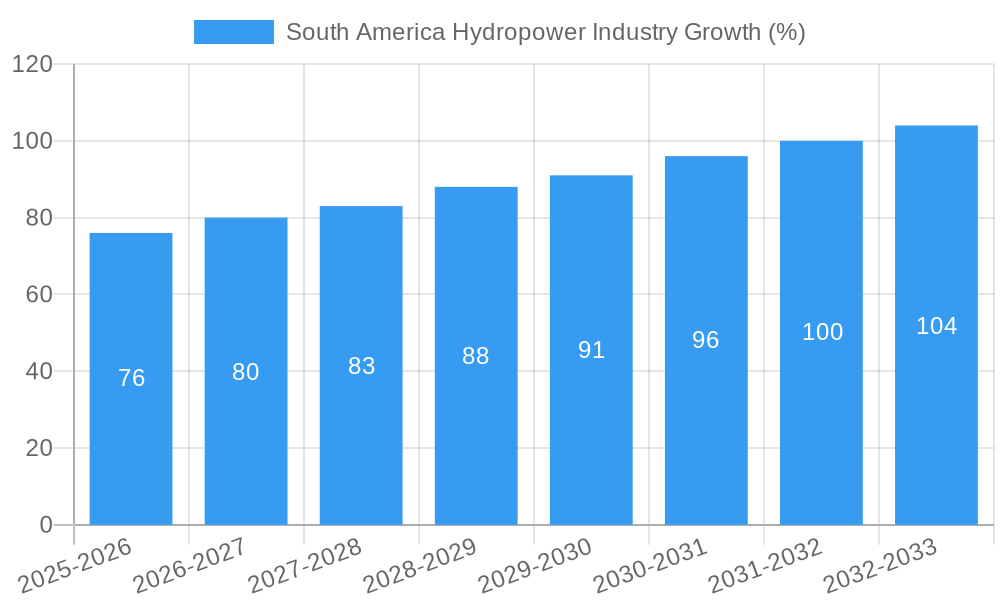

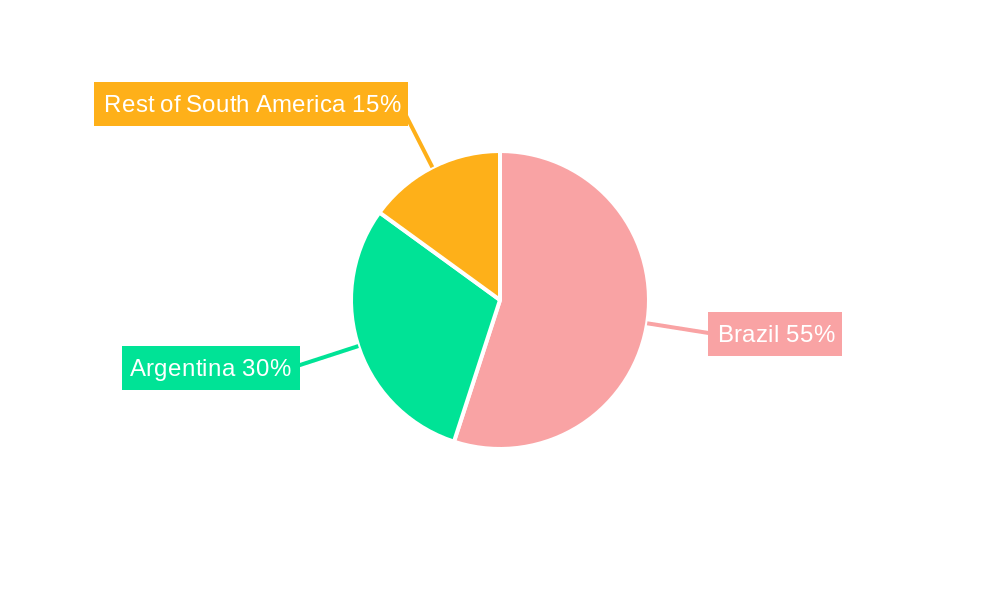

The South American hydropower industry, currently valued at approximately $XX million (estimated based on provided CAGR and market trends), exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) exceeding 3.80% from 2025 to 2033. This growth is driven by several key factors. Increasing energy demands across Brazil, Argentina, and the rest of South America, coupled with a rising focus on renewable energy sources to mitigate climate change, are significant catalysts. Government initiatives promoting sustainable energy development and investments in infrastructure projects further bolster the market. The sector is segmented into large and small hydropower projects, with large hydropower projects currently dominating the market share due to their higher energy output capacity. However, small hydropower projects are experiencing increased adoption due to their suitability for remote areas and lower environmental impact. While the industry faces challenges such as regulatory hurdles, environmental concerns (particularly regarding the impact on biodiversity and local communities), and fluctuating water levels impacting generation capacity, these are being addressed through technological advancements in dam construction and management, alongside improved environmental impact assessments.

Leading companies such as Atiaia Energia SA, Norte Energia S.A., IMPSA S.A., Voith GmbH & Co KGaA, and others, are actively involved in developing and operating hydropower plants across the region. Brazil and Argentina represent the largest markets, accounting for a significant portion of the installed capacity and future growth potential. The forecast period (2025-2033) presents considerable opportunities for investors and industry players to capitalize on the expanding renewable energy landscape in South America. Strategic partnerships, technological innovation, and sustainable practices will be crucial for navigating the evolving market dynamics and ensuring long-term success within this sector. Further analysis indicates a potential shift toward smaller-scale projects in the coming years, driven by a need for decentralized energy solutions and a greater focus on mitigating the environmental impact of large-scale projects.

South America Hydropower Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America hydropower industry, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market of Renewable Energy and the child market of Hydropower generation in South America.

South America Hydropower Industry Market Dynamics & Structure

This section analyzes the South America hydropower market's competitive landscape, encompassing market concentration, technological innovation, regulatory frameworks, substitute products, end-user demographics, and M&A activities. The analysis incorporates quantitative data such as market share percentages and M&A deal volumes (in millions), alongside qualitative factors influencing market dynamics. The xx Million market is characterized by:

- Market Concentration: Moderate concentration with a few dominant players controlling a significant share, estimated at xx%. Smaller players constitute the remaining xx%.

- Technological Innovation: Focus on improving efficiency and incorporating smart grid technologies. Barriers include high initial investment costs and complex permitting processes.

- Regulatory Frameworks: Vary across countries, impacting project development timelines and costs. Harmonization efforts are underway, but inconsistencies remain.

- Competitive Product Substitutes: Solar and wind power present increasing competition, particularly in certain regions with favorable renewable energy resources.

- End-User Demographics: Primarily utilities and independent power producers (IPPs), with increasing participation from private investors and communities.

- M&A Trends: Consolidation expected in the coming years driven by the need for economies of scale and access to capital. xx M&A deals were recorded between 2019-2024.

South America Hydropower Industry Growth Trends & Insights

The South America hydropower market exhibited robust growth between 2019 and 2024, driven by increasing energy demand and government support for renewable energy initiatives. The market size reached xx million in 2024, with a CAGR of xx% during the historical period. The forecast period (2025-2033) projects continued expansion, reaching xx million by 2033, fueled by:

- Market Size Evolution: Steady growth, driven by government investments and private sector participation.

- Adoption Rates: Increasing adoption of hydropower technologies across various sectors.

- Technological Disruptions: Advancements in turbine technology and smart grid integration driving efficiency gains and grid stability.

- Consumer Behavior Shifts: Growing consumer awareness of environmental concerns and demand for sustainable energy solutions.

Dominant Regions, Countries, or Segments in South America Hydropower Industry

Brazil and Colombia are the leading countries in the South American hydropower market, accounting for a combined xx% market share in 2024. The large hydropower segment dominates the market due to its higher energy generation capacity, contributing xx% of the total capacity in 2024. Key drivers of growth include:

- Brazil: Significant government investment in hydropower projects, abundant water resources, and a well-established energy infrastructure.

- Colombia: Growing energy demand, favorable geographic conditions, and supportive government policies.

- Large Hydropower Segment: Economies of scale, higher energy output, and established technologies.

- Small Hydropower Segment: Growing adoption driven by off-grid electrification needs and decentralized energy generation.

South America Hydropower Industry Product Landscape

The South America hydropower industry is characterized by a diverse product landscape, including various turbine designs (Francis, Kaplan, Pelton), generators, and related equipment. Innovations focus on enhancing efficiency, reducing environmental impact, and improving grid integration. Advancements in automation and digital technologies enable optimized energy production and streamlined operations.

Key Drivers, Barriers & Challenges in South America Hydropower Industry

Key Drivers:

- Growing energy demand: Driven by industrialization, urbanization, and population growth.

- Government support for renewable energy: Incentives, subsidies, and favorable regulatory frameworks.

- Technological advancements: Improving efficiency and reducing costs.

Key Challenges:

- High initial investment costs: A significant barrier to entry for smaller players.

- Environmental concerns: Impact on aquatic ecosystems and biodiversity.

- Regulatory complexities: Permitting processes can be lengthy and cumbersome.

- Geopolitical risks: Political instability in certain regions can disrupt project development.

Emerging Opportunities in South America Hydropower Industry

- Mini-hydro and micro-hydro projects: Opportunities in remote and underserved areas.

- Pumped hydro storage: Addressing intermittency issues in renewable energy systems.

- Hybrid projects: Combining hydropower with solar or wind power to maximize energy generation.

Growth Accelerators in the South America Hydropower Industry Industry

Technological breakthroughs in turbine design and smart grid integration are crucial growth accelerators. Strategic partnerships between public and private entities are facilitating project development and financing. Expanding into untapped markets with high hydro potential presents significant growth opportunities.

Key Players Shaping the South America Hydropower Industry Market

- Atiaia Energia SA

- Norte Energia S A

- IMPSA S A

- Voith GmbH & Co KGaA

- Centrais Eletricas Brasileiras SA

- ContourGlobal plc

- General Electric Company

- South Pole

- Andritz AG

- Vale S A

Notable Milestones in South America Hydropower Industry Sector

- 2021: Completion of the xx Hydropower Plant in Brazil, adding xx MW of capacity.

- 2022: Launch of a national hydropower development strategy in Colombia.

- 2023: Announced merger between two major hydropower companies in Chile.

In-Depth South America Hydropower Industry Market Outlook

The South America hydropower market is poised for continued expansion over the next decade, driven by robust energy demand, government support, and technological advancements. Strategic investments in new projects, infrastructure upgrades, and innovative technologies will be critical to unlocking the region’s vast hydropower potential and achieving sustainable energy goals. The focus on grid integration and hybrid projects will be pivotal in shaping the future market landscape.

South America Hydropower Industry Segmentation

-

1. Size

- 1.1. Large Hydropower

- 1.2. Small Hydropower

- 1.3. Others

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Chile

- 2.4. Rest of South America

South America Hydropower Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Chile

- 4. Rest of South America

South America Hydropower Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-ion Battery Prices 4.; Growing Demand for Lithium-ion Batteries in the Country

- 3.3. Market Restrains

- 3.3.1. 4.; The Country Relies on Pumped Hydro Storage Rather than Battery Storage Systems

- 3.4. Market Trends

- 3.4.1. Large Hydropower Segment is Expected to Dominate in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Hydropower Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Large Hydropower

- 5.1.2. Small Hydropower

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Chile

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Chile

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. Brazil South America Hydropower Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Large Hydropower

- 6.1.2. Small Hydropower

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Chile

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. Argentina South America Hydropower Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Large Hydropower

- 7.1.2. Small Hydropower

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Chile

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Chile South America Hydropower Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Large Hydropower

- 8.1.2. Small Hydropower

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Chile

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. Rest of South America South America Hydropower Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Large Hydropower

- 9.1.2. Small Hydropower

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Chile

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. Brazil South America Hydropower Industry Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Hydropower Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Hydropower Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Atiaia Energia SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Norte Energia S A

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IMPSA S A *List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Voith GmbH & Co KGaA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Centrais Eletricas Brasileiras SA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ContourGlobal plc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 General Electric Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 South Pole

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Andritz AG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Vale S A

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Atiaia Energia SA

List of Figures

- Figure 1: South America Hydropower Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Hydropower Industry Share (%) by Company 2024

List of Tables

- Table 1: South America Hydropower Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Hydropower Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: South America Hydropower Industry Revenue Million Forecast, by Size 2019 & 2032

- Table 4: South America Hydropower Industry Volume gigawatt Forecast, by Size 2019 & 2032

- Table 5: South America Hydropower Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: South America Hydropower Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 7: South America Hydropower Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South America Hydropower Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 9: South America Hydropower Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South America Hydropower Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 11: Brazil South America Hydropower Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil South America Hydropower Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Hydropower Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina South America Hydropower Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America South America Hydropower Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Hydropower Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 17: South America Hydropower Industry Revenue Million Forecast, by Size 2019 & 2032

- Table 18: South America Hydropower Industry Volume gigawatt Forecast, by Size 2019 & 2032

- Table 19: South America Hydropower Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Hydropower Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 21: South America Hydropower Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Hydropower Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 23: South America Hydropower Industry Revenue Million Forecast, by Size 2019 & 2032

- Table 24: South America Hydropower Industry Volume gigawatt Forecast, by Size 2019 & 2032

- Table 25: South America Hydropower Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: South America Hydropower Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 27: South America Hydropower Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South America Hydropower Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 29: South America Hydropower Industry Revenue Million Forecast, by Size 2019 & 2032

- Table 30: South America Hydropower Industry Volume gigawatt Forecast, by Size 2019 & 2032

- Table 31: South America Hydropower Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: South America Hydropower Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 33: South America Hydropower Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Hydropower Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 35: South America Hydropower Industry Revenue Million Forecast, by Size 2019 & 2032

- Table 36: South America Hydropower Industry Volume gigawatt Forecast, by Size 2019 & 2032

- Table 37: South America Hydropower Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: South America Hydropower Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 39: South America Hydropower Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: South America Hydropower Industry Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Hydropower Industry?

The projected CAGR is approximately > 3.80%.

2. Which companies are prominent players in the South America Hydropower Industry?

Key companies in the market include Atiaia Energia SA, Norte Energia S A, IMPSA S A *List Not Exhaustive, Voith GmbH & Co KGaA, Centrais Eletricas Brasileiras SA, ContourGlobal plc, General Electric Company, South Pole, Andritz AG, Vale S A.

3. What are the main segments of the South America Hydropower Industry?

The market segments include Size, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-ion Battery Prices 4.; Growing Demand for Lithium-ion Batteries in the Country.

6. What are the notable trends driving market growth?

Large Hydropower Segment is Expected to Dominate in the Market.

7. Are there any restraints impacting market growth?

4.; The Country Relies on Pumped Hydro Storage Rather than Battery Storage Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Hydropower Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Hydropower Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Hydropower Industry?

To stay informed about further developments, trends, and reports in the South America Hydropower Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence